As confirmed cases of COVID-19 continue to rise in sub-Saharan Africa, exceeding 13,000 on 20 April, governments across the region are struggling to mitigate the economic impacts.

Three key risk points

1/ The economic impact of COVID-19 will be spread unevenly across sub-Saharan Africa, with more diversified economies in East and West Africa likely to prove more resilient.

2/ International assistance and debt relief efforts will be undermined by Africa’s fragmented debt landscape and are unlikely to prevent a sharp rise in sovereign risks.

3/ These economic and fiscal challenges are likely to prompt shifts in government policies, which will open opportunities for investors despite a slow and uncertain recovery overall.

Varying symptoms

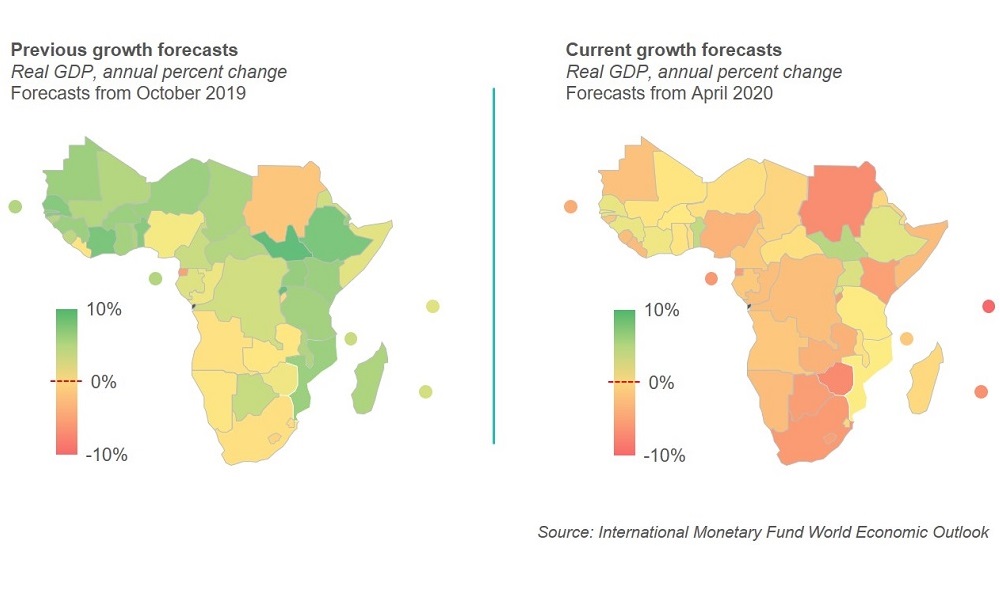

COVID-19 will have a severe economic impact on sub-Saharan Africa. In the April edition of its Regional Economic Outlook, the IMF forecast a recession of 1.8% across the region as a whole – the first since 1991 – compared with its previous forecast of 3.5% growth. Like all forecasts, this should be treated with caution. The economic impact will depend on the duration and extent of the outbreak, not only in Africa, but among its trading partners.

Nonetheless, economies overly reliant on single export-orientated industries will be worst hit. The island nations of Seychelles, Mauritius, Cabo Verde, and São Tomé and Príncipe are expected to experience contractions in GDP of between 4.0% and 10.8% – an average drop of 10.8 percentage points from their pre-COVID forecasts – as a result of the effective freeze on global tourism. The region’s oil exporters – Angola, Cameroon, Chad, Congo (Brazzaville), Equatorial Guinea, Gabon, Nigeria and South Sudan – will be hard hit by the fall in oil prices that are caused, in large part, by the demand disruption caused by COVID-19. The mining economies of southern Africa will also struggle. The economies of Congo (DRC), Botswana, Zambia and Zimbabwe all rely on primary mineral products for more than 60% of export revenues and all are forecast to contract by more than 2%.

Some countries will prove more resilient. In West Africa, Senegal, Guinea and Côte d'Ivoire are all projected to see GDP growth of more than 2.7% in 2020. In East Africa, Rwanda, Ethiopia and Uganda are forecast to grow at above 3.2%. These figures represent a drop of 3.8 percentage points from previous growth forecasts. This is a sharp hit, but significantly less than the 5.2-percentage point drop for sub-Saharan Africa as a whole or the eight-percentage point drop for the world’s advanced economies.

What these countries have in common are growth models based on domestic consumption; healthy local private sectors; and relatively robust agricultural sectors. The first two factors enable economies to keep going despite the disruption to global supply chains caused by COVID-19. Meanwhile, the agriculture sector is typically regarded as an essential service and is less affected by social distancing measures or other government restrictions.

Expensive treatments

These economic impacts require a fiscal response. Central banks across the continent have adopted aggressive monetary policy initiatives in an attempt to boost liquidity in their economies, massively increasing the funds available to commercial banks and introducing debt repayment holidays. But this will not be enough. Such measures have limited trickledown effects. Despite a rapid rise in financial inclusion in Africa over the past decade, large parts of many economies – including most small businesses and consumers – have only limited exposure to formal financial services and therefore will only see limited benefits from central bank measures.

To sustain these parts of the economy governments will have to look to fiscal policy. Many are already doing so, announcing emergency funds and loans for businesses, providing welfare support for the worst-affected citizens, and lowering or suspending taxes. But most countries went into this crisis with high fiscal deficits and little headroom to increase spending on a sustainable basis, meaning that any such fiscal stimulus will have to be funded by borrowing. This could push those countries with already high debt burdens – such as Comoros, eSwatini, Guinea-Bissau, Mauritania and Zambia – into sovereign default events.

International recognition of the economic and fiscal challenges faced by African economies will help to some extent. The IMF and World Bank announced on 17 April that official creditors had mobilised USD 57bn to assist Africa to cope with the pandemic, and suggested that support from private creditors could equate to a further USD 13bn in 2020. The IMF has provided debt relief to 19 countries in sub-Saharan Africa that effectively cancels six months of IMF debt payments owed by these countries so that they can divert financial resources to tackling COVID-19. The G20 forum has also agreed to a one-year suspension of debt repayments for the world’s poorest countries, which include the majority of sub-Saharan Africa, and urged private creditors to engage in similar actions.

But the increasing complexity of Africa’s debt profile in recent years will undermine the effectiveness of these measures. Africa now has more debt in more forms held by more creditors, from emerging markets to commercial institutions. Private-sector creditors have already expressed misgivings about the idea of blanket debt moratoriums, instead stressing the need for debts to be restructured on a case-by-case basis. China – the largest single creditor to sub-Saharan Africa – will participate in debt relief schemes but has expressed a similar preference to look at the issue on a case-by-case basis. Such restructurings demand time and resources that are currently in limited supply and are likely to still count as default events with consequences for credit ratings and future borrowing ability.

This fragmented debt landscape also undermines the negotiating ability of African governments. Debt relief initiatives from the IMF and World Bank followed unified calls by finance ministers from across the continent. However, such strength in unity is less effective in negotiations with other bilateral or commercial creditors that may only have exposure to a few countries. Such creditors are also likely to tighten requirements for new loans, making it difficult for Africa to access the USD 44bn that the IMF and World Bank believes is necessary on top of what has already been committed. Bilateral creditors struggling with their own imminent recessions will find it politically difficult to justify grants or concessional loans, while commercial financial markets are tightening.

Cautious recovery

Sub-Saharan Africa’s recovery from COVID-19 will be slow and uncertain. The IMF may be forecasting growth in 22 of the region’s 49 economies in 2020, but this growth is low, especially on a per capita basis. The resultant fiscal challenges mean that the 2021 recovery will not be as pronounced as elsewhere in the world. Nonetheless, the huge uncertainty around these forecasts means that the pandemic may well drive some long-term changes that open new opportunities for investors.

Most importantly, the scale of the crisis is likely to prompt shifts in economic policies in many countries. Not all these changes will be favourable for investors. There may be a rethink of the privatisation efforts ongoing in many southern and East African countries. Not only has the pandemic disrupted short-term schedules, but some governments will be more reluctant to sell off state-owned enterprises that have served as a vehicle for ensuring employment, or state utilities that can freeze utility bills as a form of financial relief for citizens. However, reductions in the scale of privatisation plans are more likely than reversals. Leaders such as Angolan President João Lourenço and Ethiopian Prime Minister Abiy Ahmed have already reiterated their commitment to these reforms. Meanwhile, the reinvigorated role of multilateral institutions such as the IMF will increase pressure to push ahead, and governments will be even less able to afford the burden often loss-making public companies place on budgets.

Economic diversification efforts are also likely to move up priority lists. Progress by oil exporters in diversifying their economies since the 2014 oil price crash has been limited, despite bold rhetoric, but the current crisis has been far more disruptive. Diversification efforts will be uneven as governments facing severe fiscal challenges will struggle to put in place the necessary infrastructure to make some sectors attractive to prospective investors. But reducing bureaucratic burdens, offering tax incentives, and using concession or build-own-operate models in promising sectors requires little capital expenditure.

Sectors to benefit

There are a few sectors in which investors are likely to receive a particularly warm welcome. The most obvious is healthcare. Most African governments have moved quickly to impose highly disruptive lockdowns because they know that under-resourced healthcare systems cannot cope with large-scale outbreaks. For many years healthcare expenditure in sub-Saharan Africa has hovered around 5% of GDP compared with a global average of almost double that. Many governments may conclude that greater investment in healthcare capacity is a worthwhile investment. Such plans are likely to find willing international sponsors as COVID-19 has demonstrated how easily a national outbreak can escalate into a global pandemic.

There is also likely to be a renewed focus on encouraging in-country manufacturing and agriculture. The disruption to global supply chains and the impact of depreciating currencies on import costs have re-emphasised the importance of building domestic capacity. Meanwhile, the COVID-19 outbreak has also highlighted the importance of telecommunications, already a sector seeing rapid growth in sub-Saharan Africa. Central banks have sought to encourage mobile money and other digital payment systems as a means of facilitating commerce while maintaining social distancing. Governments are using WhatsApp to spread information about the virus and answer questions, while companies from South Africa to Nigeria are developing self-assessment apps. The innovation that has been displayed will continue to create opportunities long after the pandemic that prompted it is over.