Today, multinational companies must navigate a complex array of risks—from global geopolitics and shifting regulations to activism and insider threats. They frequently find themselves dealing with these challenges simultaneously.

Multinationals must learn how to use each new crisis as a steppingstone for greater resilience. Control Risks’ recovery-led approach to crisis management embraces this idea, leveraging each crisis as a steppingstone toward a stronger and more adaptable organisation.

A whistleblower revelation

Take, for instance, a recent case in which Control Risks supported a Multinational Corporation (MNC) that experienced a significant theft at one of its major facilities in Southeast Asia.

A whistleblower revealed that nearly a million dollars' worth of product had gone missing. Believing its assets were secure, the company initially was caught off guard and lacked a focused strategy to investigate and resolve the issue.

The plant was by far the largest employer in the area and deeply intertwined with the surrounding rural community and its sociopolitical dynamics. This close-knit relationship heightened concerns about the potential for backlash and retaliation.

The stakes were high, not just for the company’s operations, but also for the safety and security of employees. Addressing the theft required a sensitive and thoughtful approach that recognised the broader implications of the crisis.

As the investigation unfolded, it became clear that the situation was far worse than anticipated. Large volumes of product were being funneled through illegal channels and sold on the black market, often with the help of former local officials who were profiting from the weaknesses in security controls.

Rather than simply aiming to patch up the immediate problem, we used a recovery-led approach to help our client use the issue as a springboard to drive a more holistic and sustainable agenda for change.

Recovery-Led approach

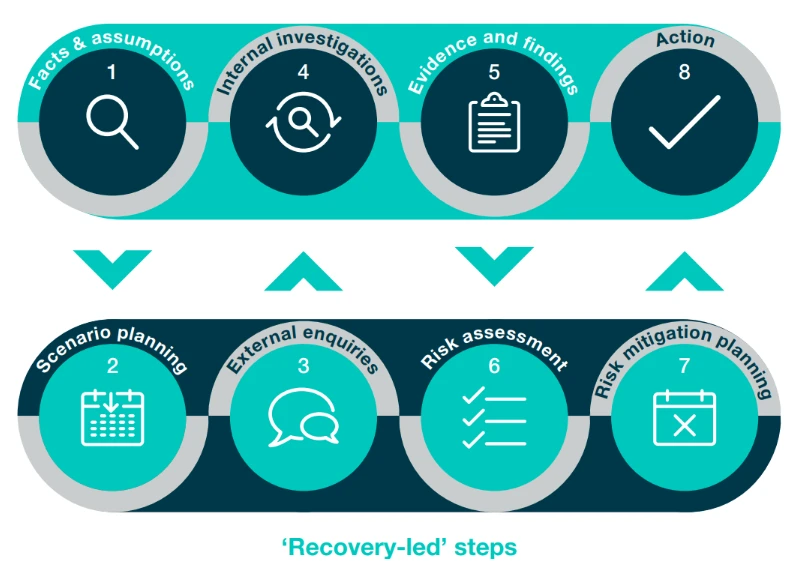

Below is how we applied Control Risks’ playbook for a ‘recovery-led’ response to a crisis to support this company:

- Facts and assumptions

We urged our client to clearly draw out and differentiate facts and assumptions. This meant reviewing audits, interviewing whistleblowers, and corroborating evidence. - Scenario planning

We guided our client through best, worst, and likely-case scenarios to anticipate how different outcomes could impact operations, safety, and reputation. This allowed the company to put in place proportionate and scalable mitigation as the investigation unfolded. - External enquiries

We conducted covert intelligence gathering in the local community to uncover the extent of the theft scheme and identify key players, all while keeping the operation under the radar to reduce the risk of retaliation or the destruction of evidence. - Internal investigation

With external insights in hand, we discreetly gathered evidence, including forensic analysis of devices, financial data reviews, and scrutiny of relevant documents. - Evidence and findings

By augmenting the internal investigation with external enquiries, we were able to provide a clearer picture of the situation and the risks to people and operations. - Risk assessment

Having gathered robust evidence, we reassessed the client’s vulnerabilities, enabling the leadership team to make informed decisions – especially crucial when there is suspected involvement of political, military, or organized crime elements. - Risk mitigation planning

Understanding the risks allowed our client to make informed choices about how to address the theft scheme in the short and long term. We created action plans for confrontational interviews and external communications, all while ensuring necessary security measures were in place to execute these actions safely. - Action

Finally, we helped our client implement their plans, which included security protection during the disciplinary procedures, but also a holistic longer-term enhancement programme, combining physical, technical and procedural security at the facility to holistically reduce the likelihood of a similar incident recurring.

The company could have rushed to implement quick fixes in the wake of the whistleblower allegations, but such haste might have led to unintended consequences – including a credible threat of not only regulatory but also physical retaliation.

Instead, by adopting a more integrated and proactive strategy, they not only addressed the immediate crisis but also shored up their business for the future. Emerging stronger and more adaptable, they safeguarded their reputation, workforce, and assets.

For industries operating in complex environments, adopting a recovery-led mindset is essential. It’s not just about surviving a crisis; it’s about using each challenge as an opportunity to better position yourself for tomorrow.