This article is based on content originally published on our partner platform Seerist, a Controls Risks company.

- The attacks have not reduced Russia’s crude oil export levels or affected the broader Russian economy. This is unlikely to change in the near term.

- At this stage Ukrainian drone strikes remain more likely to disrupt global oil product markets than to impact Russia’s supply of crude oil globally.

- However, a potential for greater disruption to both oil product and crude oil markets is credible as the war continues and as Ukraine improves its drone attack capabilities.

- The Russia-Ukraine war will remain a major geopolitical source of volatility for global energy markets.

A new dimension to the war

In early 2024, Ukraine began using domestically produced, long-range drones to target Russian oil refineries and has attacked at least 16 oil refineries to date. The strategy culminated in a 2 April attack on the Taneco refinery complex belonging to the Tatneft group of companies. Russia said output was not disrupted, but the attack demonstrated the increasingly expansive range of Ukrainian-made drones as the facility is located 1,300km (800 miles) from the frontline. The refinery is Russia’s third largest and represents about 6.2% of the country’s refining capacity. A 23 March drone attack targeting the Rosneft-owned Kuibyshev refinery in the Samara region was more disruptive, temporarily halting all production at the 29th-biggest refinery by output in Russia.

Changing tactics

Growing Ukrainian production of relatively inexpensive yet effective drones – including some with greater range – indicates that attacks on Russian energy infrastructure will likely persist. Since 2022, Ukraine has boosted domestic weapons production, including through collaboration with global arms manufacturers and by allocating subsidies. Ukraine has pledged not to use Western-supplied weapons against Russian territory. This commitment is unlikely to change.

While at the beginning of the war Ukraine avoided claiming responsibility for explosions at Russian fuel depots located close to the frontlines, Ukrainian officials in April explicitly admitted to pursuing the strategy of hitting Russian refineries to disrupt military fuel supplies as well as reduce Russian oil revenues – a key income stream for the Russian state even in the face of sanctions on hydrocarbons. Russia remains the third-largest oil producer in the world and has responded with major aerial attacks of its own that target Ukrainian energy infrastructure.

US officials have warned Ukraine against hitting Russian refineries to avoid both a major retaliation from Russia and a jump in global energy prices –particularly in a US election year. However, Ukraine is likely to retain its intent to wage asymmetric attacks on Russia’s oil refineries (as well as military targets) even though the US has recently unlocked further military aid to the country after a six-month-long political delay. Kyiv views Russia as an adversary with a far bigger population and resources, which afford a military advantage to the Kremlin. Such asymmetric attacks allow Ukraine to maximise its resources and targeting.

Disruption to refining rates

The drone attacks have contributed to a recent decline in Russian exports of oil products (diesel, fuel oil, naphtha), with volumes in the first half of April dropping to a post-pandemic low, according to analysis by S&P Global Commodities at Sea.

Russia’s oil processing levels were approaching an 11-month low as of 24 April – although it is unclear how much of the reduction is driven by attacks. Other factors that could decrease oil processing include Russia’s difficulty performing maintenance work at refineries (due to sanctions and trade restrictions limiting the country’s access to Western technology and parts), as well as recent floods in the southern regions. According to calculations by the Reuters news agency, Russia had lost 14% of its primary oil refining capacity by the end of March. Domestic fuel prices have remained largely unchanged, however, as domestic consumption constitutes less than half of production output.

As of mid-April, Russia has been quick to restore crude-processing levels at targeted facilities except for Rosneft’s Tuapse refinery near the Black Sea, according to the International Energy Agency (IEA). The IEA in its April outlook assessed that Russia’s refining system is likely able to offset capacity loss at some facilities by increasing processing volumes, or delaying maintenance work elsewhere.

Still, a major uptick in attacks on refineries could generate a more pronounced fall in Russian oil product exports due to expensive and time-consuming repair works, driving global prices up. Should Russia have to shut down some refineries, it could choose to prioritise domestic consumers and institute a diesel export ban. Earlier this year Russia imposed a six-month ban (March-October) on gasoline exports to meet domestic demand.

Crude exports unaffected

The Ukrainian attacks have not reduced Russia’s crude oil export levels or affected the broader economy – and this unlikely to change. According to vessel-tracking data compiled by Bloomberg on 16 April, Russian seaborne crude oil exports jumped to an 11-month high in the second week of April. As a result of the jump in export volumes alongside higher oil prices, the Russian state in April saw a boost in oil earnings and, in turn, the state budget.

The hike in export levels is likely partially linked to Russia’s diversion of some crude destined for domestic refineries to overseas exports. But Russia in the near term is unlikely to rapidly increase crude oil exports, given both its untapped oil processing capacity mentioned above, but also due to its pledge to OPEC+ to deepen export and production cuts. The spare capacity of Russia’s oil exporting ports is also under question.

More disruption possible

Greater disruption to both oil product and crude oil markets is credible if Ukraine further improves its drone capabilities (and Russia fails to boost its air defences) and decides to act contrary to the West’s wishes. Ukraine will retain intent to inflict more direct pain on Russian energy exports and is likely to continue developing its capabilities as the war continues.

Global energy markets would be affected in the event that Ukraine manages to successfully attack Surgutneftegas’s refinery in Kirishi, for example, a key export-oriented refinery. The refinery is located about 1,400km (870 miles) from the Ukrainian border, and recent reports suggest that Ukraine has developed a drone with a range of 3,000km. A successful attack on Russia’s oil export terminals in the Baltic or Black Seas would likewise generate more price volatility in the global markets – but Ukraine is yet to target them, and Russia likely deploys robust air defences over such strategic assets.

Global outlook

Overall, global oil markets will remain vulnerable to geopolitical tensions and regional conflicts in the coming year at least. The threats of oil supply disruption and of a global shock persist in the event of an escalation in Ukraine and the Middle East.

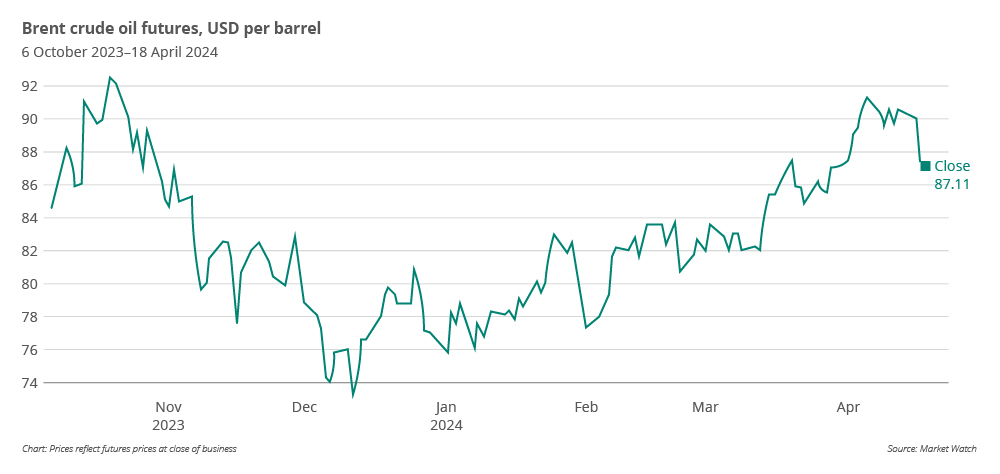

Ukraine’s targeting of Russian energy infrastructure, and Russia’s subsequent issues with repairs, have certainly impacted Russian oil product exports to some extent. But the upward pressure on recent oil prices is just as much a result of the combination of broader geopolitical tensions in the Middle East and sustained production cuts by the OPEC+ group of oil-producing countries. Brent crude oil futures rose to a symbolic USD 90 per barrel on 4 April for the first time in six months off the back of Iran and Israel tensions. That said, elevated output by non-OPEC+ members, specifically the US, Canada, Brazil and Guyana, will likely partially mitigate supply pressures in the coming months.