- Environmental inspections – and closures – will continue to affect thousands of companies every month in the coming year.

- The vast majority of companies penalised in the latest inspection rounds are private domestic companies. Nevertheless, this significantly affects the supply chains of foreign companies operating in, or doing business with, China.

- Environmental enforcement will continue to be used as a tool for industrial transformation and eliminating less competitive industrial capacity, despite Han’s insistence that environmentally compliant companies not be shut down.

Continuous crackdown

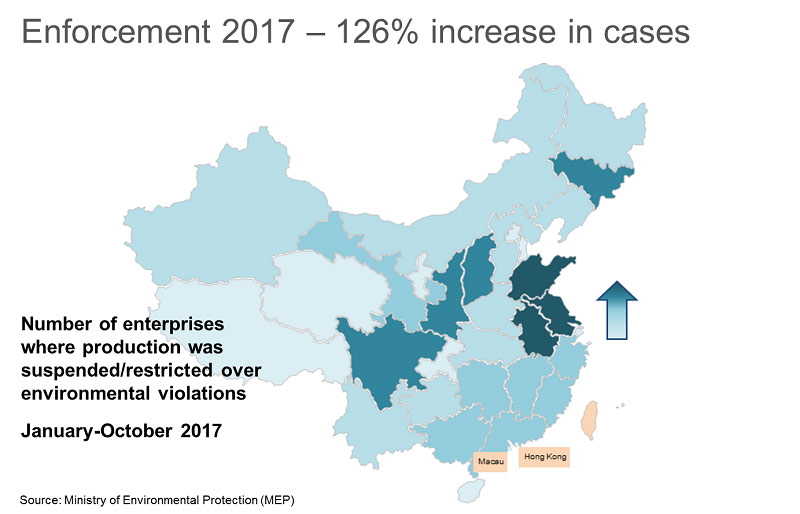

Chinese environmental enforcement has surged in frequency and intensity over the past two years and continues to intensify. Following the conclusion of nationwide 2016-17 inspections – which shocked many businesses into taking enforcement seriously for the first time due to the high number of shutdowns – the government in June formally launched the next wave of much more targeted campaigns from June 2018 to April 2019. The inspections form part of the government’s Three-Year Action Plan to Win the Battle for Blue Skies, known as the “2018-19 Blue Sky Battle Regional Supervision-Strengthening Programme”. The Ministry of Ecology and Environment (MEE) is restructuring environmental competencies to put inspection campaigns and investigations at its core.

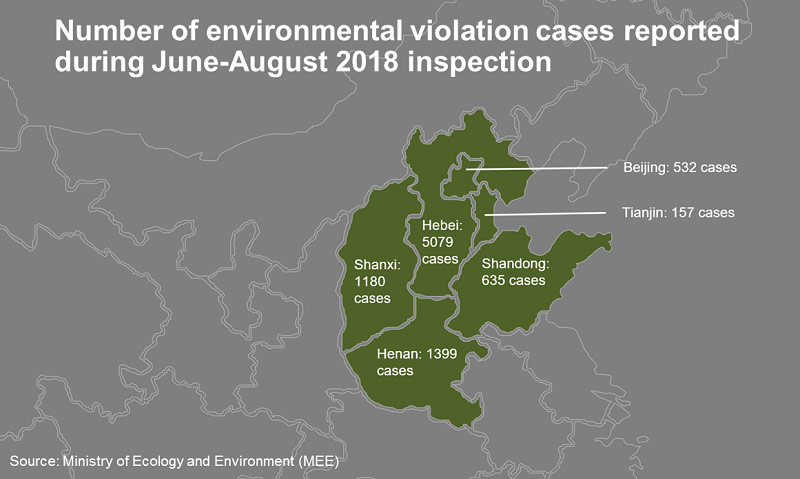

The latest wave of inspections is not nationwide, but more targeted, focusing on specific provinces identified as particularly problematic in the previous inspections. A first round – from 11 June to 5 August – was conducted in the municipalities of the capital Beijing and Tianjin (northern China), as well as priority cities in the provinces of Hebei, Henan, Shandong and Shanxi. The next wave, running from 20 August to 11 November, will continue these probes, but also conduct inspections in a further 11 cities in Shaanxi, Shanxi and Henan provinces. Meanwhile, Han’s comments came as Beijing launched its latest campaign in the Beijing-Tianjin-Hebei region to lower winter smog levels.

Who gets targeted?

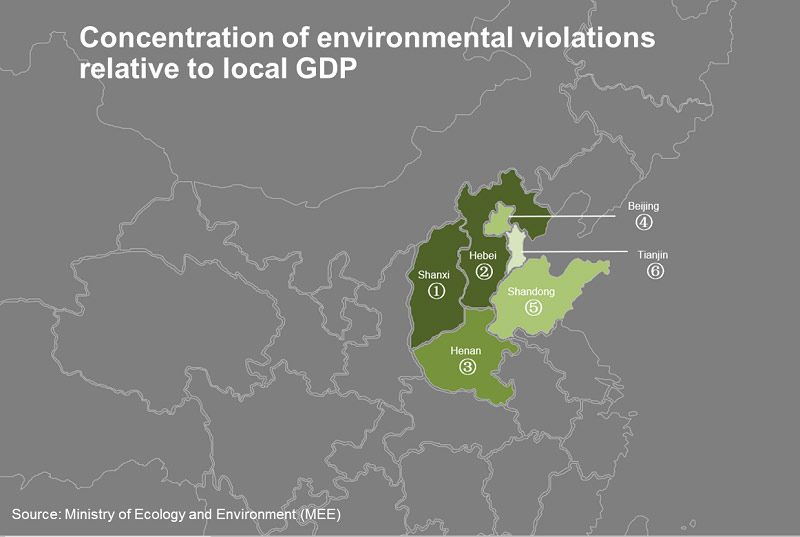

There are clear trends in the initial investigation results analysed by Control Risks, which indicate the priorities for the government’s ongoing campaigns in the coming months. For the June to August inspection results, the government as of 20 August had published 8,982 cases of violations and enforcement. Geographically, over half the reported violations occurred Hebei province, followed at some distance by Henan and Shanxi provinces. This makes sense, given the high priorities the central leadership places on cleaning up Beijing’s notoriously bad air pollution ahead of the next winter (and why there is also a separate Beijing-Tianjin-Hebei campaign). Shandong, which was the province most affected by factory shutdowns in the 2017 inspections, has comparatively fewer violations in these campaigns.

However, looking at the concentration of cases by population or GDP of the inspected localities suggests that companies operating in Shanxi face a greater threat of enforcement over environmental violations than companies in Hebei. Henan and Shanxi provinces also saw significantly more cases of violations reported in the latest round compared to the 2016-17 inspection results. Shandong and Tianjin by contrast had far fewer.

Understanding supply chain and project development impacts

Although the vast majority of enforcement cases has affected smaller, private domestic companies, the impact of ongoing enforcement will be felt across supply chains for both foreign and domestic companies. In addition, enforcement is likely to target various stages of operations, from set-up or expansions to daily operations, causing disruption and delays in each phase of development.

The 2016-17 enforcement campaign predominantly disrupted manufacturing activities, and these will remain among the most affected by environmental enforcement. However, the targets during the June-August campaign suggest a slightly different approach, with the targeting of construction sites in particular (alongside materials storage and industrial emissions) potentially affecting a much broader range of businesses.

The government likely views targeting these sources of air emissions as quick wins in curbing air pollution in the region. Curbs on construction activities are familiar to the industry in China – particularly around the Beijing-Tianjin-Hebei region during the winter months (November to March) – but the latest campaign suggests delays will become even more likely as a result of environmental enforcement. The heightened pressure on the construction industry can also be seen in the tightening of rules for public engagement during environmental impact assessments released in July, which puts particular pressure on the construction industry.

It’s not just about the environment

Despite Han's repeated urging that environmentally compliant companies not be shut down, the government will continue to use a range of environment-related tools to transform the country’s industrial landscape. Environmental protection taxes, requirements to fund more environmentally friendly transport routes, as well as direct enforcement will continue to see significant closures among companies perceived as overcapacity, outdated or non-competitive.

The 2016-17 environmental campaign tasked local officials with shutting down “small, scattered, messy and polluting” (小散乱污) companies, which meant that many of the firms shut down did not commit environmental violations, but lacked appropriate business licenses or updated permits. Although the new Three-Year Action Plan omits the “small” from the list of targets, a similar set of companies are likely to be affected.

This is not just going to affect small Chinese operations such as three-person metal workshops (many of which were permanently closed in Shandong in 2017). This will also affect major foreign companies through wider industrial reforms, for instance in chemical manufacturing. Beijing has ordered the number of chemical industry parks to be cut by half in the coming two years, causing major disruptions to companies in the sector. Most provinces are due to finalise their list of chemical parks to be closed by September, and those closures will depend both on how well companies in those parks perform environmentally, as well as how competitive and technologically advanced they are.

Mitigating reputational and business partner risks

The shift in environmental and industrial policy implementation demands that companies understand how their business relationships, and their supply and distribution chains fit into the new order. Incorporating environmental compliance in the reputational due diligence of business partners is essential for avoiding disruptions. Understanding – and being able to regularly verify – suppliers’ environmental compliance is also key to more quickly responding to disruptions linked to closures in a specific regional area, industry or chemical parks.

Failure to do this will now also be associated with much greater reputational risk. Environmental authorities are naming and shaming companies and local officials who fail to uphold higher environmental standards. The government has released almost all the company names in the over 8,000 cases reported in the June-August campaign, and is doing so in other campaigns as well.