Our Africa team considers the key trends and issues likely to shape the political environment in 2024. We also include “wild cards” – unlikely events with a high impact that could catch organisations by surprise.

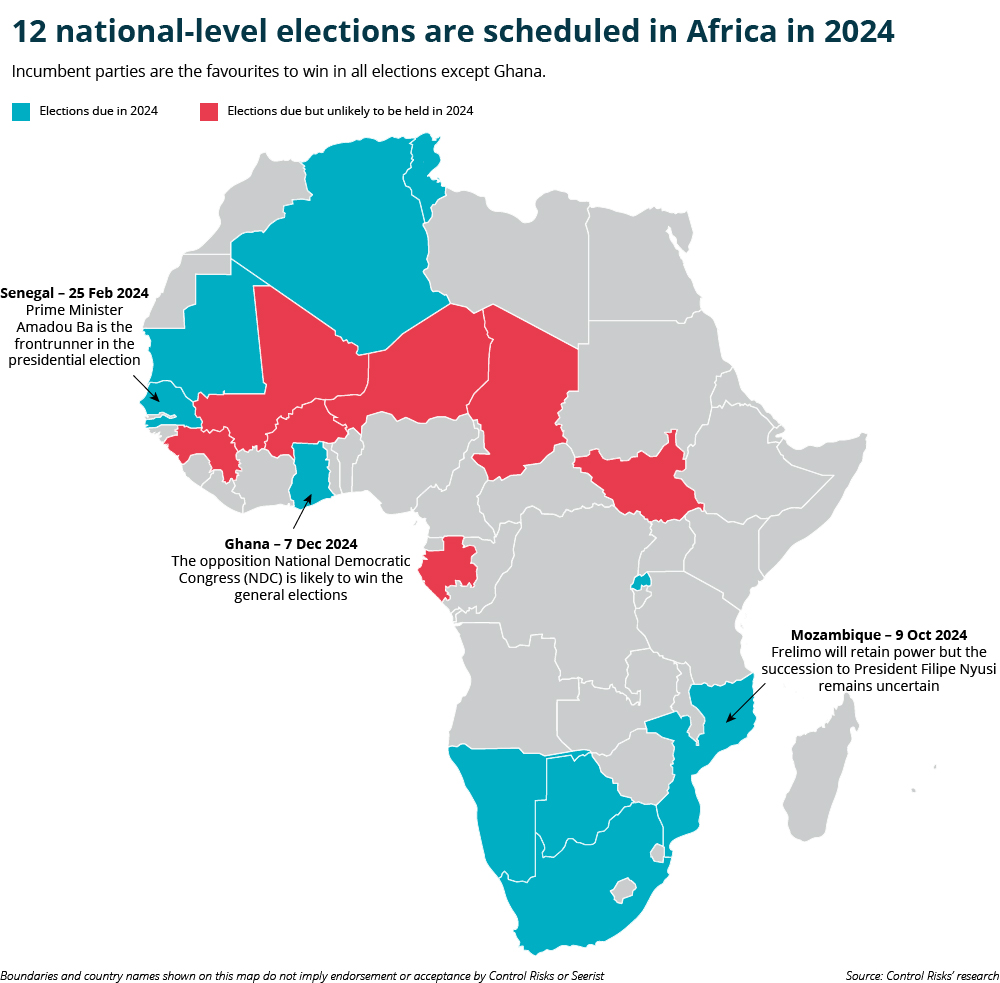

- South Africa faces a pivotal election in mid-2024 in which the African National Congress (ANC) could lose its 30-year parliamentary majority. Eleven other national-level elections are scheduled in 2024, with the opposition only likely to win in Ghana.

- In a more transactional geopolitical environment, African leaders will continue their efforts to elevate the continent’s voice in global debates, while deepening ties with a range of “middle powers”.

- Sudan’s armed conflict will evolve towards a de facto partition of the country. Flare-ups of violence are also likely in Ethiopia, while a broader Ethiopia-Eritrea war is an unlikely but plausible worst-case scenario.

- While growth forecasts for 2024 look slightly more positive than 2023, the region still lacks large-scale growth champions and will continue to struggle with a constrained financing environment.

1. South Africa: heading to pivotal elections

South Africans will head to the polls between May and mid-August. The ANC faces its toughest electoral test yet and could for the first time lose its parliamentary majority. Despite early opinion polls indicating a dismal performance, with the party polling in the low 40s in terms of vote share, the ANC's strong election machinery could still save President Cyril Ramaphosa from a major setback. Our most likely scenario sees the ANC maintaining a slim majority or forming a coalition with smaller parties.

Policy changes, including port and rail sector liberalisation or unbundling of national power utility Eskom, are unlikely before the elections. Assuming Ramaphosa secures re-election, a more favourable environment for reforms may emerge in late 2024, with cabinet reshuffles facilitating significant changes.

Wild card: ANC-EFF coalition. If support for the ANC drops below the mid-40s, the party would likely be forced to find a larger coalition partner. A deal with the Economic Freedom Fighters (EFF) would be the probable outcome, pushing government policy sharply to the left and its foreign policy further away from the West. In such a scenario, Ramaphosa would resign after the elections and be replaced by Deputy President Paul Mashatile.

2. Political instability: will the coup epidemic spread further?

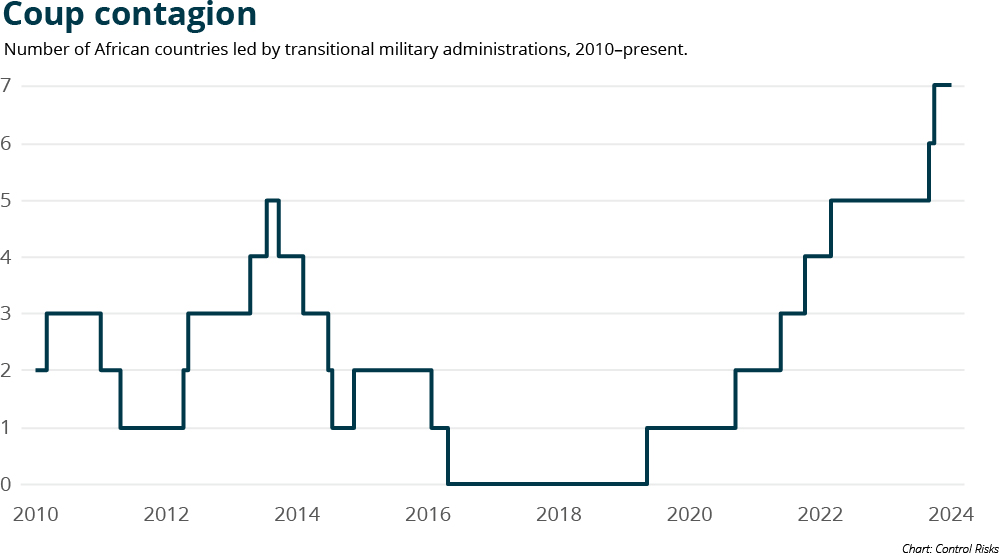

Despite being confined to small economies, military coups continue to have an outsized impact on international investor sentiment and risk perceptions towards the broader region. With seven military takeovers in the last three years, it is easy to predict further “coup contagion” in 2024. Populations have generally embraced military leaders, and regional and international responses have been ineffective. Several countries exhibit vulnerabilities that make them potential coup targets, such as Madagascar, which has just held controversial elections, and Cameroon, Congo (Brazzaville), Equatorial Guinea and Uganda, where the succession plans of longstanding presidents remain unclear.

In 2024, the coup threat will be highest in countries already under military leadership, none of which are likely to organise elections in 2024. Juntas appear increasingly unstable in Burkina Faso, Niger and Guinea. Another coup in at least one of these countries is probable in the next year.

Wild card: coup in Cameroon. The political system around 90-year-old President Paul Biya appears increasingly paralysed by internal rivalries. While Biya has worked hard to “coup-proof” his regime, a health scare or permanent incapacitation would leave a power vacuum that military strongmen would be quick to fill. A long and volatile military transition and a complete shake-up of institutions would follow.

3. Nigeria: the going gets tough for the Tinubu administration

After winning early applause from the business community with a series of bold policy moves, President Bola Tinubu is now struggling to deliver on his promises to repower the economy. The optimistic assumptions laid out in the 2024 budget look increasingly out of touch with reality as the naira (currency) continues to slide. Oil and gas production will likely recover slightly in 2024, but not enough to give the government sufficient room to accelerate investments in infrastructure.

While Tinubu makes continued efforts to improve Nigeria’s standing abroad, social discontent with the high cost of living is likely to grow, likely leading to protests and fraying unity within the administration.

Wild card: reforms pay off. An improvement in the central bank’s forex position, which would likely come from a rapid increase in oil revenue in 2024, could see the authorities clear the backlog of unmet forex demand – a key concern for businesses. Combined with a planned tax simplification reform, this could encourage investment from businesses more confident about their ability to repatriate funds.

4. Economy: the funding squeeze continues

Despite a slightly improved 2024 growth forecast of 4%, up from 3.3%, according to the IMF, the region will continue to struggle with constrained financing due to high US interest rates and debt concerns. Some African countries, locked out of international debt markets, may issue green bonds, but the Eurobond drought is expected to persist until at least late 2024. China's economic slowdown and shifting priorities will limit infrastructure loans, with commitments since 2022 at a 20-year low.

The threat of default remains high, exemplified by Ethiopia's expected debt restructuring after a missed repayment on 11 December. Kenya faces a June repayment deadline, likely manageable with multilateral support. Ongoing restructurings in Zambia and Ghana are anticipated in 2024, while other countries at high risk of debt distress (19 according to the IMF in 2023) will increasingly lean on international donors, facing conditions to raise revenue and invest in decarbonisation.

Wild card: a debt default in Kenya. The depreciation of the shilling (Kenyan currency) against the dollar over the past year has strained public finances and made the Eurobond debt relatively more expensive. Although Kenya’s access to multilateral financing cushions its debt position, a rapid increase in oil prices, failure to secure food supplies amid climatic shocks or collapse in tax revenues could see Kenya unable to make its Eurobond repayment.

5. Horn of Africa: caught up in intractable conflicts

Ethnic tensions in Ethiopia will continue to result in bouts of violence. In Amhara and Oromia regional states, insurgent groups will continue to clash with state security forces. In the absence of a negotiated settlement, with both federal authorities and insurgent groups reluctant to engage in talks, the security environment will remain precarious.

Wild card: an Ethiopia-Eritrea war. Ethiopia-Eritrea relations have deteriorated sharply in recent months, triggered by Prime Minister Abiy Ahmed's statements regarding Ethiopia's willingness to “fight” for Red Sea port access. A new conflict would devastate regions that have yet to recover from the 2020-22 Tigray conflict. An Ethiopian invasion would be unpopular internationally and would likely derail Western reconstruction funding and ongoing debt-restructuring negotiations. It would intensify pressure on Ethiopia's government stability and exacerbate existing security challenges in the rest of the country.

6. Tanzania: economic ascendancy continues

President Samia Suluhu will continue to position Tanzania as the premier investment destination in East Africa. Having in 2023 secured financing to upgrade its main port of Dar es Salaam, made progress in the building of its standard gauge railway (SGR) to bolster its connections to central Africa, and signed a host government agreement to launch its liquefied natural gas (LNG) project, Tanzania looks set for spectacular growth in 2024.

Wild card: EACOP financing. Should the government finalise financing for the East African Crude Oil Pipeline (EACOP), which would transport crude oil from Uganda through Tanzania, the country would be well on its way to surpassing Kenya as the regional economic powerhouse in the coming years.

7. Sahel: militants take advantage of security vacuum

Militancy will continue across Mali, Niger and Burkina Faso in 2024. Militants will deepen their territorial foothold and expand their operations and networks towards other West African states. The security vacuum in the border area between the three countries will escalate as military juntas appear unable to fill the gap left by the departure of international troops in 2022.

Prioritising a heavy-handed response, the militaries’ actions will intensify the targeting of civilians and communal tensions, allowing militants to boost recruitment and install alternative governance systems. With juntas distracted by internal challenges, armed groups will continue to expand towards new areas, creating new hotspots for militancy including northern Benin and Togo, south-western Mali and potentially southern Niger.

Wild card: caliphate in the north, attacks resume in large cities. Militant groups could take advantage of the security void to start organising blockades and eventually take over large towns and impose their authority on large swathes of territory in northern Mali or Burkina Faso. They could then resume a campaign of terrorist attacks targeting civilians and Western interests in Bamako (Mali), Ouagadougou (Burkina Faso) or Niamey (Niger), as seen between 2015 and 2018.

8. Trade: integration makes progress, despite regional politics

Continental trade integration will achieve a milestone with the launch of the Pan-African Payment and Settlement System (PAPSS). Developed by Afreximbank and hosted by Kenya, the initiative, championed by Kenyan President William Ruto, facilitates cross-border payments, reducing transaction costs for regional businesses by eliminating the need to convert currencies into foreign denominations. All central banks are expected to join by the end of 2024, followed by commercial banks by the end of 2025.

However, regional politics pose challenges to trade integration. In West Africa, ECOWAS faces divisions over military coups in the Sahel, maintaining sanctions on the Nigerien junta and potentially disrupting trade in the first half of 2024. Clashes and potential sanctions loom over likely election delays in Burkina Faso and Mali. East Africa will see rivalry between Tanzania and Kenya over capturing imports complicate relations in the East African Community (EAC).

Wild card: Sahelian countries leave ECOWAS or the CFA franc. Sahelian military juntas continue to derive economic benefits from their membership of ECOWAS and the CFA franc monetary area. However, their increasingly strident rhetoric against France and the regional bloc could override economic considerations and escalate to a point where the three juntas together exit ECOWAS or leave the CFA franc currency zone to pursue an independent monetary policy.

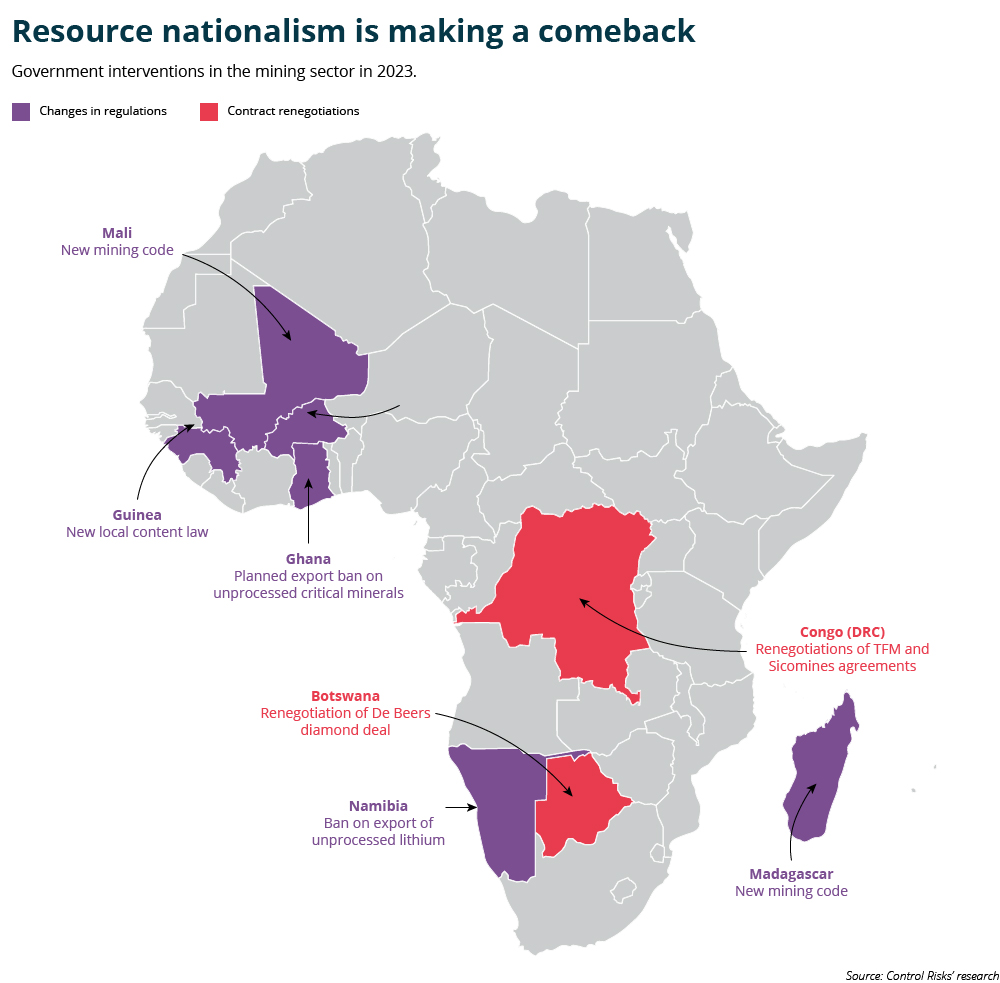

9. Resource nationalism: beware of misplaced confidence

Recognising the importance of their mineral wealth for the global energy transition, African countries are increasingly assertive in their management of their natural resources. In 2023, we recorded regulatory or contractual interventions by governments in eight mining markets, including major contract renegotiations in Botswana and Congo (DRC), and new mining regulations in Mali and Burkina Faso. These pressures will grow further in 2024. In Congo, the government and state mining company Gécamines will intensify their efforts after the December 2023 elections to improve the terms of joint-venture agreements and reposition Gécamines as a major actor in the trading of copper and cobalt. In the Sahel, government plans to build refining capacity in Burkina Faso and Mali could trigger a showdown with gold mining operators, which currently send their product abroad for refining.

Wild card: new investments in high-risk critical minerals projects. A major US investment in a mining project in Congo could catalyse further interest from mining majors, which have been hesitant to commit large sums until now. We could also see strategic investments from Saudi Arabia and the UAE, which have ambitions to position themselves as electric battery powerhouses.

10. Geopolitics: Africa pursues closer ties with middle powers

2023 saw efforts by African leaders to elevate the continent’s profile in global debates – for example, a peace mission conducted by five heads of state to Ukraine and Russia, Ruto’s compelling case for a fairer global financial system, or the permanent seat granted to the African Union at the G20. The main economies of the region continue to resist geopolitical pressures to align with global powers, which are also likely to pay less close attention to Africa in 2024 due to domestic distractions (such as the US election campaign).

In this context, African leaders will increasingly find political convergence with middle powers such as Brazil, India, Turkey or Gulf states. An alignment of views on topics such as climate finance, the Russia-Ukraine and Israel-Gaza conflicts, reducing the dominance of the US dollar or reforming multilateral financial institutions will provide a supportive platform for investment and trade into Africa.

Wild card: Africa’s carbon offset market takes off. In the wake of the COP28 climate summit in late 2023, growing interest in international carbon credits could see a boom in projects for the conservation of Africa’s natural ecosystems. Gulf countries are likely to be particularly active in developing African carbon markets. Carbon deals could provide African countries with a revenue boost, but they will have to deal with rising scrutiny over their transparency and integrity.

This article is based on a research note originally published in Seerist. Find out more about how Seerist’s adaptive artificial intelligence combined with localised geopolitical risk expertise can help you identify, monitor and mitigate risks.