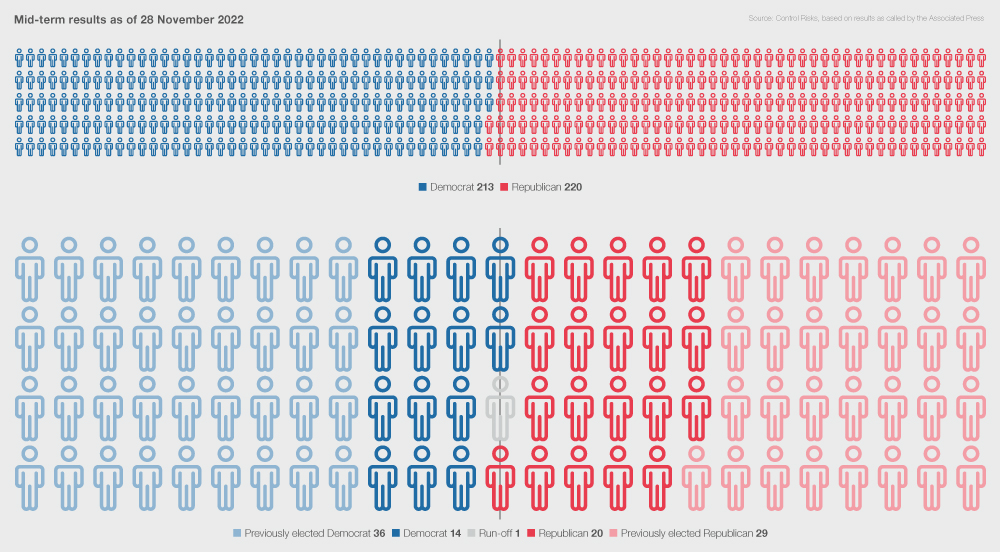

In late November 2022, Opposition Republicans had won control of the House of Representatives (lower house), while ruling Democrats have retained control of the Senate (upper house) in the US Midterm elections.

A divided government is now nearly certain for two years, likely creating legislative deadlock on all but a scant few issues of overwhelming bipartisan agreement. Democrats are in an unusually strong position for any party following a mid-term election, and President Joe Biden’s administration is likely to use executive action to push its policies. Additionally, a House Republican agenda focused on investigations, while likely to polarise the electorate ahead of 2024, is unlikely to severely impede government function or elevate business risks.

A strong performance from the ruling Democrats

Most administrations lose partial or total control of Congress during a mid-term election because voters tend to turn against the president’s party. Nevertheless, the Democrats had an unusually strong showing electorally, losing the House by only 9 seats – far fewer than the 20+ average - and holding on to the Senate for the first time since the 2002 mid-terms, which was an unusual election following the 9/11 terrorist attacks.

This strong performance was likely due to several factors, including the relative resilience of the economy with high employment despite elevated inflation, the unpopularity of a conservative Supreme Court ruling ending nationwide guarantees to the right to abortion and the relative electoral weaknesses of some candidates that Republicans nominated in key races.

Despite having lost control of the House, Democrats will likely be bolstered by their relatively strong results. Consequently, the administration is likely to push for key policy priorities than otherwise expected following a mid-term election. Executive action, including through guidance issued via regulatory agencies and driven by renewed foreign policy, is likely to increase. Presidents historically tend to turn to these tools in the aftermath of mid-term elections, in large part because executive authority is comparatively unconstrained in these areas by a hostile legislature. Democrats have held on to the Senate, but by the thinnest of margins, with a run-off in Georgia on 6 December determining whether the Vice-Presidents tie-breaking vote will be required. Nevertheless, they will breathe easier knowing that they have two more years for confirming presidential appointees to key positions in the executive, regulatory agencies, independent commissions and the judiciary – including any new vacancies in the Supreme Court.

Sensing popular support from the vote and with no pressure to rush confirmations, the often legislatively stagnant post-election “lame duck” period is now likely to see a flurry of activity over the next month. In addition to necessary government funding and appropriations bills, proposals in consideration are those most likely to be opposed by a Republican House. These include nationwide legislation to protect same-sex marriage, electoral reforms and further funding support for NATO and Ukraine.

Expected divided government

After the inauguration of the new Congress in January, a two-year period of divided government and legislative deadlock will begin. The business climate during this period is likely to remain stable, though uncertainty will increase as policy driven by executive action can easily be reversed by the next administration. In the absence of federal legislature, state-level laws will continue to diverge on key issues impacting businesses, including data privacy, ESG investments, minimum wages, abortion access and drug policies. Legislative intervention in most sectors will remain low, with large-scale industrial investments as seen during the first two years of Biden’s term now much less likely since Republicans will be reluctant to grant Biden any economic policy triumphs prior to 2024. New legislation regarding green energy or climate-related investments is unlikely. Significant revisions to tax policy, including on corporate taxation, are similarly unlikely in the next two years.

With paralysis on most issues, Congress will likely turn its attention to the key areas of bipartisan alignment, largely centred on geostrategic rivalry with China. Budgetary stand-offs and debt limit (unless addressed by Democrats in the “lame duck” period ) brinksmanship are also likely to intensify, with the Biden administration and emboldened Democrats in the Senate likely to mount strong opposition to Republican budgetary bills. Nevertheless, both parties have learned from experience over the past ten years that voters tend to blame Congress for failures to pass budgets or fund the government, and ultimate disruptions to the business environment will be minimal and sovereign risks will remain low.

Institutional risks

House Republicans have signalled their intent to increase investigations into the administration, focusing on the response to COVID-19, relations with China and the business affairs of Biden’s son. While such investigations may consume some administration attention and resources, they are unlikely to significantly impede government function over the next two years. Such political theatre is not atypical, with both parties having used House investigations and hearings to advance their political agendas in the past. Additionally, the widely accepted outcome of the mid-term elections highlighted the resilience of the US electoral system despite fears of disputed results.

Nevertheless, the very narrow mid-term victory will likely reinforce the underlying trend of political polarisation ahead of the 2024 presidential election. Not only do members of both parties increasingly vote along party lines, but they are diverging on key major political and social issues. As a result, although businesses can generally still count on a peaceful transfer of power, unrest risks are likely to be elevated and elections are likely to be increasingly contested and drawn out.

This article is based on online analysis provided by Control Risks exclusively to Seerist. Find out more about Seerist – the only augmented analytics solution for risk and intelligence professionals.