How foreign companies can navigate persistent geopolitical risks in Asia

After an intense, months-long military impasse, India and China appear to be withdrawing troops from contested border hotspots, signaling both sides want to diffuse tensions. However, there remain several lingering and perplexing questions about the future trajectory of New Delhi’s precarious relationship with Beijing, and how it will move forward from its lowest ebb in 45 years.

Of immediate concern are the retaliatory economic measures undertaken by India against China in recent months – including banning dozens of Chinese-made mobile applications, detaining shipments, and modifying legislation to curb Chinese investment. Despite the thaw in tensions, these measures do not look like they will be rolled back in the near future, partly due to hardening attitudes amongst the Indian electorate towards China.

Investors are left wondering whether India intends to actually follow through on its high decibel rhetoric against Chinese commercial interests. Does a permanent breakdown of economic relations loom? Amid the coercive diplomacy and sanctions, it is easy to forget that India-China economic ties are deep and underpinned by numerous economic advantages. With the influx of Chinese investment in India, particularly since 2014, the traditional trade relationship between the two countries has evolved into complex economic interconnectivity. If anything, border skirmishes in recent years have repeatedly revealed a mutual reluctance to risk a direct conflict, with both governments making efforts to keep a lid on spiraling escalations. We think, for the foreseeable future, neither New Delhi nor Beijing is likely to break from the predictable pattern of behaviour that has fluctuated between provocations and peace talks over several decades. Nevertheless, there are trigger points that could see a sudden deterioration, such as further military encounters that result in more casualties. Equally, India’s ruling Bharatiya Janata Party (BJP) government – which is contending with mounting discontent regarding its handling of the COVID-19 crisis – may yet opt for the politics of distraction and stoke anti-China sentiment.

What we can say then, with some certainty, is that businesses with footprints in both countries should brace for a prolonged period of vacillation and mutual strategic distrust, which will continue to impact Asian supply chains.

Pending protectionism to increase operational risks and costs

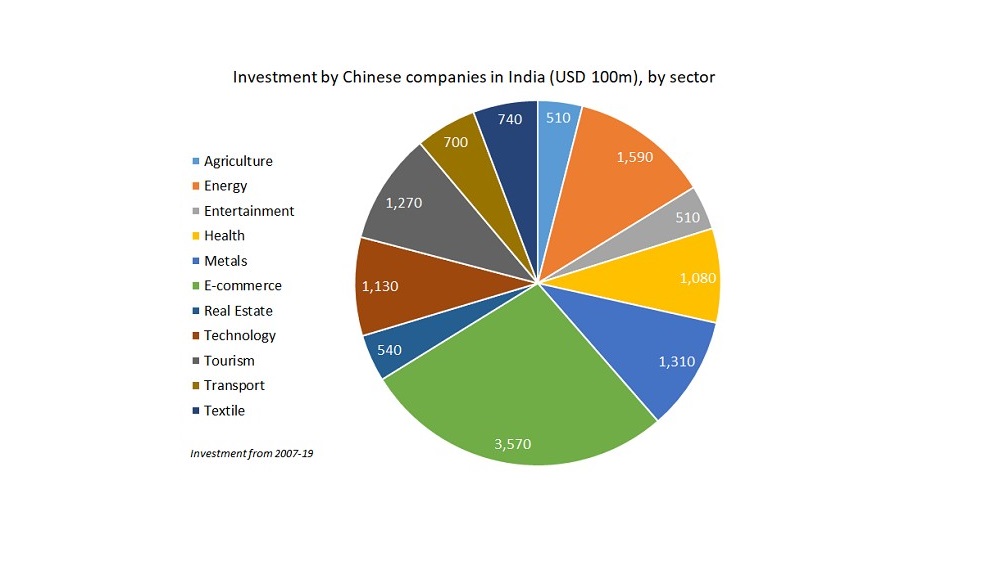

The immediate fallout of the current tensions has translated into intensified regulatory scrutiny and funding constraints for sectors in India that are heavily dependent on Chinese investment. These include automotive and other consumer durables; pharmaceuticals; telecommunications; chemicals; and renewable energy. In particular, Indian technology start-ups (which have received more than USD 4bn in investment from Chinese funds over the past six years) will face significant financial and solvency risks amid India’s deepening macroeconomic crisis and slowdown in domestic consumption.

Source: American Enterprise Institute’s China Global Investment Tracker

Aggressive trade protectionism will also heighten operational risks for all foreign companies with manufacturing operations in either country, particularly in the chemicals, automotive and pharmaceuticals sectors. This is likely to inhibit their access to crucial components, even as they struggle with persistent business resumption challenges due to the ongoing coronavirus pandemic. More broadly, ongoing supply chain shifts in Asia are likely to worsen many companies’ risk exposure to such geopolitical spats in the coming months.

For example, aggressive regulatory enforcement in China has particularly affected the chemicals and petrochemicals sectors, with many companies shifting manufacturing bases to India. However, prolonged delays in customs and port clearances for Chinese products entering India will now escalate time and cost overruns and likely nullify any gains achieved from the sourcing of cheaper Chinese imports. Indiscriminate import restrictions on Chinese products are also likely, further escalating production costs and hurting businesses in India in the long run.

Ambivalent diplomatic relations will continue to undermine regional cooperation

Aside from the current dispute, India's diplomatic engagement with China will remain largely ambivalent in the coming years, owing to its deep-seated concerns about China's geopolitical influence in the region. This will continue to complicate the value of Chinese capital in growing the Indian economy, posing enduring challenges for India's economic policies. In the realm of foreign investment, New Delhi will struggle to reconcile competing imperatives and political bargains – balancing the need for a transparent, open, and competitive investment environment with longer-term security considerations and the demands of local businesses.

This ambivalence is also likely to stall progress on institutional frameworks and regional agreements that would have otherwise helped to protect and stabilise existing trade relationships. India’s decision to stay out of both Beijing’s Belt and Road Initiative (BRI) and the China-led Regional Comprehensive Economic Partnership (RCEP) trade pact reflect longstanding concerns about economic overdependence on China. Meanwhile, the Quadrilateral Security Dialogue – an informal group comprising Australia, India, Japan, and the US – remains unlikely to provide a viable alternative to China-led initiatives in the region in the near future.

For China-linked business interests, this means that India's broader investment environment will continue to be undermined by an unpredictable policy landscape which often manifests as loosely drafted policies, ad hoc amendments, and occasional policy reversals. As such, Chinese companies or those with China-linked supply chains will continue to face significant regulatory and operational risks across multiple stages of the investment or operational process, especially if their investments involve commercial development processes, such as land acquisition and construction (approvals for which are notoriously tricky in India).

Companies must carefully navigate political minefields

Resurgent rhetoric about supply chain onshoring, while good at capturing headlines, is not a viable solution for the vast majority of companies. Businesses that find themselves caught in geopolitical crosshairs must instead increase their monitoring and understanding of their own vulnerabilities, be they legal, operational, or reputational.

Separately, Chinese and other foreign companies operating in India should take steps to carefully examine the country’s evolving stakeholder landscape. International companies, now more than ever, need to devise decentralised and proactive engagement strategies that focus on state-level stakeholders (who can act as crucial allies and interlocutors), before considering federal government figures. Chinese investors should closely monitor public perceptions in India and seek to control narratives surrounding their investments (focusing, for example, on their value proposition rather than on contentious political issues). Exploring joint ventures with domestic companies that have the necessary clout with government and media stakeholders is a key avenue through which such problems can be mitigated.