The year ahead

No other event will shape 2024 for Mexico more than the general election on June 2nd, the first since the ruling Morena, led by AMLO, won in 2018 with a whopping 54% of votes. Morena’s candidate, former Mexico City governor Claudia Sheinbaum (2018-23), is set to win. She has maintained an ample lead over Xóchitl Gálvez, the candidate of the opposition Fuerza y Corazón por México (FCM) coalition. Poll aggregator Oraculus places Sheinbaum’s advantage at 32 points as of mid-January. Meanwhile, third-party candidate, Jorge Álvarez Máynez of the Citizen Movement (MC) party, lags far behind – with his final numbers likely to wallow at around 6%-8% of voter preference. Whatever the outcome, the many actors at play this year will face the challenges outlined below.

Organized crime

Given the substantial number of renewed positions (20,367) and the pervasive territorial influence of organized criminal groups (OCGs), 2024 is likely to witness its highest-ever levels of political violence during elections. OCGs will try to sway outcomes by profiling and financing candidates who can enable optimal conditions for their illicit activities. This will involve the elimination of competitors, including through targeted candidate assassinations – as of January 31st, nine such cases have already been recorded in this election cycle. Municipal contenders are particularly vulnerable, constituting 71% of assassination victims, according to think tank México Evalúa.

Political violence will likely impact electoral behavior patterns in two paradoxical ways:

- Lower turnout: wary of violence, citizens will be discouraged from taking part in the polls.

- Higher turnout: OCGs will mobilize their social bases and either incentivize or coerce people to vote for whomever is most convenient for their interests.

The likelihood of either effect occurring or prevailing will primarily depend on the dynamics among local OCG structures and their relationship with the population.

Morena goes all-in

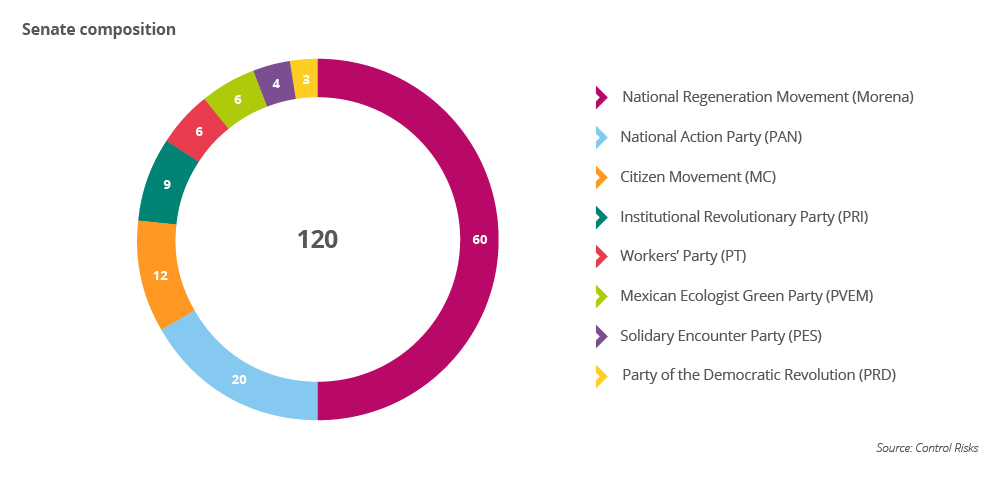

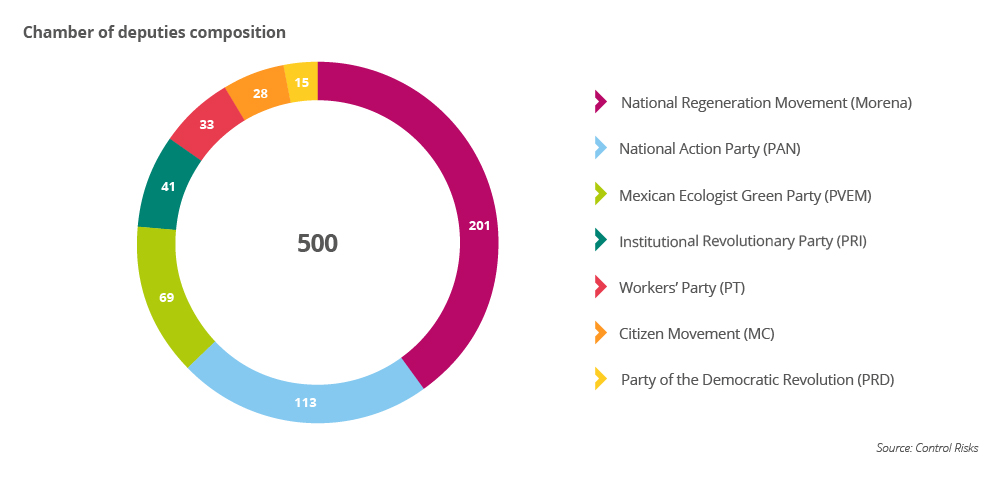

However, the chances of Morena regaining a supermajority are slim, particularly given the erosion of the party's legitimacy during its first-ever federal governance period under AMLO, coupled with its legislative decline in 2021. However, this outcome cannot be ruled out, especially given that the FCM is knee-deep in controversies and mired in accusations of cronyism and influence peddling.

While the opposition coalition first announced a strategy to renew its deteriorated image by encouraging citizen participation and pledging to integrate reputed professionals to participate in political processes, it was quickly co-opted by its party leaders Marko Cortés, Alejandro Moreno and Jesús Zambrano – respectively of the right-wing National Action Party (PAN), the centrist Institutional Revolutionary Party (PRI) and the left-wing Party of the Democratic Revolution (PRD). These leaders, among other things, appointed themselves to party-representation seats in Congress for the next legislature. The move will weaken the opposition’s prospects of securing a firm legislative force.

Leaving so soon?

Sheinbaum gained legitimacy as Morena's candidate through the party’s internal selection process and AMLO's endorsement; she will need to sustain this to ensure cohesion within her coalition. The challenge will be particularly daunting given the vacuum left by AMLO’s popularity, which remained strong at 55% (according to the latest poll by newspaper El Financiero) at the end of 2023.

To Morena and Sheinbaum’s electoral benefit, AMLO will remain a relevant political figure even after he leaves office. AMLO and Morena are aware that they lack the supermajority for constitutional reforms to be approved but will most likely use that as a rhetorical tool for politicization against the opposition during the campaign.

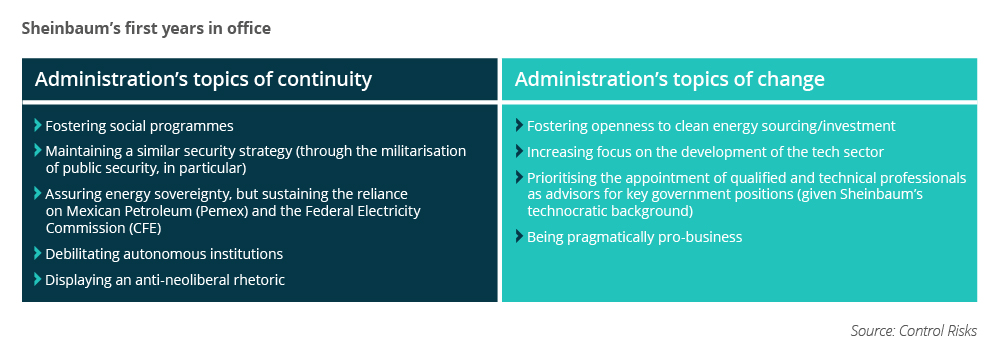

Once AMLO no longer has the state apparatus and exposure to shape the agenda, his influence will diminish – especially considering his stated intention to retreat from the public spotlight at that time. His legacy will likely have a more pronounced impact during the first half of Sheinbaum’s administration, with a probable decline during the second half. This will grant Sheinbaum greater room to maneuver.

Whether she breaks from AMLO ‒ and to what extent and on which issues ‒ remains to be seen, as she has been notoriously reluctant to reveal her positions. In addition, should AMLO prove to constrain Sheinbaum beyond his term, she would not lack precedent for going her own way. Bolivian President Luis Arce, former Ecuadorian President Lenin Moreno (2017-21) and former Colombian President Juan Manuel Santos (2010-18) each diverged from their predecessors—Evo Morales (2006-19), Rafael Correa (2007-17), and Álvaro Uribe (2002-10), respectively. Prior to the election, a key indicator by which to gauge the level of Sheinbaum’s independence will be her authority in selecting candidates for key government posts.

The upstairs neighbor

A rematch of the 2020 US election is almost certain following the victory of former president Donald Trump (2017-21) in the New Hampshire state Republican primary on January 24th. Come November, President Joe Biden, likely to secure his party's nomination, will face Trump. Whereas a Biden victory will entail policy continuity, Trump has made the United States-Mexico Canada Agreement (USMCA) one of his campaign focuses. His re-election in November would threaten the agreement ahead of its scheduled review in 2026. Both potential US administrations are likely to leverage trade disputes to negotiate issues such as immigration and fentanyl trafficking, which would have implications for Mexico.

In addition, a prospective Trump victory raises concerns about the resurgence of “El Efecto Trump” (the Trump effect), whereby his political force increased risk aversion during the election of 2016, destabilizing the Mexican peso. This effect has already impacted the peso this time around: it became the hardest-hit currency after Trump's victory in the Iowa caucus on January 16th.

The broader geopolitical context

Despite global geopolitical uncertainty and domestic hurdles, Mexico has maintained an overall climate of political stability throughout the AMLO administration. Nearshoring remains a key focus in the business landscape. While the trend continues to thrive due to Mexico's advantageous location, businesses relocating their value chains will keep facing several challenges, including:

- Exacerbated water crisis in the northern and Bajío regions

- Road connectivity issues

- Unreliable energy supply and limited development of renewable energy sourcing

- Insecurity

- Limited real estate space in northern states

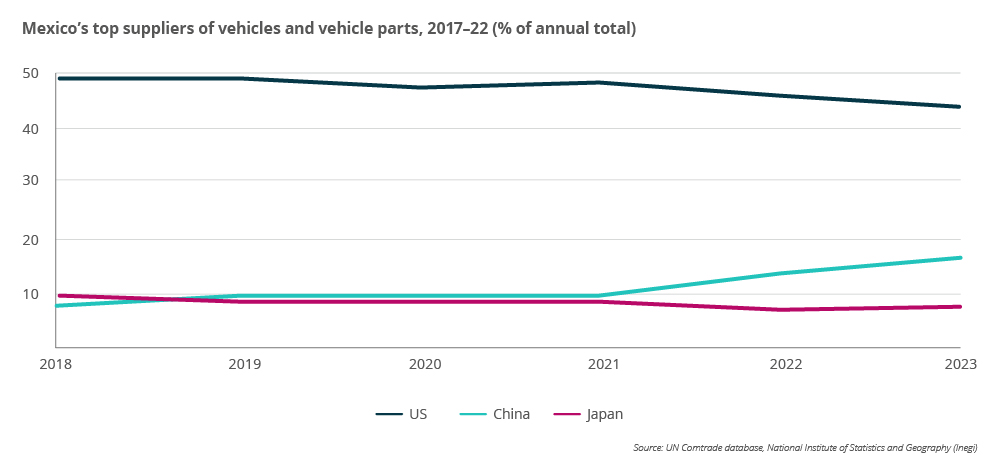

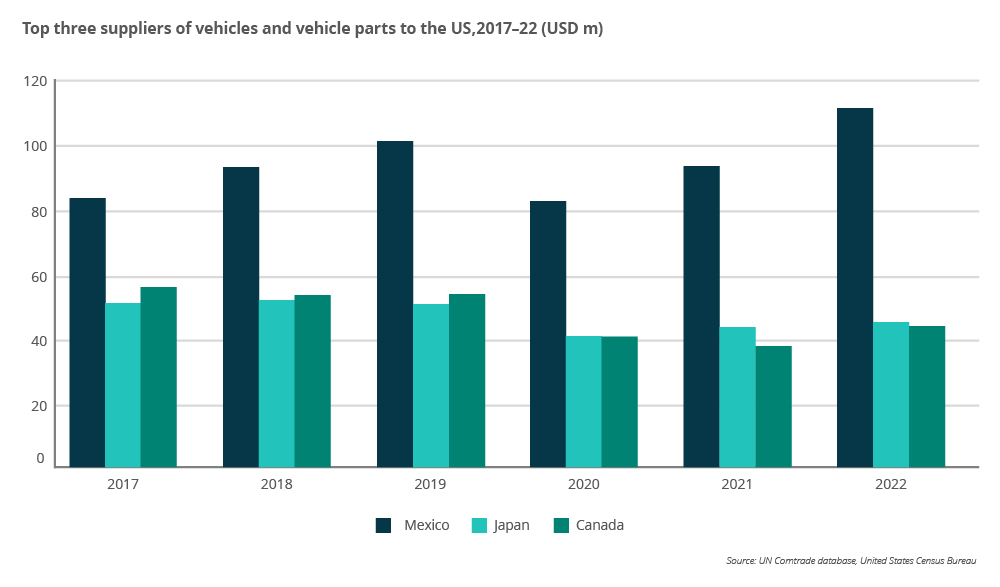

Another key issue is Mexico’s relationship with China. In early January, the US Census Bureau reported that Mexico is poised to surpass China as the leading exporter to the US, mainly as tensions between the latter prompted investment shifts towards Mexico. Mexico's bilateral relationship with China has been ambiguous, likely to avoid attracting too much attention from the US. However, US politicians have raised concerns about growing Chinese capital flows into Mexico, particularly when it comes to its impact on US national security. This has elicited calls for Mexico to strengthen its foreign-investment screening – evidencing mounting US pressure to curb the influx of Chinese products entering the US through Mexico.

Yet, while Chinese investment in Mexico has increased, it hasn't reached a level comparable to North American and European investments. The robust US-Mexico relationship will likely force Mexico to pick the US’ side – if it hasn’t already. For instance, Finance Minister Rogelio Ramírez de la O in December 2023 stated that Mexico prioritizes its trade and financial relationship with the US over others.

Sources:

“2024 Presidential Election”, oraculus.mx

“2024 elections on track to become most violent in history”, politica.expansion.mx

“AMLO closes 2023 with 55% approval: El Financiero (EF) survey”, elfinanciero.com.mx