The countries in the very North of Europe are often thought of as stable, transparent and predictable – in short, an ideal investment environment. However, as our local experts point out, that view can be facile and deceptive.

In this article, we highlight three trends that are affecting the Nordics and therefore investments in the Nordics: digital disruptions and the associated threats faced by investors; transition traction, highlighting the many impacts of the advanced state of energy transition; and corruption creep, looking at Sweden’s slow climbdown from leading the least corrupt countries.

1. Digital distruptions

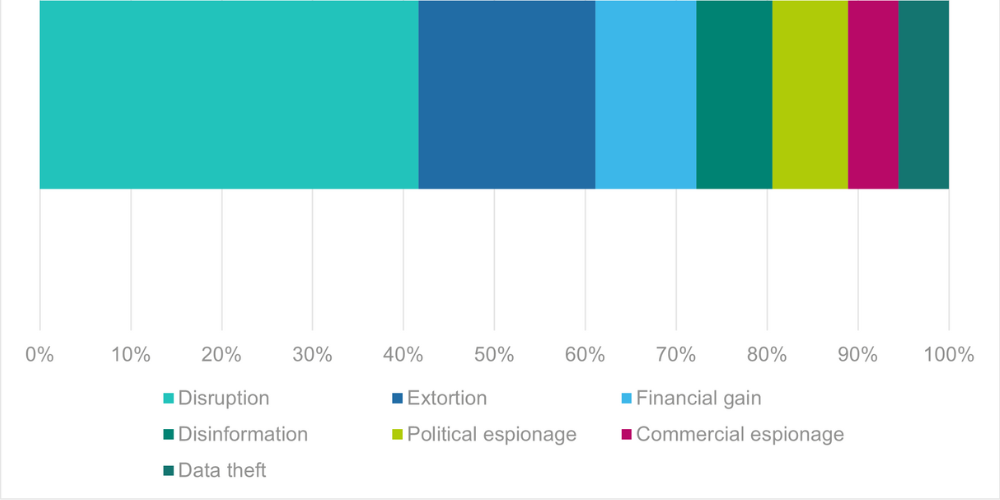

The Nordic region has seen a step change in the cyber threat landscape since 2022, as geopolitical tensions and conflicts have spilled over into the cyber domain. Cyber threat actors across the spectrum – state, criminal and activist – have increased their targeting of Nordic organisations. These disruptive cyber attacks have targeted critical national infrastructure and critical IT suppliers, having a significant knock-on effect on organisations across sectors. According to Control Risks’ data, strategically significant cyber incidents impacting Nordic organisations have doubled since 2021.

For example, Danish authorities in November 2023 disclosed what they called “the most extensive cyber-related attack” ever on Danish CNI and the energy sector, forcing several affected organisations to disconnect from the local or national energy distribution. Meanwhile, geopolitically influenced non-state actors have significantly increased their targeting of Nordic organisations in disruptive extortion attacks, including ransomware and data leak extortion, as well as defacement and DDoS. Reflecting wider global trends in cybercriminal targeting, several major IT service and cloud hosting providers based in the region have seen their services disrupted in the past 12 months, inconveniencing customers relying on those services as well as sensitive corporate and customer data breaches.

The trend of more disruptive incidents – whether directly aimed at critical infrastructure and services or indirectly through the supply chain – is increasingly likely to become the new normal in the region at large.

Figure 1: Targeting intent in strategically significant cyber incidents impacting Nordic organisations, 2022-2024

While such threats are not new, the frequency and scale of attacks is putting pressure on Nordic organisations to ensure that security controls and mitigations, as well as response plans, are up to the task. Cyber threats can have significant impact on a company, from operational downtime and financial effects to punitive regulatory and legal actions, as well as reputational damage and a loss of trust among customers and clients. Conversely, effectively managing cyber risks and being able to demonstrate maturity and resilience is increasingly seen as a value generator and a key differentiator in the market.

From an investor perspective, it will be critical to understand how these strategic changes in the Nordic cyber landscape translates to tangible threats and risks to specific geographies, sectors and asset types, to be able to map how these changes impact the current portfolio as well as any planned acquisitions.

Control Risks’ Digital Risk experts have seen an increased demand from Nordic and other private investors for support across the investment life cycle, from pre-investment due diligence on specific targets through to portfolio-wide cyber risk management programmes. From a pre-acquisition perspective, thorough cyber due diligence will not only help map the current threat to a specific asset, but also reveal any known vulnerabilities or breaches. This enables investors to value the prospective investment and the costs of remediation more accurately. Meanwhile, assessing how these changes impact your portfolio companies from an external threat perspective – and how well equipped they are to meet these new threats based on their current level of maturity and controls – will be a key aspect of effective portfolio cyber risk management.

2. Transition traction

Nordic countries are advancing faster than most in terms of energy transition1 offering significant opportunities in renewables and other clean energy technologies. But as the region’s deep decarbonisation unfolds, it is increasingly shaped by geopolitical, regulatory, and social developments that can impact the ownership and valuation of such assets. Control Risks’s Global Risk analysts are regularly deployed to help local and out-of-region investors and corporates assess geopolitical and ESG risks affecting the Nordic region regarding issues like the ones here:

Investment risks at the energy transition frontier

The war in Ukraine and wider geopolitical tensions have made the Nordic region a frontier of both geopolitical conflict and of the energy transition. Not only are Nordic countries moving towards their own net-zero or even negative GHG emissions targets, but they also aim to export massive amounts of clean energy to the rest of the EU (in addition to the already important role played by Norway in replacing Russian natural gas).

This has translated into a rising threat against critical infrastructure, and while direct confrontation remains unlikely, the risk of sabotage has become all too real. NATO and individual Nordic countries have deployed naval and other forces to counter this, but questions have been raised around capabilities and priorities in how to defend an increasingly complex and expansive energy system across the region and surrounding seas.

Add to this the uncertainties around government vs. private responsibilities, tightening regulation to prevent unwanted foreign investors or components, and new clean energy IP protection, and it becomes clear that investors increasingly need to consider various scenarios and implications for the ownership and valuation of Nordic clean energy assets.

Business as unusual in the Nordic energy sector?

Nordic countries have long demonstrated a remarkably stable and strategic policy approach to green growth. They have built out clean energy infrastructure, invested in research and development, adapted regulations, and pursued close regional coordination as well as climate diplomacy and cleantech trade across the globe.

But while broad-based political, business, and public support for decarbonisation remains, opinions on how to achieve this in practice are evolving. Geopolitical and supply chain shocks can have a significant impact on which technologies are deployed, and when and where. For example, Sweden’s new commitment to nuclear energy following its latest election; Denmark’s struggles to action visionary energy islands and large-scale offshore wind due to rising costs and complexity: Finland’s winter 2022 coal and LNG grab to secure its energy supply; and Norway’s preference to electrify rather than phase out its massive fossil fuel industry. And with new asset types being rolled out across the region, new regulatory challenges are emerging, such as how to create a functioning market for CCUS. 2

Importantly, US, Chinese and even other European clean energy subsidies have put pressure on Nordic countries to reciprocate. They have done so hesitantly and selectively. As open, free trade economies that have placed huge bets on clean energy exports, they have a strong interest in creating a level playing field.

Relations with China will also be crucial to accelerate deployment of solar due to critical component dependencies. It remains to be seen at what scale Sweden and Finland will be able to manage sustainability concerns to get their own critical minerals and uranium mining going in the coming decade.

Naturally, Nordic transition policy choices will be shaped by the further evolution of the EU taxonomy and other reforms. While there is a high degree of alignment with the EU Green Deal and sustainability agenda, there are also examples of contention, such as the Norwegian decision to go ahead with deep sea mining despite EU opposition.3

Last but not least, local opposition will remain a challenge – for example, by some estimates this has caused around 10-15% of all renewable energy projects in Denmark to fail4 – as Nordic stakeholders are getting better organised and their concerns are diversifying. Regulations continue to be adapted to try to build support for clean energy, including increased compensation for local communities.

Absent major political shifts or serious conflict escalation, Nordic governments are likely to continue working to ensure the clean energy sector remain profitable and supporting clean energy technology exporters. But there is certainly room for both positive surprises and disappointments, depending on your clean energy bet.

For foreign investors in Nordic clean energy, you will need to navigate an evolving political landscape. And in terms of managing stakeholders, you will be compared with domestic institutional investors aiming to be pioneers of sustainability. Similarly, Nordic sensitivities to geopolitical events may require consideration, as exemplified by recent exclusions in response to the Israel-Palestine conflict.5

3. Corruption creep

In the 2023 Corruption Perceptions Index (CPI)6 released in January 2024, the Nordic trio of Denmark, Finland and Norway (after New Zeeland) top the CPI ranking globally, as least perceived to be corrupt.However, Sweden has, for the second year running, recorded its lowest-ever score, now falling to sixth place.

What is problematic is not the score or the rank itself, but the trend – Sweden used to be ranked first (and continues to be widely regarded as a beacon and standard setter of good governance and business practices). Over the last decade, Sweden has seen several incidents7 involving high-profile corporates with stories of bribery, money-laundering and other illegal and questionable business practices.

While the above cases have mainly been about activities carried out outside of Sweden, domestic corruption is also prevalent, – particularly in local government. A report8 published in June 2023 by the Swedish Agency for Public Management, the government’s organisation for analyses and evaluations of state and state-funded activities, found that – while still low in absolute terms – various forms of unethical business practices are markedly higher at municipal and regional levels than on the national level. The report cites several examples that demonstrate willingness among local actors to offer or to receive different forms of benefits.

Nepotism and cronyism appear to be more common than direct bribery but are more difficult to detect. As to be expected, local level public procurement appears to be a particularly risk-prone and problematic area. Within municipal procurement, the report stated that activities regarding technical administration and planning, and construction are the most risk-prone areas.

In an emerging development, corruption in the welfare sector is appearing as a subset of a larger problem. Criminal actors are implementing strategies to take undue advantage of Sweden’s far-reaching welfare system, with money laundering through local health centres owned and operated by criminal organisations being a recent modus operandi.9

Investors, particularly those pursuing roll-up/buy-and-build strategies, would do well to add unethical business practices (and reputation and integrity issues generally) surrounding their intended targets and key principals to their pre-investment diligence. Mapping relations between the target and municipal and regional political leaders and key officials can also be useful exercises, especially in higher-risk sectors such as construction or healthcare, or those with high exposure to public procurement. Further diligence should be considered if the stakeholder mapping has identified red flags pertaining to the target’s business practices and third-party relationships. This typically includes a risk-based review of the target’s accounting data, process walkthroughs, and interviews with the company’s senior management and other key individuals.

We see the benefit of this approach daily: in the last 12 months, Control Risks have helped clients navigate both pre-deal and post-close diligence successfully in several sectors in Sweden, including, for instance, in transport sector consumables supplies, construction, and in social infrastructure supplies, to name a few. Control Risks can help investors and portfolio companies and other corporates to navigate all these issues and more. To find out more please visit our M&A and Investment-related Services, or contact us directly.

1 Energy transition: The countries making most progress in 2023 | World Economic Forum

2 Regulatory framework for CCS in the Nordic countries

3 Deep-sea mining can yield many riches. The EU is against but its neighbours are keen

4 Researchers will increase citizen engagement in the transition towards green energy – University of Copenhagen

5Danske pensionskasser vil ikke længere være med til at finansiere israelske bosættelser: Stadig flere trækker penge

6 2023 Corruption Perception Index Transparency International

7“Bribe-takers” and brothels – scandal at the world's leading security firm; The TeliaSonera Scandals: A Swedish Trauma; Ericsson pleads guilty in U.S. to federal bribery violations, agrees to pay $206 million penalty; Swedbank chief executive sacked as €135bn money laundering scandal escalates

8 New challenges and old problems – Corruption in municipalities and regions

9 Varningen: Gängkriminella driver vårdcentraler