In the past, many companies in China ignored issues of conflicts of interest (COI) because they assumed that it was just the cost of doing business in China, until they started counting the cost – lost revenue from employees siphoning off business to competing companies that they own, losing margin through excessive discounts to conflicted companies, loss of legitimate distributors, suppliers unable to compete with the insider trading, and in the most serious of cases, damage to reputations and erosion of shareholder value. Serial COI problems cause losses to a company – the proverbial death by a thousand cuts – and are a serious distraction to managers who would rather focus on growing the business. There are, unfortunately, too many examples of COI to count.

A foreign company buys a Chinese company and retains the former owners to work with the new company; however, the business experiences no growth for two years. It was later discovered that, on the day of the purchase, the former owners set up companies on the side and immediately started to siphon business off to their own companies.

A sales manager sets up multiple distribution companies through family and friends. She gives special pricing and rebates to these companies, so that they can secure more business than other distributors. She receives a portion of their business in her personal bank account.

A procurement manager sets up a deal with suppliers whereby he receives a 10% kickback for awarding them business.

You are probably thinking that is all well and good, but that this is not a problem for our company in China. Except you are probably wrong. If your company has been in China for over ten years, our research shows that you have a more than 75% chance of experiencing undiscovered COI issues. The seriousness and impact of COI on the company can be debated, but their prevalence cannot – COI is part and parcel of doing business in China.

Too serious to ignore but very difficult to investigate

As serious as business leaders are finding COI issues, they are also very frustrated by the lack of success in investigating and prosecuting COI cases. COI issues usually come to light when a whistle-blower makes allegations that someone in the company is self-dealing through conflicted interests. The whistle-blower typically gives some company names and describes how an employee is using these for their own benefit. The company then conducts a financial audit but in most cases cannot find a connection. It is unsurprising that audits rarely uncover COI issues, primarily because auditors do not usually look for problems: an auditor is not an investigator. Auditors perform a prescribed set of tasks to ensure proper governance has been carried out. If they find an issue, they alert the company to it, but because COI issues are perpetrated by company insiders, they are quite easy to hide and can only be identified through rigorous investigation.

Even when a company finds evidence, what should it do? Local law-enforcement agencies in China are rarely interested in taking on such cases – they usually tell companies that these are an “internal matter” they should deal with themselves – and strict Chinese labour laws often present difficulties in firing employees, even with cause. If, as is often the case, the company is dealing with a senior business leader linked to alleged COI issues, removing them may harm the business. What then?

Business continuity

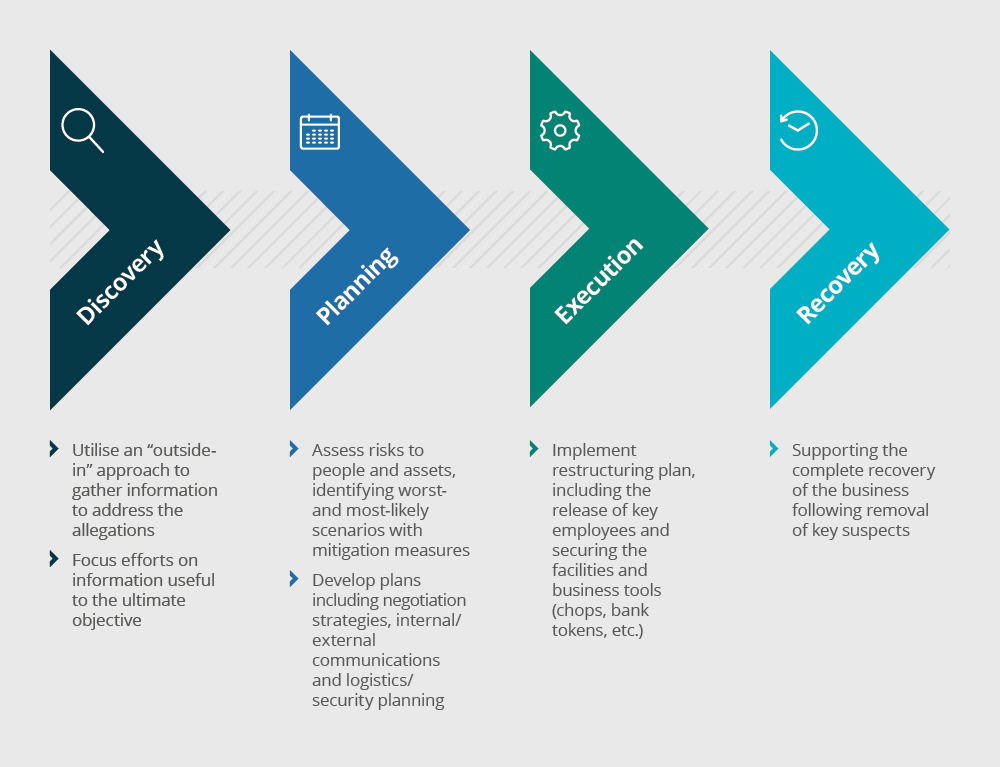

We recommend a process to investigate and resolve COI issues in China that meets some key objectives:

Companies should treat COI cases as a challenge to business continuity, instead of being a legal issue. They should not think strictly in terms of assembling “evidence”; rather, they should think about gathering information on what to do. When faced with COI allegations, it is critical that the company develop an intelligence-based assessment of the risk to business continuity and create an execution plan to mitigate and minimise that risk.

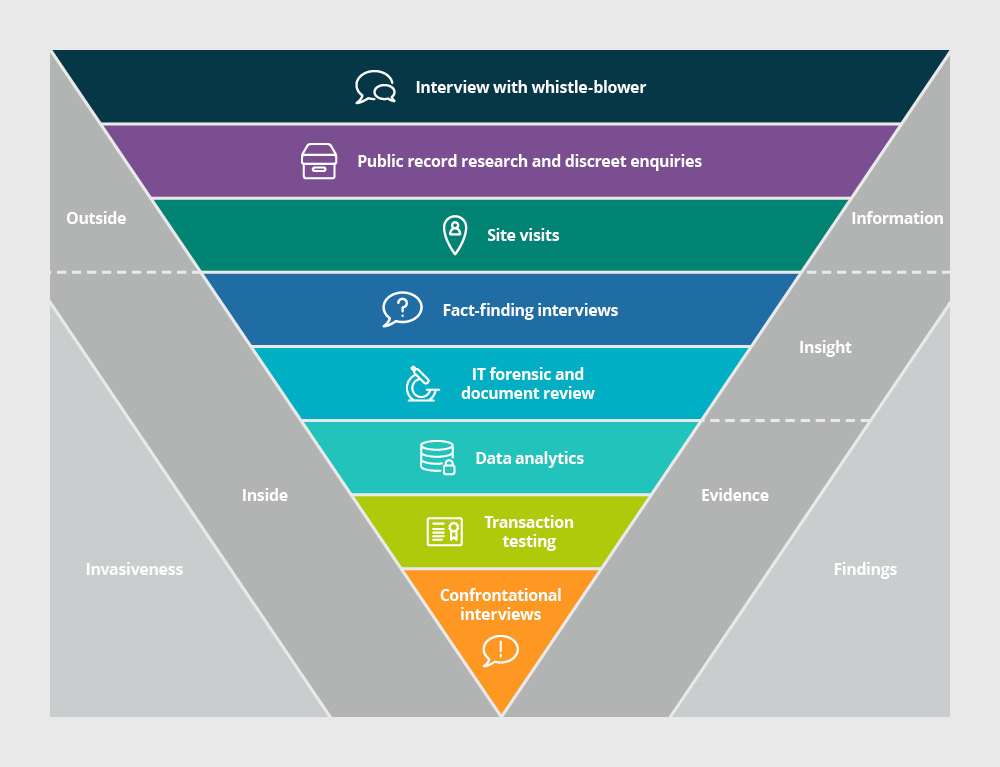

We start with discovery – a process to gather information to support future actions. COI is fundamentally a problem that happens outside the company with third parties that have links to employees. Therefore, investigations should start outside the company and then move inside.

Once we have decided what to do with the intelligence we have gathered (i.e., terminate the business leader, suspend/reprimand others), we can plan the actions we will take. It is critical to properly sequence and coordinate actions and communications to maintain business continuity. A key step is scenario planning: identifying the known risks to the greatest degree possible considering previous incidents and the expected behavioural patterns of the antagonist. How likely is the business leader to respond aggressively to dismissal? Are there stakeholders who might support them against the company? The company will then be able to identify the most likely and worst-case scenarios and develop a strategy to prevent and/or respond to issues before they become a crisis that affects business continuity, people, assets and reputation.

In the next phase, we carry out the actions in the planning phase, responding to situations as they escalate. In our experience, execution never goes precisely according to plan. However, if the scenarios and plans have been developed thoroughly, the team can quickly respond to issues as they arise and bring the situation back under control.

In the recovery phase, the company returns to a successful path it has sought all along. One of the best outcomes of taking a business-recovery approach to resolving COI issues is the insights the company gets during the process, enabling it to improve procedures and governance to ensure something similar does not happen again.

Conclusion

When faced with COI issues, clients focus too much on chasing the alleged perpetrators while ignoring the fundamental vulnerabilities in their systems and processes that got them into trouble in the first place. In addition to the high success rate of the business-continuity approach, the ultimate value lies in identifying systemic problems in the selection, qualification and management of third parties. Investigations often enable a company to shut down self-dealing and to strengthen its processes and governance to mitigate against COI risk.