When examining the relationship between a city’s economic growth and its resilience, comparing outwardly similar cities yields interesting results. Certain cities offer the same resilience/risk as others, but faster growth. Equally, some cities offer the same expected growth, but a better resilience/risk score. This provides a simple basis for making investment choices for an urban real estate project. Furthermore, it is possible to enhance local resilience through a rigorous all hazards and threats led approach.

Forecasting national & city economies

In thinking about prospects for national economies, forecasters and commentators such as ourselves divide our time about equally between deciding what is the most likely outlook for any given national economy, and considering what might disrupt that forecast and send the economy concerned spinning in a different direction.

Collapses in house prices, accelerating wage inflation, larger-than-expected tax rises, unusually weak productivity growth: these are a few of the many stock villains threatening to hijack the plot, where macroeconomic forecasts are concerned. Each has an equal and opposite hero, promising to embarrass the forecaster with a better-than-expected outturn.

Where city performance is concerned, the life of a forecaster is more sedate. There is little high-frequency data to examine, so fewer surprises to test the forecaster’s nerve or provoke rapid changes of view. Most of the interest is in the long term prospects for cities, and hence trends, rather than quarter-by-quarter or even year-by-year fluctuations around those trends.

Comparing city forecasts with resilience

However, that does not mean that the question of how likely it is that a city is knocked off-course, gets ignored. Those who are investing for the long haul, whether in real estate, physical infrastructure or building-up awareness of major consumer brands in particular cities, all want to know about the risks to forecasts as well as the central projections. All else being equal, a city that is resilient to shocks is a better bet than one that is not.

So what factors might alter a forecast for a city? And what do we mean by ‘resilient’? There are many possible dimensions, and no single way to classify them, but here are some obvious ones.

Political stability: Is the city located in a country where there is stable government, with smooth transitions of power, as well as property rights and the rule of law, probably but not necessarily involving democracy with free-and-fair elections? Does the nation have peaceful relations with other nations or, at the other extreme, is it subject to military threat?

Financial & economic stability: Is the city located in a country where debt levels are manageable, where there are no obvious major risks with the currency or asset prices, and where there is a low risk of spiralling inflation threatening both the real economy and the accumulated value of wealth?

Infrastructure: Does the city have enough infrastructure to allow it to continue growing, whether in terms of roads, electricity supplies, airport capacity, broadband, or many others?

Environmental factors: Are there problems with air or water quality that might start to undermine a city’s growth, by deterring investors and reducing the willingness of educated and skilled people to migrate to the city?

Social cohesion & welfare protection: Are there welfare or other systems in place to protect those who suffer when economic conditions turn down, to reduce conflicts over scarce resources, and to minimize the risk of unrest? Will poor health and housing prevent a city from moving above a certain level of development? Are large numbers of people left unemployed, unable to improve their circumstances, or generate economic growth?

Population: Is the country’s population keeping track of GDP/GVA, or is it running far ahead or behind, either putting pressure on scarce resources or creating labour shortages that threaten growth? Are large numbers of people migrating from rural to urban areas, swamping the ability of cities to absorb them? Or is urbanization so far developed that this valuable source of new labour is beginning to disappear?

Is there a trade-off?

Where resilience is concerned, strong performers are most likely to be found among the cities of North America, Europe (though perhaps not those in the former communist countries) and parts of Asia-Pacific such as Japan and Australia.

And yet typically these are not the fastest growing of the world’s cities. Those are more likely to be found in emerging economies, including India, emerging Europe, Africa and elsewhere. These are also the most common locations for new urbanisation projects as investors look to profit from the enticing demographic and economic trends. The dynamics of rapid growth may have seen a negative trade-off in terms of resilience, but a well-conceived project has the potential to benefit from a rapid growth environment while being as resilient as possible in its own right.

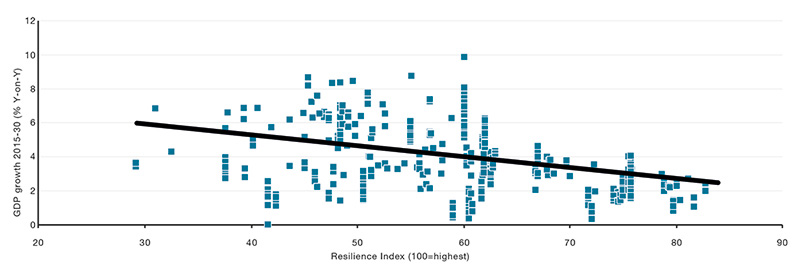

We have been investigating the relationship between resilience and growth using our Global Cities database which provides Oxford Economics forecasts for the 730 largest cities in the world. As a starting point, we have compared the results for GVA growth with a composite measure of resilience that we have developed. The results are shown in Figure 1.

Figure 1: Economic Growth & risk/resilience: the trade-off

The main stories of Figure 1 are that there does appear to be a trade-off between growth and resilience, as reflected in the downward sloping trend line, but that the deviations around the line are large – implying that some cities offer a particularly favourable trade-off and others a particularly poor one.

Getting the best of both worlds

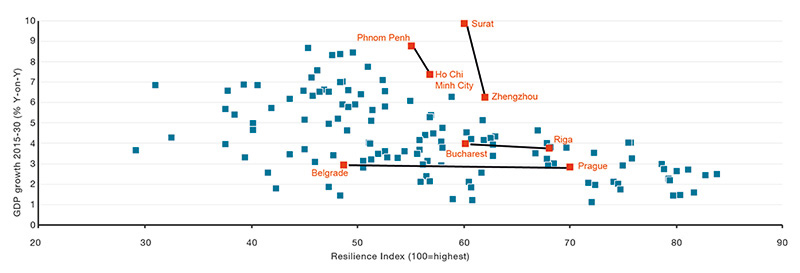

It should be noted that at this stage of our research we are just using national rather than city data to measure city resilience – which is why there are the downward lines on the chart; with for example all of the Chinese cities stacked on top of one another, rather than spread out horizontally as well as vertically. This is clearly just a crude approximation, which can be improved upon.

Figure 2: Economic Growth & risk/resilience: city pairs

Accordingly, in Figure 2 we just report on the fastest growing city in each country. On the graph we have picked out several city pairs. The message here is that doing that makes it possible to make some choices between locations. So it can be seen that Phnom Penh is just as resilient as Ho Chi Minh City, but offers significantly better growth performance, implying that investing in the former is likely to be a better decision than investing in the latter. The latter is also true for Surat in India, compared with Zhengzhou in China.

Equally, it can be seen that Belgrade is forecast to achieve much the same growth as Prague, but is more at risk (or less resilient to risk) than the latter. So Prague comes across as a better investment choice than Belgrade. Similarly, Riga looks to be a better choice than Bucharest.

Crucially for developers and all stakeholders in large scale urbanisation projects, lack of resilience is not something that is an inevitable part of the landscape that has to be passively endured. A new project can become a locum of increased resilience by adopting from the outset a multi-agency and stakeholder approach that is threat and hazard led.

Author

- Richard Holt, Head of Global Cities Research, Oxford Economics