On 30 March, The Supreme Election Council (YSK) published its final list of candidates for the 14 May presidential and parliamentary elections. In this article, we forecast the likely election outcome and how it is expected to impact the domestic political situation and Turkey's foreign relations over the next year.

- The opposition unity candidate, Kemal Kilicdaroglu, will likely win the presidential election in a second-round run-off on 28 May.

- The government and its supporters are likely to contest the result, and protests will take place in the following weeks, with some potential for violence.

- No one party or grouping of parties is likely to secure enough seats in parliament for a majority; the executive power of the presidency means that this will not be an immediate obstacle to government functioning.

- Pre-election unity between opposition parties will likely break down eventually. The president will have to engage in time-consuming consensus-building to see off the threat of snap elections.

- Under a new leader, Turkey's relations with the West will most probably improve, and its economic situation stabilise slightly. However, the government will still face significant challenges and could revert to the nationalist sentiment or heavy spending seen under incumbent Recep Tayyip Erdogan.

Unity candidate

The YSK on 30 March announced that four candidates had fulfilled the requirements to stand as presidential candidates. Incumbent President Erdogan and Kilicdaroglu were nominated by their parties, the Islamist, centre-right Justice and Development Party (AKP) and the secularist Republican People's Party (CHP), respectively. Two independent candidates also gathered the required number of signatures to stand, Sinan Ogan and Muharrem Ince. Ince is a former CHP member and was the opposition unity candidate in the 2018 presidential elections; he has the potential to draw votes from Kilicdaroglu in the first round.

Likely outcome

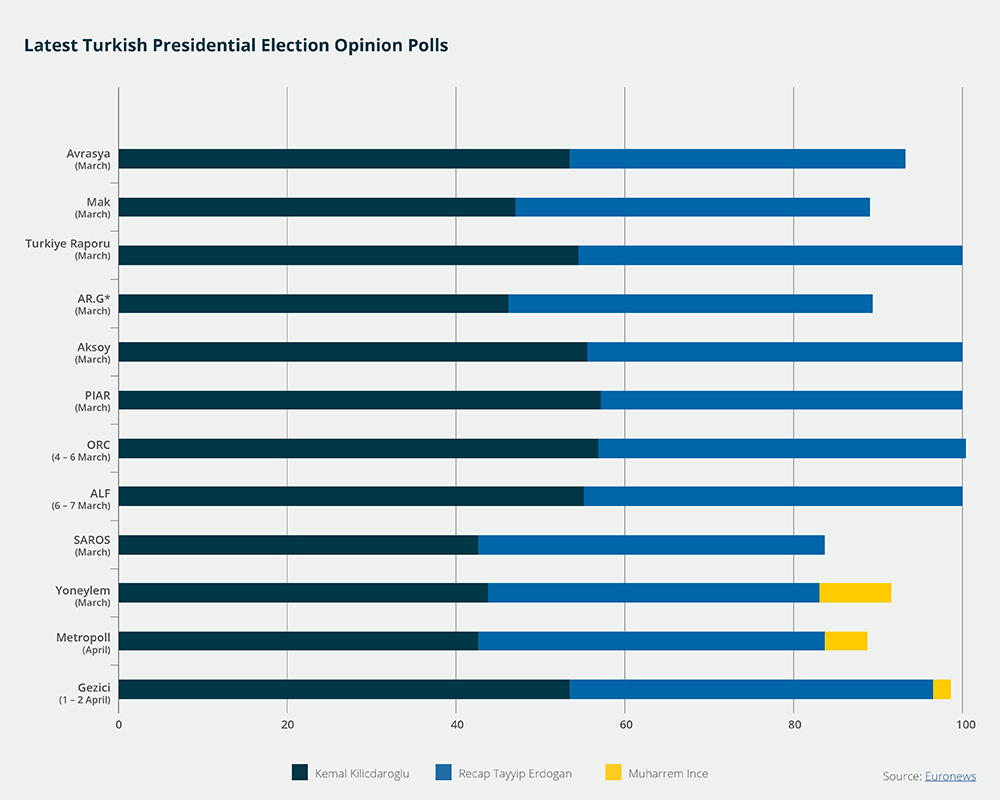

Polling throughout March and into early April has indicated a several percentage point lead for Kilicdaroglu over Erdogan, and Kilicdaroglu remains likely to win in the second round. The Democratic Peoples' Party (HDP), which changed its name to the Green-Left Party (YSP) ahead of the campaign and typically wins between 10% and 15% of the vote, announced in March that it would not stand a candidate. The move is a tacit show of support for Kilicdaroglu. Kilicdaroglu will also have the support of the six parties of the opposition unity alliance, including his CHP, the nationalist Good Party (IP) and four smaller parties.

The parliamentary elections will see Erdogan's AKP win the most seats but remain well short of a majority in parliament, even with the support of its parliamentary ally, the ultra-nationalist Nationalist Movement Party (MHP). The opposition alliance will only command a majority in parliament with the support of the YSP.

With under a month until the election, Erdogan could scrape back support. His campaign in the coming weeks will promise social support, investments and new infrastructure projects. Pro-government media will continue highlighting the links between the YSP and Kurdish militants as a means to undermine Kilicdaroglu and will also play on fears of instability under a change of government.

However, the primary concern for voters, the economy, is unlikely to see a significant improvement in the coming month, which will continue to undermine support for the government. Year-on-year inflation for March stood at more than 50% and has been above double digits for several years, driving a cost-of-living crisis.

Contestation

The incumbent government is likely to contest an opposition victory. There is considerable potential for the government to attempt to pressure the YSK to alter the results or not publish results showing a government defeat. It could also claim foul play if the YSK declares an opposition victory.

Protests by supporters of both sides are likely, with potential for violence and disruption in the central areas of large cities in the weeks following the second round of the presidential election. Personnel will face incidental threats and disruption to business routines.

In the event of a victory for Erdogan or the AKP, the opposition will likely contest the outcome. This will presumably result in sustained protest activity, potentially for months, that would see a heavy-handed police response.

Political uncertainty

An opposition victory will likely also result in a period of political uncertainty as Kilicdaroglu and his supporters attempt to assert control over government institutions. This will probably see the effectiveness of government functioning reduced, at least temporarily. However, essential services and processes, such as taxes and visa services, are unlikely to see interruptions.

As ideological differences resurface, the pre-election unity between opposition parties will probably break down after the election. In the short term, the executive powers of the presidency mean that this will not pose an obstacle to governing. However, with time, the threat of new alliances within parliament forming against the president will build, meaning that the president will have to engage in time-consuming consensus-building to see off the threat of snap elections.

Foreign relations

Turkey's foreign relations would likely improve, at least in the first year of a non-AKP-led government. Relations between Turkey and its Western partners have been rocky in recent years, particularly since an attempted coup d’état in 2016, which some within Erdogan's government have suggested may have been supported by Turkey's Western allies.

Kilicdaroglu's close advisors have already indicated that a Kilicdaroglu government would seek to improve ties with the US and the EU and take steps to rapidly acquire better visa conditions for Turkish citizens travelling to the EU.

Economic outlook

Steps to improve foreign relations are likely to boost Turkey's economy, as would a smooth transition of power, with both of these elements reassuring skittish investors that Turkey remains within the Western sphere and adheres to corresponding democratic values. An improvement in investor sentiment, coupled with a more orthodox approach to the economy, would positively impact the strength of the lira currency.

A Kilicdaroglu government would also likely reverse some of the tendencies of the Erdogan government that have been weighing on the lira's strength. In particular, a Kilicdaroglu government would presumably allow greater independence for the Central Bank on monetary policy and would probably rein in spending initially.

Longer-term outlook

In the longer term, the drivers of Turkey's current abrasive foreign policy and domestic economic interventions will likely remain. The new government will inherit a weak economy, and short-term measures to restore economic health, such as increasing interest rates, will most probably weigh on its support. As the new government seeks to prevent the pre-election opposition alliance parties from turning against it, the temptation will increase for the new government to resort to tactics favoured by Erdogan, such as appeals to nationalist sentiment or heavy spending to sustain its support base.

*This piece was written several weeks before the election, so things may have changed since publication.