Last year, in the wake of Russia's invasion of Ukraine, many Western nations ramped up their economic pressure on Russia by enacting waves of sanctions restrictions and export controls. The governments of more than 30 countries, including the US, EU and UK, halted exports of cutting-edge technology and equipment, dual use products and luxury goods to Russia. In addition, hundreds of international companies pulled out of the Russian market – in some cases going further than the legal restrictions required them to – thereby further constricting trade opportunities. Nevertheless, banned products continue to flow into Russia via countries that have traditionally strong trade ties or are geographical neighbours of Russia. This creates additional risks for international manufacturers who have ceased operations in Russia but still might become exposed to Russia-related sanctions risks through Russia’s trade partner countries.

How does Russia circumvent export bans?

In May 2022, the Russian Ministry of Industry and Trade (“MinPromTorg”) proposed to legalise unauthorised (often referred to as “grey” or “parallel”) imports to Russia for a range of products. This move aimed to cushion the impact of sanctions and the departure of international companies from the Russian market. Essentially, the new regime permits Russian companies to bypass sanctions by importing various goods without the consent of the original brand owner or manufacturer. Parallel import schemes often involve small-scale foreign firms in third countries that acquire goods no longer officially available on the Russian market and re-export them to Russia. By the end of June 2022, the scheme had received the green light from the Russian authorities. Following the legal changes, major electronic marketplaces in Russia also authorised the sales of goods that arrived to Russia through the parallel import schemes.

MinPromTorg also published a precise list of products covered by the parallel import mandate, which are itemised by brand and product specifications and primarily comprise consumer goods. According to calculations by AKRA, one of the leading credit rating agencies in Russia (like Fitch and Moody’s), the list permits grey imports of products that, in 2021, comprised 36% of Russia's total imports in terms of value. However, various media outlets have reported that dual-use semiconductors – which do not appear on the MinPromTorg product list – were also brought into Russia via parallel import in 2022. An investigation published by Reuters shows that between February and October 2022, USD 777m worth of semiconductors produced by US firms found their way into Russia and were allegedly used in cruise missiles attacks against Ukraine.

The head of the Federal Customs Service of Russia estimated that between May and December 2022, the combined value of goods entering Russia via parallel import exceeded USD 20bn (or 2.4m tons of goods in nominal terms). The scheme is mainly targeting products of companies that have declared their exit from the Russian market. Notably, the parallel import policy permits the grey import of smartwatches from brands that have ceased sales in Russia, while denying the same privilege for products from companies that continue to operate within the country’s official sales framework.

Which countries are indirectly exposing organisations to Russia?

Russia has concealed its trade statistics, hindering organisations’ ability to trace parallel imports. According to a joint alert issued by the US Department of Commerce and the Financial Crimes Enforcement Network, countries allegedly involved in the re-export of sanctioned goods to Russia and Belarus include Armenia, Brazil, China, Georgia, India, Israel, Kazakhstan, Kyrgyzstan, Mexico, Nicaragua, Serbia, Singapore, South Africa, Taiwan, Tajikistan, Turkey, the UAE, and Uzbekistan.

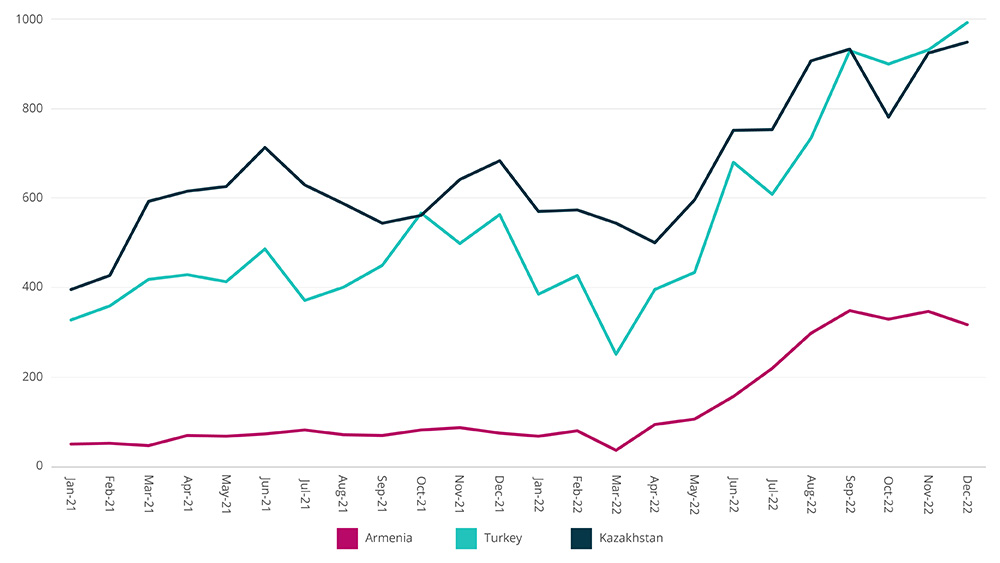

Our analysis of official statistics reveals the dramatic growth in three particular countries’ exports to Russia from 2021 to 2022: Armenia (whose exports to Russia grew by 287%), Turkey (145%) and Kazakhstan (125%). By December 2022, monthly exports from Turkey and Kazakhstan to Russia approached USD 1bn each. Combined exports from Armenia, Turkey and Kazakhstan to Russia between May and December 2022 totalled USD 14.9bn.

Fig. 1: Exports to Russia, USDm

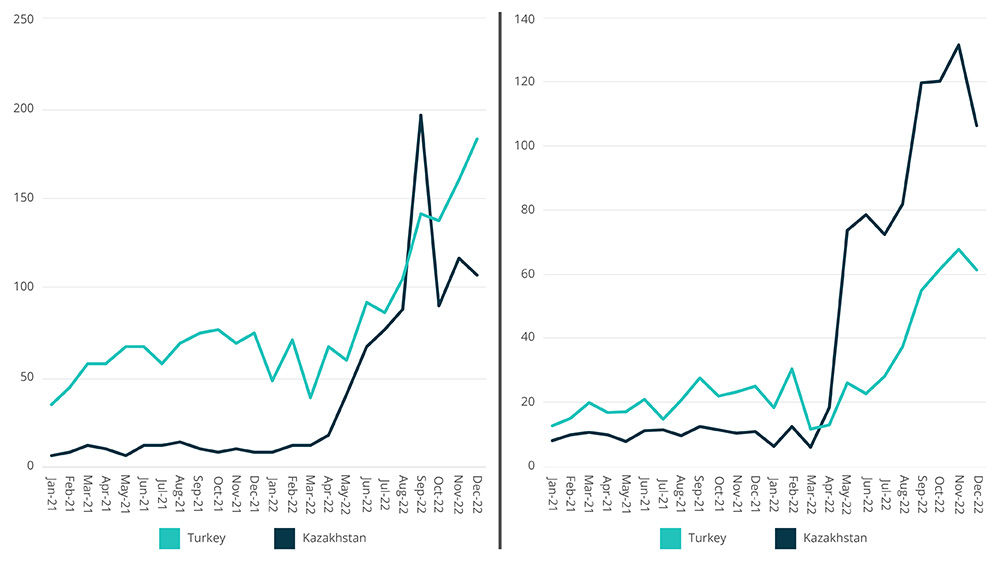

We explored these countries’ export data at a more granular level, using the Harmonized Tariff Code (HTS) product groups classification, which is used worldwide in international trade statistics and official state documents, including in sanctions regulations. Our analysis shows that exports from Turkey and Kazakhstan to Russia have surged in recent months, with industrial equipment and parts being the main drivers of this growth. Between May and December 2022, Kazakhstan witnessed an extraordinary rise of 797% year-on-year in the export of boilers, machineries, and mechanical appliances to Russia, while small-scale equipment parts and tools grew by an impressive 1,746% year-on-year. Turkey, on the other hand, saw a growth of 110% year-on-year in the export of electric machinery and a 209% year-on-year increase in optical, measuring, and medical equipment to Russia, marking the leading export categories.

The surge in these exports is depicted in the graphs below, which highlight the rapid increase in two categories that contain items listed in the US and EU export control lists.

Fig. 2: Electrical machinery and equipment, parts thereof, USDm

Fig. 3: Boilers, machineries and mechanical appliances, parts thereof, USDm

Mechanical equipment and electronics are included in the export bans introduced by the EU and US against Russia in 2022, and major global manufacturers in these sectors have announced their withdrawal from the Russian market. MinPromTorg has also authorised the parallel import of these products, including those named in the ban.

Specific sanctioned product types have been increasingly exported to Russia from Kazakhstan. For example, exports of oil and petrol-filters for internal combustion engines reached USD 2.8bn in Q4 2022, a striking growth of 1,416% compared with Q1 2022. This product type is specifically referenced in the US sanctions, and in the MinPromTorg’s parallel import order. We note that Russia and Kazakhstan are members of the Eurasian Customs Union, which allows no customs to be levied once the product enters one of the member-states. The union also includes Armenia, which has seen a surge of exports to Russia but does not disclose export data broken down by the specific export codes and categories in the same way as Kazakhstan and Turkey.

How is this trade happening?

According to details in journalistic investigations and our own research, the process of export ban circumvention looks as follows: Russian importers use legal entities outside of Russia to order goods from an international company that may be unwilling or legally unable to export to Russia. After receiving the payment from the Russian importer, a firm in Turkey, for example, places an order with a supplier from the EU or the US. Then, the products arrive to the customs storage warehouse in Turkey. After that, a re-export procedure is initiated – this way, the products go straight to Russia without going through customs clearance in Turkey. Nevertheless, Russian customs identify these goods as imported from Turkey, not the EU or US. The manufacturer of the equipment is typically unaware of the destination of their goods.

Our research reveals that a number of companies registered in certain former USSR countries, including Armenia, Kazakhstan and Kyrgyzstan, offer these “re-export” services to Russia and – unlike Turkey – can offer customs clearance services because they are members of the Eurasian Customs Union (which also includes the heavily sanctioned Belarus and Russia). This means that once the goods enter the territory of any union member-state and go through customs clearance, they no longer need any additional customs procedures and can freely circulate within the union.

International manufacturers are facing increased risk of their products being diverted to Russia, in some cases in violation of sanctions or the position taken by the manufacturer about sales to Russia. A range of small-scale firms registered in countries with long-standing economic and political ties to Moscow appear to be engaged in the circumvention of export bans and sanctions. The pool of countries that might be involved in grey imports to Russia includes those that have geographical proximity and traditionally strong trade ties with Russia; these countries have not introduced sanctions against Moscow and/or are members of Russia-led international organisations.

Although most international companies remain focused on their potentially sanctionable direct links to the Russian market, they need to evaluate their exposure to Russia through third countries that trade with Russia. The sophistication of the parallel import schemes suggests that obtaining an end-user certificate may not guarantee that companies’ products do not land in Russia.

How can organisations manage the risk of their products being diverted to Russia?

The nature and level of the risk of product diversion to Russia will vary according to an organisation’s sector and the types of goods and services it sells. Nonetheless, there are a few common steps that each organisation can take to assess the level of risk of diversion, investigate any indication that diversion may have happened, and prevent it from happening in the future.

1. Assess

There are everal steps you can take to determine the level of risk facing your organisation’s products. The US government advisory noticed referenced earlier identified 18 countries that pose a higher risk for product diversion due to their trading relationship with Russia. Organisations with sales to these countries can review their internal sales data from the past few years – be they direct sales or through third-party agents and distributors – to evaluate whether there have been sudden spikes in volumes. We recommend applying additional scrutiny to recently appointed agents and distributors in these markets, as there is unlikely to be historical data to allow for comparison with the period before sanctions were imposed. If there have been sudden changes, then we recommend reviewing the reasons for this with sales teams or third-party agents and distributors.

There are also a range of external data sources and information points that can improve your situational awareness. You can consult MinPromTorg's website to determine if your goods and services are approved in Russia for parallel import and actively monitor media to identify whether comparable products to your own are being diverted to Russia. Organisations should also monitor their own whistle-blowing channels to see whether these types of issues are being raised.

These steps are unlikely to definitively determine whether your products are being diverted to Russia, though they should improve your confidence in the level of risk you are exposed to, and perhaps identify areas for further investigation. We helps clients review whether their products are being marketed on Russian e-commerce websites or being discussed in deep and dark web forums associated with parallel imports.

2. Investigate

Organisations that identify reasons to investigate the risk of product diversion further have two means to do so: an internal investigation within their organisation and relevant third parties, or the use of additional intelligence gathering. The aim with both steps, which are not mutually exclusive, is to identify fact patterns and data points that support or refute that product diversion is happening.

The internal investigation should focus on a more detailed review of sales data, sales contracts, and invoices, with a focus on anomalous and atypical activity. We have seen indications of product diversion in the past where agents and end customers have been entered into CRM software as being based in one country (such as the UAE), though the email addresses and telephone numbers of the individuals working at those companies are associated with a sanctioned country (such as Iran). Organisations that rely on third parties for their sales activity will need to invoke audit rights in their contracts, or – where these contractual terms do not exist – on the good will and engagement of their distributors and agents to review comparable data, and to discuss how these organisations approach compliance.

There are a number of ways to approach the external intelligence gathering. Organisations can focus on their products in a particular company to identify whether and how these products are being re-exported to Russia, including the channels and methods being deployed. We know from our experience with Turkey’s trade with Iran that there were particular routes and typologies to how products were diverted. Organisations can also refresh their intelligence on agents and distributors, with a particular focus on these companies’ connections to Russia. This could include establishing whether they have been incorporated in Russia, have Russian shareholders and principals, whether they have a history of sales to Russia, or whether local business partners are aware of them re-selling products to Russia. We recommend reviewing e-market platforms in Russia and the high-risk countries to establish whether they sell items restricted for export that are produced by your company. If you find them there, collecting business intelligence into their sellers may provide clues about how and where your products were diverted from their original destination. These steps can improve your confidence in determining whether there is ongoing or historical product diversion, and provide confidence about their future trading practices.

3. Prevent

The steps we recommend for assessing and investigating the possibility of product diversion can also be used to look ahead and to limit the potential for this to happen in the future. In addition to these, we recommend:

- Reviewing investigative reporting and advisories and enforcement action by governments to stay ahead of the typologies for product diversion that are relevant to your industry.

- Monitoring sales data in countries trading with Russia to identify anomalous sales activity.

- Applying additional scrutiny to subsidiaries, third parties, and end customers in countries trading with Russia by adjusting diligence and risk assessment methods.

- Training frontline employees engaged in business development in the typologies for product diversion and the legal consequences.

- Conducting compliance audits of higher-risk subsidiaries and third parties to identify shortcomings in their approach to sanctions and product diversion, and to monitor the implementation of any improvements you mandate.

- Ensuring your whistle-blower hotline is open for internal and external use and prompt action is taken to investigate any incoming reports related to any alleged breach of international sanctions.