The initial public offering (IPO) for Dubai’s government-owned toll gate operator Salik closed on 29 September, raising USD 1bn. With the Salik IPO, Dubai is further lengthening the list of strategic privatisations in the Gulf Arab region.

- Saudi Arabia, Abu Dhabi and Dubai will continue to open up key state-owned assets for investment to raise revenue and boost investor interest and stock market activity in their respective economies.

- Other Gulf Arab states will likely be slower to follow this privatisation trend. However, Oman and Bahrain in particular, will likely look to conduct similar sales as part of efforts to prop up state finances.

- Partial privatisations, particularly in Saudi Arabia and the UAE, will constitute attractive and comparatively safe investment opportunities owing to these governments’ large financial reserves.

- However, to seize these opportunities, investors will need to carefully assess non-financial risks associated with the region’s sometimes challenging geopolitical, political and reputational environments.

Heating up

Dubai’s privatisation drive has gathered steam since early 2022. Dubai in April listed 18% of utility company DEWA on the Dubai Financial Market, raising as much as USD 6.1bn. In June, it sold a minority stake in port operator DP World for USD 5bn, and later the same month it listed 12.5% of business park operator TECOM for USD 463m. The sales have generated significant interest. For both the Salik and DEWA IPOs, the government chose to increase the size of the offerings due to high investor demand. The government increased the size of the floated stake in Salik from 20% to 24.9%, and in DEWA from 6.5% to 18%.

Billion-dollar privatisations have become increasingly common in Gulf Arab markets. With its latest sale, Dubai is following Saudi Arabia and Abu Dhabi’s lead. The Saudi government’s selling spree started in earnest – and after several false starts – with the listing of a 1.7% stake in its national oil company Saudi Aramco in December 2019 and January 2020 for close to USD 30bn. Abu Dhabi kickstarted its latest privatisation drive in September 2020 with a USD 1bn placement of shares in the distribution business of Abu Dhabi National Oil Company (ADNOC).

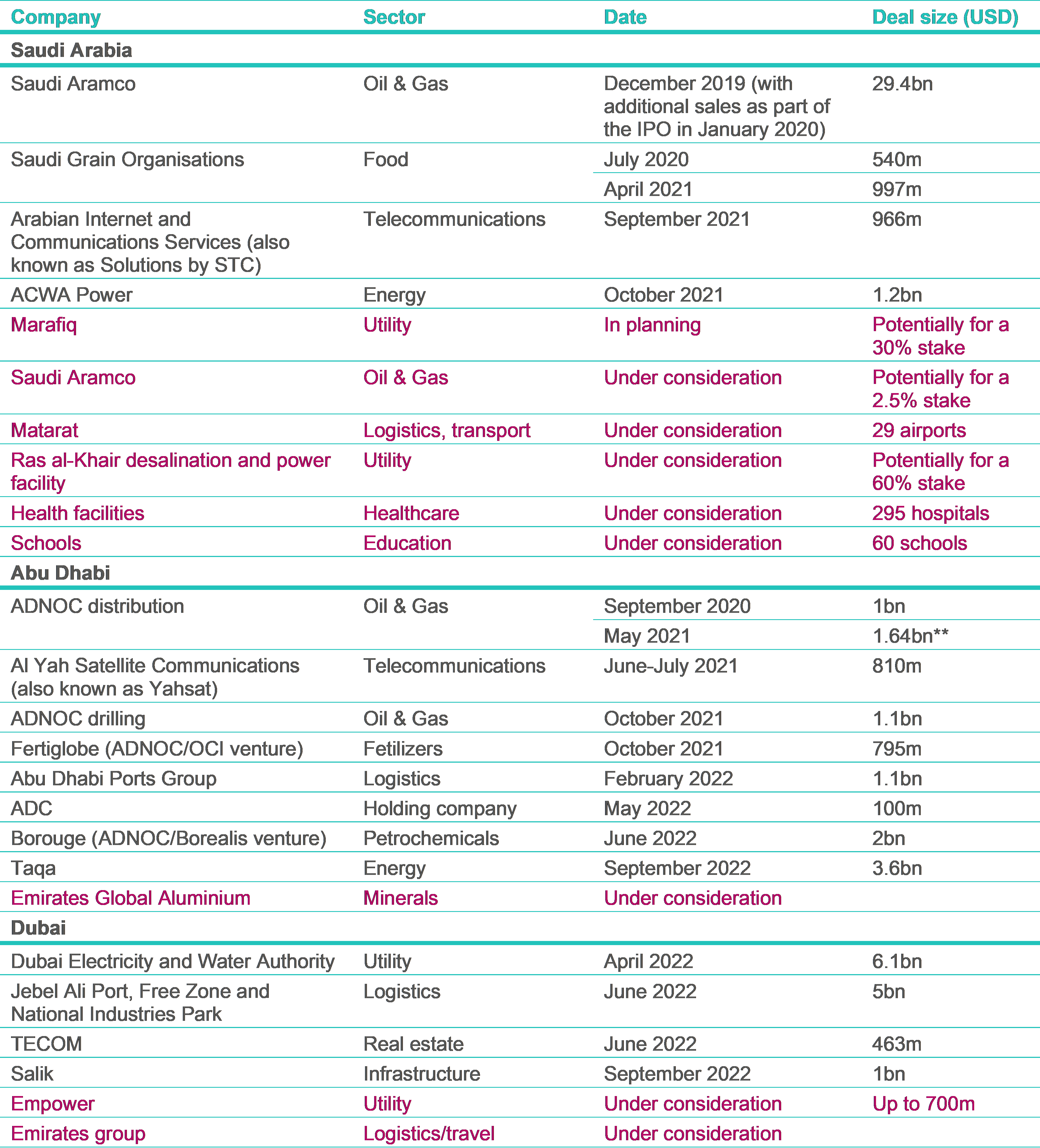

Table: Major privatisations in Saudi Arabia and the UAE since 2019 (past privatisations in black and mooted ones in purple)*

Finding this article useful?

The drivers

At the root of recent privatisation campaigns is the desire of regional governments to fund economic diversification by monetising state assets. For instance, when Saudi Crown Prince Mohammed bin Salman bin Abd al-Aziz Al Saud (known as MbS) first hinted at plans to privatise state assets, during an interview in January 2016, he indicated that he aimed to raise funds to be re-invested in diversification projects. Saudi Vision 2030 – which was unveiled in April 2016, and outlines a roadmap for economic diversification – further identified privatisations as a key avenue for raising government revenues.

In addition, Gulf Arab states’ privatisation strategies increasingly aim to boost inward foreign investment and raise investor interest in the region. With regard to IPOs, Saudi Arabia and the UAE have sought to increase the size and liquidity of their financial markets with a view to boosting overall economic activity, building up the international credentials of their stock exchanges and encouraging listings of private domestic companies. In some instances, efforts to rationalise governments’ asset portfolios and boost performance will also partly motivate stake sales in state-owned assets – as illustrated by the 2020-2021 privatisation of milling companies owned by the Saudi Grain Organisation.

The path forward

Saudi Arabia and the UAE will continue to open up state assets to investors in the coming years. The kingdom announced in May 2021 that it aims to privatise USD 55bn in assets by 2025, and Dubai in November 2021 stated that it plans to sell stakes in ten state-owned entities. Boosting economic diversification remains a key priority for these Gulf Arab states and the costs of associated initiatives are sizeable. Moreover, although global stock market headwinds amid inflation concerns will negatively impact Gulf Arab stock exchanges, regional governments will continue to pursue long-term efforts to grow financial activity.

In other Gulf Arab countries, privatisation drives have been slower to pick up speed. Nevertheless, over the coming months interest will grow, particularly in Oman and Bahrain. Oman’s state-owned energy conglomerate OQ is reportedly considering privatising some of its upstream and midstream operations. Similarly, in February local news outlets reported that Bahrain’s state-owned energy asset holding, Nogaholding, is considering stake sales. Both Gulf Arab states are looking to strengthen their fiscal positions and invest in economic diversification measures.

Qatar and Kuwait will continue to lag behind their Gulf Cooperation Council peers, with likely little privatisation activity for still another couple of years. Qatar faces few fiscal pressures and it has shown little urgency to privatise government assets in recent years – despite occasionally hinting at a potential sale of stakes in Qatar Airways. Meanwhile, Kuwait entertains privatisation plans and has announced that it seeks to sell stakes across eight sectors by 2025. However, under current political deadlock, these plans likely remain unrealistic.

Seize the opportunities…

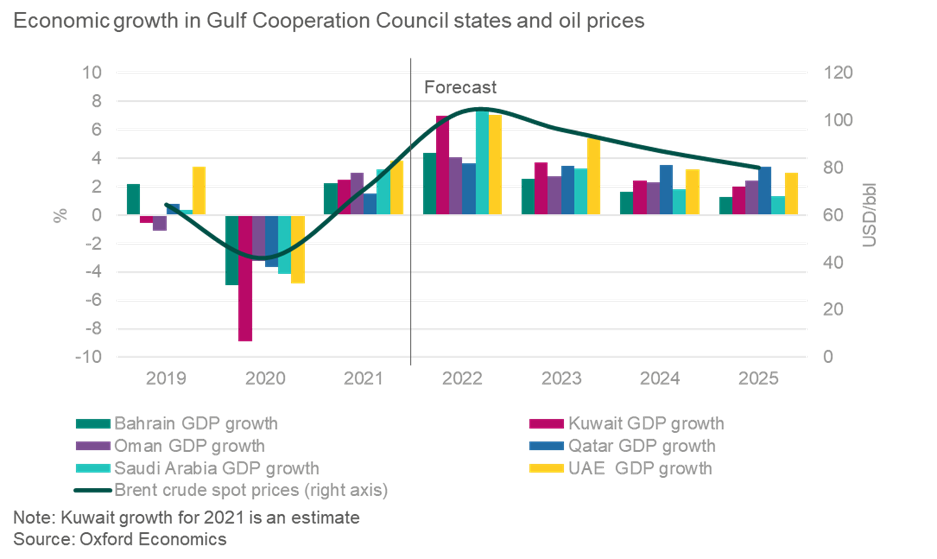

Saudi and Emirati privatisations will continue to generate significant international interest. Investments in these Gulf Arab states’ assets are relatively safe by emerging market standards, with their operations backed by large and relatively liquid government financial reserves. In addition, they typically offer high returns supported by regional economies that remain propped up by still-strong oil prices and efforts to boost domestic consumption by encouraging high-skill immigration. Thanks to these key characteristics IPOs of state-owned Gulf Arab assets have fared comparatively well despite growing global recession concerns.

… but manage the risks

Nonetheless, investors will need to carefully consider the risks associated with stake acquisitions. Gulf Arab states face latent geopolitical and security threats stemming from instability in and tensions with neighbouring countries. Notably, negotiations between the US and Iran to revive the Joint Comprehensive Plan of Action (JCPOA; the 2015 nuclear plan) remain in the doldrums. A definitive failure to agree a deal would likely revive regional instability, including threats emanating from non-state actors in Iraq and Yemen. Strategic assets in Gulf Arab states, particularly in the energy and transport sectors, would constitute primary targets in such a scenario.

Gulf Arab governments will avoid actions that would significantly dampen investor interest; for example, outright expropriations remain highly unlikely. Still, political risks will stem from governments’ control over strategic assets. For instance the authorities have occasionally leveraged state-owned assets, particularly in the energy, infrastructure and logistics sectors, to achieve geopolitical objectives rather than solely commercial ones. This will occasionally lead to some opacity in corporate decision-making and could impact asset profitability.

Finally, foreign investors will need to be mindful of the reputational risks associated with partnering with state-owned entities. International activists may see investments in the defence and digital technology sectors as facilitating alleged human rights abuses. Similarly, investors in the tourism and entertainment industries could face accusations of abetting government efforts to distract from their human rights records. In addition, reputational risks will also stem from Gulf Arab governments’ ties to foreign partners deemed hostile to the West or sanctioned regimes, such as Russia and Syria.