Global Insight Podcast

Control Risks experts discuss the geopolitics of critical minerals and how we anticipate regulation and investment in the industry to evolve.

The race for critical minerals needed to support the energy transition has reached an inflection point. Despite heightened geopolitical, environmental and investment risks, the surge in demand offers a significant opportunity for companies looking to play across the whole value chain. Control Risks investigate various global trends businesses need to be aware of in 2024.

Control Risks experts discuss the geopolitics of critical minerals and how we anticipate regulation and investment in the industry to evolve.

The critical minerals sector is evolving at a rapid pace, but seizing opportunity in the space means managing a range of significant risks, including pollution, poor working conditions, and increased regulation. Hear our experts’ take.

In this quarter’s Geopolitical Outlook, Control Risks experts discuss critical minerals considering current geopolitical dynamics, regulation and investment.

In 2024, the critical minerals sector will face significant shifts, from battery gigafactories, trade controls and emerging technologies. Control Risks explores these, risers and fallers and other key trends that are likely to impact global supply-chains for critical minerals in 2024.

The search for a stable critical mineral supply for the energy transition is facing a financial challenge post-pandemic. Despite increased government commitment, some are seeking alternative funding amid low spot prices in early 2024, posing potential political and financial crime risks. Investors must protect their investments against geopolitical shifts and changing demands.

As demand for critical minerals escalates, we expect a focus on seabed mining to intensify significantly this year, despite a high risk of associated controversy. Seabed mining carries environmental risks, and will tap into or generate territorial disputes. However, it also offers huge opportunity for companies and governments alike.

Sign-up today to receive the latest insights from our experts on critical minerals.

Control Risks’ ESG Country Monitor is an intuitive dashboard that helps you evaluate your exposure to sector-specific socio-economic, environmental and governance dynamics in the markets where you operate.

Control Risks’ Sanctions Country Monitor helps you assess your sector specific sanctions risks across hundreds of jurisdictions worldwide.

Understand how geo-political and geo-economic trends impact your strategy, profitability, and operations.

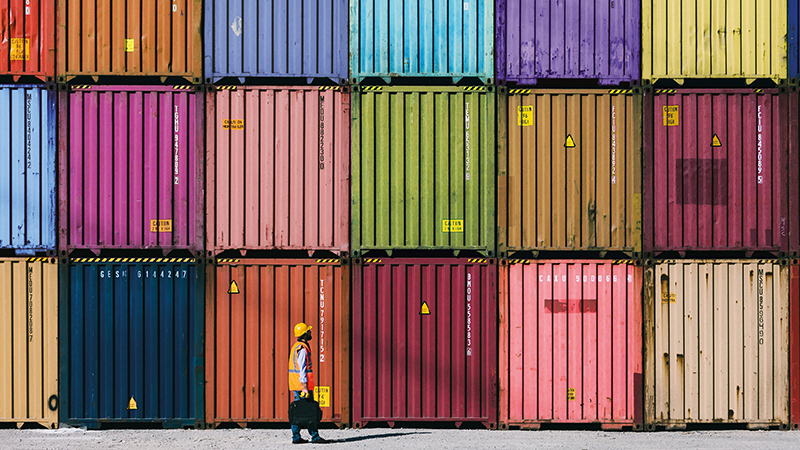

We’ll help bring your supply chain risks into sharp focus, helping you gain greater visibility and control. We map and assess your exposure, understand the implications of this exposure specific to your organisation, and find solutions to mitigate against these risks to ensure ethical, compliant operations.

Investor support services to assist across the entire investment lifecycle.

We work with your counsel to assist in gathering and analysing evidence for proceedings including tribunals, regulatory, civil and criminal actions.