The UK left the EU on 31 January and is now in a transition period, due to expire on 31 December 2020.

Four key risk points:

1. Businesses operating in the UK will face no immediate changes because the UK will maintain alignment with all EU laws and regulations during a transition period until 31 December.

2. Although some form of deal on the future relationship between the UK and the EU is likely before the end of the year, this is unlikely to be comprehensive and significant uncertainty is likely to continue for many sectors.

3. Finalising all the details of the UK-EU future relationship is likely to take at least two years, even if talks are relatively straightforward and an interim deal is done in 2020.

4. Businesses should also continue to plan for an alternative, less likely, scenario where talks fail, and the UK exits the transition period in December without a deal.

Nearing the end

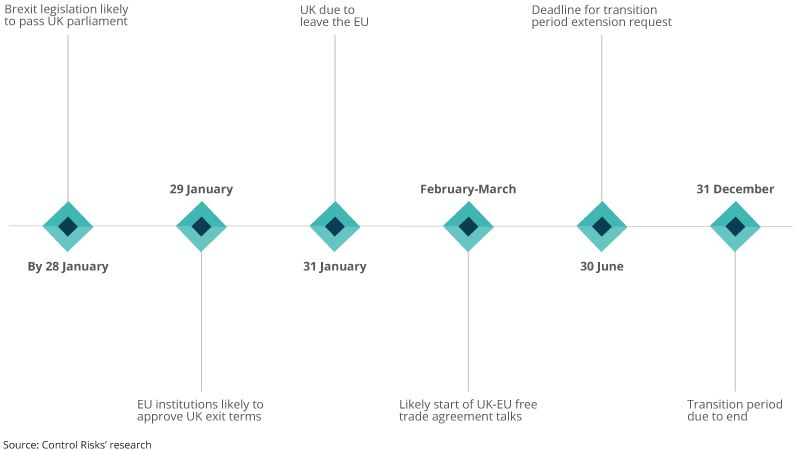

After winning a comfortable parliamentary majority in the December 2019 election, Prime Minister Boris Johnson is now able to achieve his aim of “getting Brexit done”. The withdrawal agreement reached between Johnson and the EU in September 2019 completed its UK parliamentary progress and the European Parliament (EP) ratified it on 29 January. Although some MEPs had raised concerns about the agreement’s provisions on citizens’ rights, the EP approved the deal in time for the UK to leave on 31 January.

Exit

The UK now ceases to be a member of the EU and all its political structures. However, it will continue to be part of the EU’s single market and customs union until at least the end of a transition period – due to expire on 31 December – and all EU laws will apply to the UK during this period. As a result, businesses operating in the UK will be able to continue to operate as they currently do until the end of the year. There will be no new tariffs or checks on goods travelling between the EU and the UK, and UK service companies will retain their rights to operate in the EU. Freedom of movement for workers will also continue. Meanwhile, the UK and the EU will start the next stage of the negotiations to determine their future relationship.

Brexit Timeline

Under the terms of the withdrawal agreement, the UK has the right to request an extension to the transition period. However, Johnson insists that the UK will not do so. Of course, Johnson also insisted that he would not request a delay to the UK’s exit date in October 2019 and ended up doing that. However, on this occasion there are two key reasons why he is likely to stick to his word. The first is that the make-up of the UK parliament has changed significantly following the December 2019 election. There is now highly unlikely to be enough support in parliament to force Johnson to change his position on an extension. Second, the request for an extension must be made before July, six months before the transition period is due to end. At this point, there will be no sense of urgency about the state of talks and thus no impetus to request an extension.

Back to the negotiating table

The start of trade talks between the UK and the EU will dominate the coming months. Fundamentally, in terms of its future trading relationship with the EU, the UK faces a choice between regulatory divergence and market access. Johnson and other pro-Brexit politicians have always indicated that they believe that both are possible. However, the EU is likely to swiftly move to dispel this. For full access to the single market, the EU will demand a “level playing field” to ensure that UK companies do not gain an unfair advantage over ones in the EU. This means that the UK would need to sign up to continued regulatory alignment in a range of areas including labour rights, state aid, taxation and environmental rules. Without this, the EU is extremely unlikely to agree to tariff- and quota-free trade. The UK will begin the negotiations by insisting that it will not sign up to regulatory alignment, as confirmed by Chancellor of the Exchequer (finance minister) Sajid Javid on 17 January. However, this will lead to an impasse and the EU is unlikely to change its red lines.

The UK is likely to respond to the likely rejection of its initial demands with a more piecemeal approach. In some sectors, such as financial services, the UK is likely to prioritise divergence over market access. In others, such as manufactured goods, there may be room for negotiation. However, this approach will be laborious and almost guarantee that a comprehensive free trade agreement will not be concluded by the end of 2020. More likely is a limited agreement on those areas where the UK is prepared to maintain regulatory alignment and those where it has already decided that it is prepared to lose access in return for greater freedom. More complex areas are likely to be deferred for further discussion in 2021.

Northern Ireland

On top of discussions on individual sectors, negotiations on the future of Northern Ireland will once again prove difficult. The continued uncertainty over the future of individual sectors will likely mean that full clarity on the status of Northern Ireland will be impossible before the end of the year.

The Northern Ireland protocol attached to the withdrawal agreement outlines the basis of future trade between Northern Ireland and the Republic of Ireland and the rest of the UK. However, the details of exactly how this will work are yet to be fleshed out. Under the terms of the protocol, Northern Ireland will formally leave the EU’s customs union, but will remain aligned with EU regulation related to trade. Difficulties will therefore arise if the UK elects to diverge from that regulation and new tariffs are imposed on goods travelling from the UK to the EU. In that scenario, any goods from Great Britain entering Northern Ireland that are “at risk” of entering the EU across the Irish border will be subject to those tariffs. As a result, checks on goods crossing the Irish Sea westwards are likely from January 2021 and the initial implementation of these checks is likely to see disruption at ports.

Big questions remain

Although the increased clarity deriving from having a firm date for the UK leaving the EU is positive for businesses to some extent, it should not lull them into a false sense of security. Significant uncertainty remains over the nature of the future relationship between the UK and the EU and in turn about the ways in which businesses will be able to operate in the UK from January 2021. Finalising all the details of the UK-EU future relationship is likely to take at least two years, even if talks are relatively straightforward and an interim deal is done in 2020.

For those that have supply chains that cross the UK-EU border, the outcome of trade talks will have a significant impact on whether these can continue unimpeded. Assuming that a trade deal is done, this may entail different requirements for different types of goods and new bureaucratic burdens.

For businesses in the services sector, uncertainty is likely to continue beyond 2020 as the UK and EU are unlikely to be able to resolve this area within the year. London’s financial services sector is particularly likely to see wholesale regulatory change post-2020. Meanwhile, companies based in the UK are likely to lose the comprehensive right to provide services within the EU and will need to rely on piecemeal agreements.

There are also likely to be changes that affect all sectors. One of the most significant areas to be resolved is data transfer provisions.

The return of no deal?

If negotiations become acrimonious in the coming months, the process could collapse, and the UK would exit the transition period at the end of 2020 without a deal in place. Control Risks considers this a less likely scenario than a continued orderly process, but it is certainly a credible one. As a result, businesses should keep an eye on developments and prepare for the potential impact of no deal being reached. In that scenario, trade into and out of the UK would be conducted under WTO terms, which would entail the imposition of new tariffs and non-tariff barriers. Once again, negotiations are likely to go down to the wire and the no deal scenario is likely to remain a possibility until late in 2020.