Analysis

Israel, Lebanon compete for maritime energy resources

- Middle East

Israel, Lebanon compete for maritime energy resources

Competition over oil and gas resources in the eastern Mediterranean sea continues to roil tensions between long-time adversaries Israel and Lebanon.

- Negotiations over the maritime boundary will continue to stall, as both sides remain unwilling to make major compromises over their claims to potentially vast stores of o"shore natural gas.

- Both countries will continue to explore and exploit their claimed o"shore natural gas resources and will not shy away from developing in controversial areas along the disputed maritime area.

- Israeli-Lebanese relations will remain hampered by mutual distrust and opposing interests, though a military conflict between the two is unlikely over the coming year.

- Mutual arrangements (distinct from maritime boundary negotiations) to explore and exploit resources could support economic activity. However, distrust between the neighbours makes such arrangements unlikely.

Pressure rising in negotiations

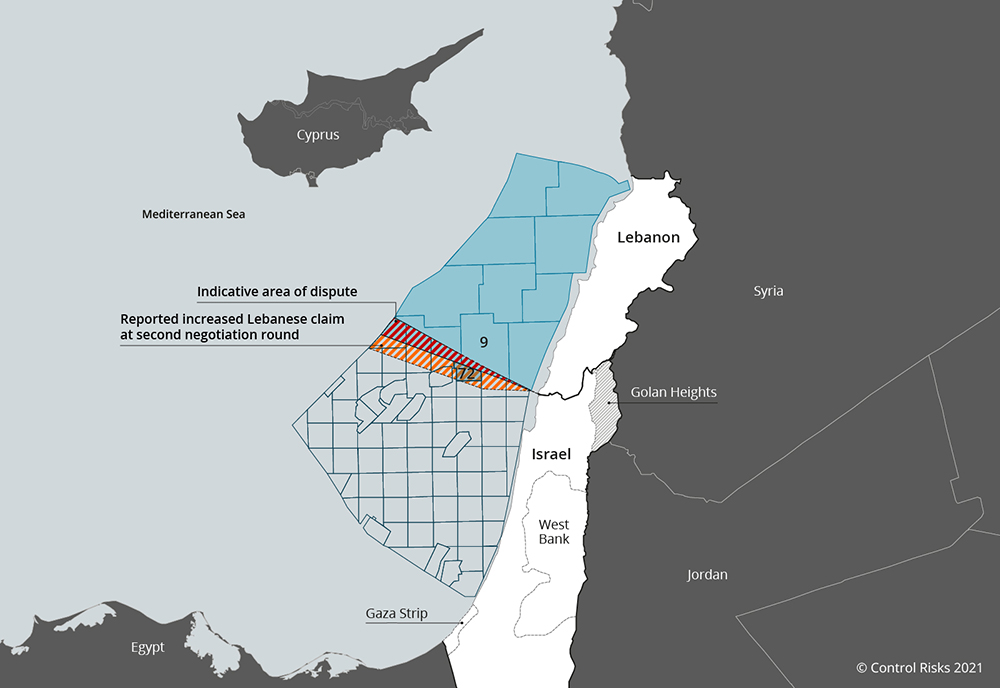

Israel and Lebanon have had unresolved land and maritime border disputes for decades. The current maritime dispute is over a maritime area that both Lebanon and Israel claim sits within their respective Exclusive Economic Zones (EEZ). In 2010, Lebanon presented a chart and lists of geographical coordinates to the UN that set its claim limit 81 miles (131km) into the Mediterranean. In 2011, Israel submitted to the UN a claim to an area within that runs 10 miles (16km) inside the proposed Lebanese EEZ, creating a roughly 332 square mile (860 sq km) area of dispute.

The maritime dispute has moved centre stage in recent years, as Israel has developed o"shore natural gas fields that have been a boon to its domestic energy security and exports. Meanwhile, Lebanon’s attempts to find o"shore natural gas fields have not yielded as much success. Nevertheless, both countries remain intent on boosting their co"ers by extracting natural gas in the eastern Mediterranean. This disputed o"shore area makes up part of the greater Levantine Basin, which, according to a 2010 US Geological Survey, is estimated to hold 1.7bn barrels of oil and 122trn cubic feet of gas.

Recent talks

Lebanon and Israel held their most recent round of direct negotiations under a UN-negotiated framework with US mediators in October 2020 in the city of Naqoura (Lebanon). There were no breakthroughs, and both sides accused the other of creating hurdles to a settlement. In November 2020, Israeli and Lebanese officials indefinitely postponed further talks. Both sides will remain intransigent, and deep mutual distrust will continue to hinder significant progress.

On 12 February, S&P Global reported that Lebanon plans to register with the UN new o"shore coordinates that would increase its claimed maritime space. Lebanon’s potential move to expand its maritime claim would increase the disputed area from 332 square miles (860 sq km) to 884 square miles (2,290 sq km). Lebanon’s new claim would include part of the Karish gas field in Israel’s claimed waters, which is already being developed by companies that received production licenses from Israel to start extracting gas by the end of 2021.

Lebanon has not yet filed these new coordinates with the UN. They are likely choosing to use the prospect of filing the claim to pressure Israel to agree to more favourable terms in negotiations over the currently disputed 332 square mile (860 sq km) area. A positive settlement has become increasingly important to Lebanon’s government over the last year, as the country is going through a severe financial crisis.

Israel’s energy advances

Despite the row with its northern neighbour, Israel will continue to develop its o"shore natural gas resources over the coming years, and oil and gas companies will maintain their interest in Israel’s o"shore natural gas fields. Recent deals to export Israeli gas to Jordan and Egypt, as well as increasing potential for energy trade with the UAE, have made the Israeli energy market more attractive for foreign companies.

The Israeli government will maintain a positive disposition towards the natural gas sector. Prime Minister Binyamin Netanyahu in 2015 personally pushed to pass the set of agreements known as the Gas Framework, which were needed to begin the development of o"shore natural gas fields. The Ministry of Energy, which is responsible for the energy sector and natural resources, will continue to work with companies to ensure that terms are favourable to sustain foreign direct investment.

In mid-2020, the Israeli Ministry of Energy’s third o"shore bid round sought tenders for block 72, which runs along the disputed northern border of Israel’s EEZ, suggesting that the country will continue to push for energy exploration in the areas near the disputed line. However, Israel is unlikely to go as far as o"ering licenses for exploration within the 332 square mile (860 sq km) disputed area. Israel on 3 January 2021 announced that it was planning to hold its fourth o"shore bid round in 2021; the Ministry of Energy has highlighted its planned o"ering in maps on its website, which show that three more blocks that run along the northern border of Israel’s EEZ will be o"ered. Lebanon will continue to criticise Israel’s exploration activities bordering the disputed area, which will put further pressure on already hostile bilateral relations and ongoing maritime negotiations.

Lebanese politics hinder energy sector

Although Lebanon also seeks to develop its own o"shore capabilities to help address its long-term energy challenges, its ability to do so is severely hampered by political stagnation. Lebanon has not formed a new cabinet since Moustafa Adib resigned as prime minister in September 2020. The Lebanese government lacks the political willpower to implement reforms to develop the sector, and the country’s unstable security environment has undermined foreign companies’ willingness to invest in the sector in large numbers.

Nevertheless, Lebanon will continue to permit businesses to explore in Block 9, some of which lies in disputed waters, as this block is deemed to have the greatest reserves within Lebanon’s EEZ. Lebanon’s attempt to increase its EEZ and its willingness to allow companies to operate in blocks that are potentially contested will further complicate negotiations, making an agreement unlikely.

As a result, foreign relations between Israel and Lebanon will remain beset by mutual distrust and staunch rhetoric, though we do not expect an escalation into military conflict over the coming year.

A bridge too far

Elsewhere, arrangements have been used to ensure the exploration and exploitation of resources that potentially straddle an undelimited boundary. Such arrangements may allow parties to a dispute to organise economic activity without prejudice to any final delimitation. However, in light of the deep distrust between Israel and Lebanon, such arrangements are unlikely. In the unlikely event that delimitation is achieved after the next round of negotiations, further practical measures, notably concerning exploitation of resources, will require ongoing diplomatic e"orts; the US remains the most likely candidate country to mediate such a process.