Latin America and the Caribbean (“LatAm”) will continue to be a focus of US Foreign Corrupt Practices Act (FCPA) enforcement amid persistent corruption concerns in the region. These were analysed in the 2023 Capacity to Combat Corruption (CCC) Index.

FCPA enforcement

Extra-territorial anti-corruption enforcement declined in 2021 and 2022 largely because of institutional and business disruption during the COVID-19 pandemic. This trend has yet to be reversed – including in the case of the US, even though the country is by far the most active global anti-corruption enforcer. FCPA corporate enforcement, for example, remained below average in 2022, with companies and regulators continuing to favour deferred prosecution agreements (DPAs). These typically involve financial penalties, disgorgement, compliance reforms and monitorships rather than pleas or prosecutions.

US FCPA enforcers continue to promote and reward voluntary self-disclosure and robust remediation of corruption violations. The US in 2022, for the first time in two years, declined to prosecute two companies that voluntarily disclosed bribes. In January, the DOJ announced reforms to its Corporate Enforcement Policy (CEP), which covers FCPA cases, that incentivise “immediate” disclosure of violations and “extraordinary co-operation” with regulators to obtain a declination with disgorgement (as opposed to prosecution) – even when cases involve “aggravating” factors.

Combatting corruption

In this context, declining enforcement actions should not be misconstrued as a lack of resolve on the part of the US to combat corruption worldwide. On the contrary, the administration of US President Joe Biden has repeatedly expressed its commitment to do so. This commitment was articulated in the US Strategy on Countering Corruption, published in December 2021. Specifically, the strategy declares combatting corruption “at home and abroad” as a “top security priority” for the US. Senior US officials – including Attorney General Merrick Garland – have reiterated their high intent to investigate FCPA violations in policy speeches in 2022 and 2023.

LatAm has been singled out as a specific focus of this strategy. It is no coincidence that the DOJ and the SEC in April published a Spanish-language version of A Resource Guide to the US Foreign Corrupt Practices Act.

Cross-border collaboration

Both the DOJ and the SEC have presided over multimillion/billion-dollar settlements in LatAm since Biden took office in 2021 and before. Although most of the investigations that culminated in settlements were led by the DOJ and/or the SEC, they involved collaboration with anti-corruption agencies based in the region. US government press releases on FCPA-related developments often acknowledge the assistance of local partners (most notably, Brazil’s Attorney General’s Office, Comptroller General and Public Prosecutor’s Office). This intercountry, intraregional collaboration leverages a multijurisdictional anti-corruption apparatus that – despite the regionwide variations and vicissitudes in the fight against corruption in recent years – provides an ever-evolving institutional base from which corruption networks can be investigated, dismantled and prosecuted.

Anti-corruption collaboration is underpinned by long-standing personal relationships between US prosecutors and their Latin American counterparts that have been forged over the years. Whistleblowing has also become, and will continue to be, an integral component of the US’ anti-corruption toolkit in LatAm. In FY2021 and FY2022, there was a huge increase in whistleblower tips received by the SEC. According to the SEC, Brazil and Mexico were among the six countries from which “the highest number of tips originated”. This reflects the SEC’s increasing success at incentivising the practice, including through the payment of large-scale “awards”.

Lost momentum

LatAm remains characterised by high levels of corruption and the pervasive influence of organised crime, as well as by the lack of institutional capacity, legislative wherewithal, and/or political will to address either. The five “illustrative types” of public corruption classified by the Biden administration – viz. grand corruption, administrative corruption, kleptocracy, state capture and strategic corruption – are all prevalent in the region. Yet the anti-corruption movement within LatAm has lost momentum. The 2023 CCC Index (a data-driven tool to assess the ability to detect, punish and prevent corruption across 15 countries) registered a decline in the regional average score for the first time since 2020.

This reflects a variety of concurrent factors, including democratic backsliding, entrenched authoritarianism, political instability, the lingering effects of the pandemic and rising insecurity. In the minds of most voters, these issues (particularly the latter two) have seen corruption replaced by day-to-day, existential concerns over health, money and personal security. This is seen in governments’ policy agendas and election candidates’ campaign manifestos (with some noteworthy exceptions: #Guatemala). This may change as the pandemic dissipates and inflation comes under control, or in the event that there is a large-scale, high-profile corruption-related data leak à la the Panama or Pandora Papers. However, there is little indication we’ll see a significant change in the regional mindset this year.

Countries to watch

Brazil: The legacy of Operação Lava Jato (“Operation Car Wash”) still hangs over regional efforts to combat corruption. Although tarnished by misconduct allegations against prosecutors and the principal judge involved, it provided an unprecedented opportunity and example for the multijurisdictional co-ordination of anti-corruption investigations. Brazil still plays a key role in such investigations, often in close collaboration with the US. This has continued in recent years despite the simultaneous undermining of, and executive interference in, Brazil’s anti-corruption apparatus by former president Jair Bolsonaro (2019-22). Notwithstanding their chequered past on the corruption front, we expect current President Luiz Inácio Lula da Silva and the now-ruling Workers’ Party to continue bilateral investigative co-operation.

Mexico: Despite promising much on the 2018 election campaign trail, President Andrés Manuel López Obrador (AMLO) has delivered little – if anything – on the anti-corruption front. This is of concern to the US (and Canada) given Mexico’s importance to regional trade and the North American economy. The United States-Mexico-Canada Agreement (USMCA)’s designated anti-corruption chapter that provides for enforcement co-operation between the three North American countries is not just a tick box exercise. Going forwards, we expect FCPA scrutiny in Mexico to intensify in the context of the following interrelated factors: nearshoring from Asia to Mexico; the increasing presence of Chinese companies in Mexico; and US-China rivalry.

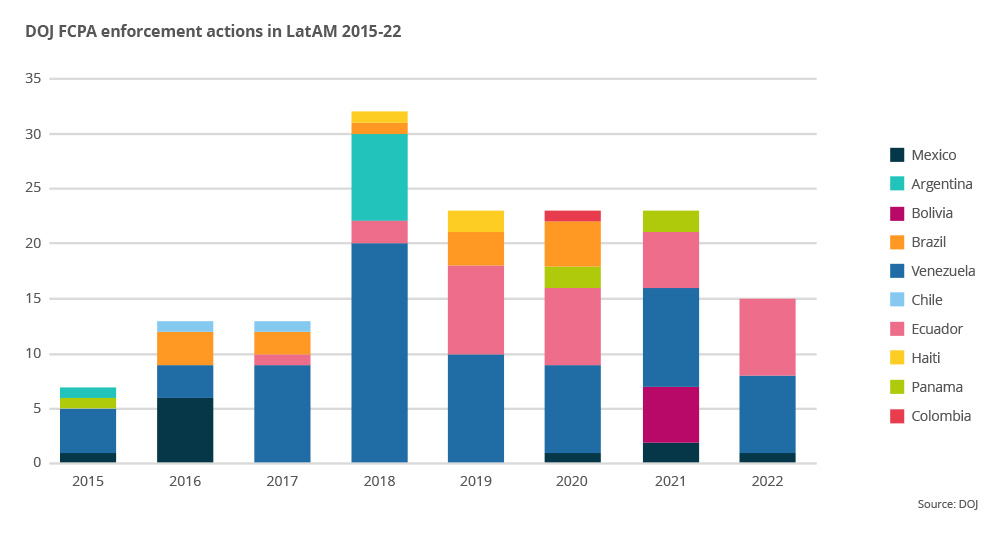

Venezuela: It has been the subject of the largest number of DOJ FCPA enforcement actions of any country in LatAm. This is unsurprising given (1) its particularly poor corruption environment – Venezuela is always the worst-performing country in the CCC Index – and (2) its status as a pariah state and consequent perennial exposure to US sanctions. Enforcement actions this year point to a continued spotlight on:

- The oil and gas sector – in particular state-owned company Petroleums of Venezuela (PDVSA) – despite a loosening of some sanctions in 2022.

- Former government officials (which in part explains a comparatively high number of individual, rather than corporate, enforcement actions) and their alleged involvement in bribery, money laundering and currency exchange manipulation schemes.

- Miami (Florida) – where both the US Immigration and Customs Enforcement and the Internal Revenue Service collaborate closely with the DOJ – as a focal point for money laundering by Venezuelan nationals.

Lesson learnt

FCPA enforcement activity will continue to focus on industries, sectors and/or materials/products that are:

- Particularly vulnerable to large-scale corruption during public procurement processes – for example, infrastructure, health and pharma, and waste management.

- Multinational/multijurisdictional – for example, retail, the aviation industry and the extractive sector (including commodities trading). Many corruption investigations span more than one region.

- Strategically important to national security in the US and/or in the context of the nearshoring trend – for example, critical minerals, manufacturing, technology and telecommunications, and security detection/automation.

Industries synonymous with the activities of unscrupulous intermediaries and vendors – for instance, the extractive sector – are periodically the focus of investigations as well, highlighting the need for companies to carry out comprehensive third-party due diligence. Robust internal account controls (such as a centralised compliance department) as well as clearly defined and disseminated anti-corruption policies and procedures are also a must. The SEC and DOJ frequently cite failings in this respect in their resolution press releases. Such deficiencies can often be a particular problem for companies experiencing rapid expansion without implementing the requisite and corresponding compliance measures.

Sources:

“The 2023 Capacity to Combat Corruption Index”

DOJ correspondence declining prosecution for FCPA violations (March 2022)

DOJ correspondence declining prosecution for FCPA violations (December 2022)

“The United States Strategy on Countering Corruption”

“Attorney General Merrick B. Garland Delivers Remarks to the ABA Institute on White Collar Crime”

“SEC Whistleblower Office Announces Results for FY 2022”

“Two Former Senior Venezuelan Prosecutors Charged for Receiving Over $1 Million in Bribes”

This article is based on a research note originally published in Seerist. Find out more about how Seerist’s adaptive artificial intelligence combined with localized geopolitical risk expertise can help you identify, monitor and mitigate risks.