As de-carbonisation initiatives gain momentum worldwide, lithium has become a new mining frontier, even called “white gold” by sectorial media. The mineral is an important element in many countries’ path out of their fossil fuel dependence. It is the main component in electrical vehicles batteries and is also used in many other electronic devices, including mobile phones. Multiple international media outlets have reported on the rising risks of lithium shortages globally in the past few months as demand skyrockets. This will pose significant opportunities for producing countries in the coming decade.

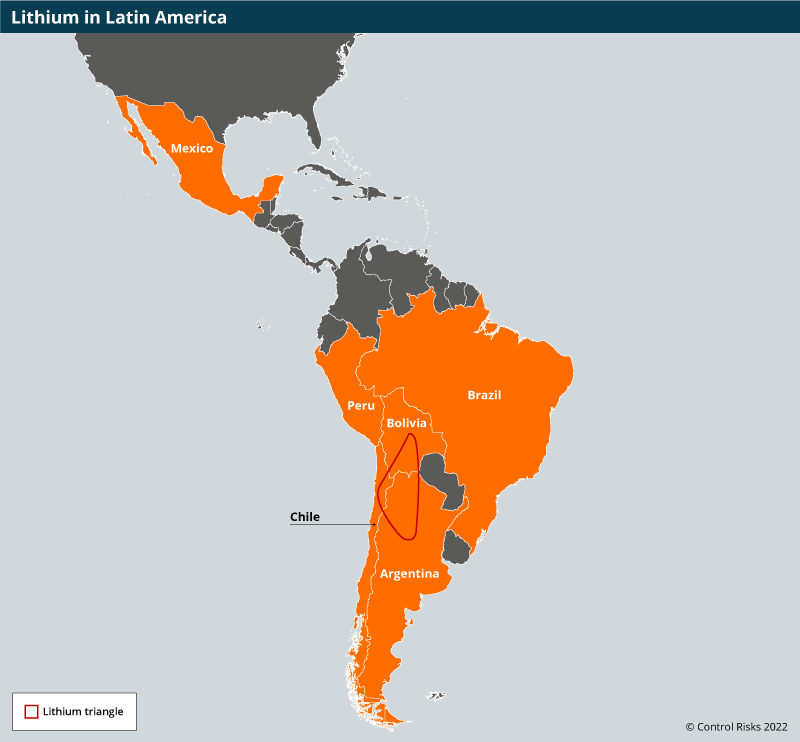

According to data by the US Geological Survey, Australia is the largest producer. However, Latin America holds a significant share of the world’s lithium reserves. This makes the region a potential mining hub for the next several years.

Lithium Triangle

The Lithium Triangle, comprised of Chile, Argentina and Bolivia, accounts for the largest reserves of the mineral in the world. This region has attracted increased foreign interest in the past few years, though its production potential remains underexploited. In Bolivia, for example, extraction remains highly limited to small projects. This is due to technical difficulties associated with lithium extraction in the country, overly restrictive government policies and the lack of technology at the national level. President Luis Arce has, over the past year, attempted to improve the country’s production prospects – mainly by promoting international bids. However, results will likely remain modest as Bolivia lacks an approach aligned with international standards and specific regulations over lithium exploitation.

Chile is regionally ahead in exploration capacity, with operational projects in an advanced stage. The country used to lead the global production until 2017, when it was surpassed by Australia given Chile’s slow pace to allow new players into its market. Still, Chile remains a promising investment destination on this front and the government maintains a favourable rhetoric vis-à-vis investors. However, the ongoing constitutional process, coupled with a stronger pro-environment approach by the new administration of President Gabriel Boric, means that regulatory risks will be heightened for at least the next 12 months. Legislative proposals related to the preservation of water resources, in particular, will likely entail increasing operational costs for businesses. This will also be compounded by the rising activism of Indigenous groups.

Argentina, which holds the second largest amount of lithium identified globally, is keen to promote new (and massive) investments in the mining sector. Despite the country’s long-standing macroeconomic imbalances and the elevated regulatory burden facing multinationals, President Alberto Fernández’s administration has, over the past year, actively worked to attract mining investors. These efforts have included mining-specific measures to streamline the investment environment. However, multinationals operating in the country remain highly exposed to regulatory risks associated with price and capital controls, which ultimately will continue to sustain elevated levels of financial volatility.

Mexico and Peru

Mexico is a complex case for investors in the sector. On the 20th April 2022, Congress approved a presidential reform to the mining law to nationalise the country’s lithium reserves. This was mostly meant to give President Andrés Manuel López Obrador (AMLO) a political win after a blow to his flagship power reform, which legislators failed to pass, as the government did not need the change to stop granting lithium mining concessions. However, it has put existing licenses under the spotlight, as AMLO has already said all lithium mining concessions granted before the reform will be scrutinised. Should the Mexican government find that concessionaries are not ready for the exploitation phase, that they did not carry out Indigenous consultations (when appropriate) or that there were irregularities in the bureaucratic process, it will seek to cancel them. There is ample space for the federal government to decide on the fulfilment of these requirements in a discretionary manner. In this context, certain business organisations – such as the National Employers’ Association (Coparmex) – have expressed concerns, as the cancellation of concessions would be detrimental to private investment. Ultimately, the Mexican government does not have the necessary technology for lithium exploitation, which could pave the way for some form of public-private partnerships for lithium mining in the future. Otherwise, alienating private investment would result in failure to take advantage of Mexican lithium reserves.

In Peru, production also remains incipient. Recent projects have aroused increased concerns among government representatives over potential radiation associated with lithium extraction, as it would be mixed with uranium. Legislative proposals to boost the sector have nonetheless advanced. On the 14th May 2021, the country’s Congress approved a bill to declare lithium production an activity “of public interest” and the mineral “a strategic resource”. Furthermore, Peruvian President Pedro Castillo has said he intends to boost the industrialisation of lithium, which would further pave the way for improvements to the country’s production prospects over the coming year. However, Castillo’s significant political problems add uncertainty to this scenario: he will face new impeachment threats from Congress (having survived a second impeachment attempt on the 28th March) and his popularity continues to sink. Furthermore, the ruling Free Peru party’s persistent calls for Castillo to re-negotiate ongoing contracts continue to undermine investor confidence.

Complex (but promising) outlook

Overall, Latin America will continue to present major opportunities for mining investors with a moderate-to-high risk appetite. Foreign investors are unlikely to face discrimination – most governments acknowledge the importance of attracting foreign capital amid the region’s widespread economic challenges and the need for eco-friendly technology for its extraction. Risks related to resource nationalism will therefore be limited. However, increased fiscal concerns will sustain considerable tax uncertainty (for example in Chile and Argentina). This is unlikely to significantly impact the profitability of new projects, however; particularly as evidence suggests there will be high levels of global demand for the coming years.

As environmental, social and governance (ESG) trends gain momentum at both the global and regional levels, related risks become increasingly relevant to businesses. The socio-environmental impacts associated with lithium production are yet to be fully understood by academics, but they have already fostered increasing concerns among environmentalists and social movements in Latin America. Issues such as air, soil and water contamination – in addition to the impacts of mining on the surrounding communities – will likely continue to pose reputational, regulatory and operational risks for businesses lacking sound compliance protocols.

The particular risk landscape for mining in Latin America will require a proactive and mostly on-the-ground approach by private players. From a risk management perspective, successful investors in the region will likely be those who implement comprehensive pre-investment risk (including ESG) assessments and continuous monitoring strategies based on solid local knowledge.