On 2 December, the UAE celebrated 50 years since its independence in 1971. This anniversary year has been as much a commemoration of the country’s achievements as it has been a time of strategic economic and geopolitical realignment.

- Over the coming decade, the UAE will accelerate efforts to move beyond its role as a regional business hub to one as a global economic player.

- In doing so, the country will actively boost trade with the largest economies globally, while drawing foreign direct investment (FDI) and building its domestic pool of human capital.

- To support efforts to expand trade and FDI, the UAE will emphasize soft power abroad and promote itself as a global policy actor and partner.

- The country’s policy realignment will generate investment opportunities for foreign businesses but also sustain MEDIUM regulatory risk due to the ambitious and rapid pace of regulatory reform.

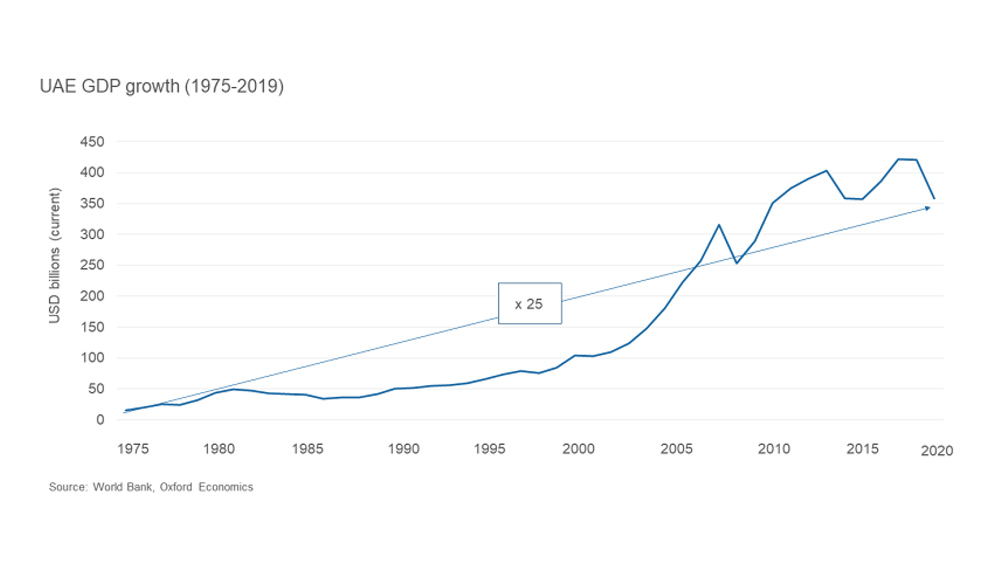

The UAE’s rapid growth over the past 50 years has been underpinned by Abu Dhabi’s development of the oil and gas sector and Dubai’s expansion as a regional business hub, particularly capitalising on rapid regional growth in the 2000s. To maintain its course, however, the Emirati leadership assesses that it needs to decouple itself from regional business and morph into a global economic actor. This need has become more evident in the context of the broader Middle East and North Africa region, where some countries remain mired in conflict and instability, and as the decarbonising global energy landscape threatens to turn the region’s oil wealth into a stranded asset.

Shipping in Dubai Creek in Dubai (UAE), May 1967. (Photo by Chris Ware/Keystone Features/Hulton Archive/Getty Images)

The clearest indication to date of the UAE’s reorientation towards a global business outlook was the 7 December decision to shift the working week from the regional norm of Sunday to Thursday to the global norm of Monday to Friday. The authorities hope that the move will facilitate international business by syncing the working week and boosting foreign investment in the local stock exchanges. In addition, the UAE introduced in September the Projects of the 50, which sets initiatives for the country’s continued growth across a wide range of sectors, including trade and economic diversification.

Beyond the horizon

Over the coming years, the UAE will shift its focus from acting as a regional entrepot to a more global trade role. The Projects of the 50 notably sees the UAE boosting exports to major global economies including Australia, China, the UK, Russia and Indonesia. As part of these efforts, the Emirati authorities have progressed on free trade negotiations in recent months, including with India, South Korea, Israel and Indonesia. The UAE will also aim to play an increasingly central logistics role in China’s Belt and Road Initiative, which draws up logistics routes between East Asia to Europe, the Gulf Arab states and Africa.

Diversifying the economy

The Projects of the 50 also sets out a plan for diversifying the UAE’s domestic economy, including weaning the country off its dependence on oil and gas revenues. In particular, the UAE will aim to grow its knowledge, digital and technology economy. A new Data Protection Law announced in October 2020 came into effect on 2 January 2022 – an effort to regulate the industry, as it is expected to grow and become increasingly integrated with international data flows. In parallel, the UAE will look to expand its domestic pool of talent. To this end, it plans to train 3,000 new coders every month over the coming year and will introduce incentives to establish programming companies in the UAE.

More broadly, to drive private sector growth, the UAE will aim to attract foreign know-how and has liberalised immigration rules for talented individuals and freelancers, allowing them to sponsor family members and granting them the right to remain in the country for 180 days without a job. To boost long-term FDI, the government has also allowed full foreign ownership of onshore companies. Driving long-term FDI and highly-skilled immigration will help the UAE to foster a robust private sector and develop potential avenues for homegrown service and goods exports. Other strategic sectors that will likely be targeted for growth in the coming years will include renewable energy, agribusiness, petrochemicals, defence and healthcare.

Focus on diplomacy

With renewed attention on attracting global business, the UAE has increasingly recognised that a diplomacy-focused foreign policy will best complement the country’s ambitious economic growth plans. Accordingly, Abu Dhabi is increasingly leveraging soft diplomacy tools. The country mediated a de-escalation in tensions between Pakistan and India in April 2021 and engaged in talks with the Taliban in November of the same year to run operations at Kabul International Airport.

Similarly, the UAE has sought to de-escalate regional tensions with its historical rivals. It has engaged in talks with Turkey in recent months, culminating in a meeting between Crown Prince Mohammad bin Zayed Al Nahyan and Turkish President Recep Tayyip Erdogan in Istanbul on 24 November – the first such visit in almost a decade. Emirati National Security Advisor Tahnoun bin Zayed Al Nahyan also made landmark visits to Qatar in August and travelled to Iran on 6 December. These efforts will grow regional economic trade and set up communication channels that limit the risk of renewed tensions.

The UAE will also seek to raise its status as a leader on the international policy scene. The authorities have viewed the ongoing Expo 2020 Dubai as the first world exhibition in the Middle East, Africa and South Asia region, affirming the UAE’s role as key representative of states much further afield. Similarly, the country will host UN’s annual climate summit, the Conference of Parties, in 2023 (COP28). Such efforts will boost the UAE’s attractiveness as a potential partner for global foreign policy leaders, including France.

Opportunities and risks

Continued efforts to align the country’s regulatory framework with international norms and standards, such as the introduction of a new labour law in November 2021, will sustain the risk of rapid and occasionally unpredictable regulatory changes. The ambitious regulatory reform agenda will occasionally also raise compliance costs for businesses. Finally, the existence of different jurisdictions in the UAE, with occasionally different legislation at the federal- and emirate-level and in free zones, will also contribute to compliance costs for businesses operating across more than one emirate or free zone.

Nevertheless, the UAE’s increasingly global focus and continued economic diversification will provide significant partnership and investment opportunities for foreign companies in the coming years. Efforts to manage regional tensions will help to reduce geopolitical risks associated with doing business in the UAE. Regulatory reforms, including the ongoing liberalisation of immigration rules but also the decriminalisation of alcohol consumption and allowing unmarried couples to cohabit, will also help attract foreign companies and workers.