Economic turmoil

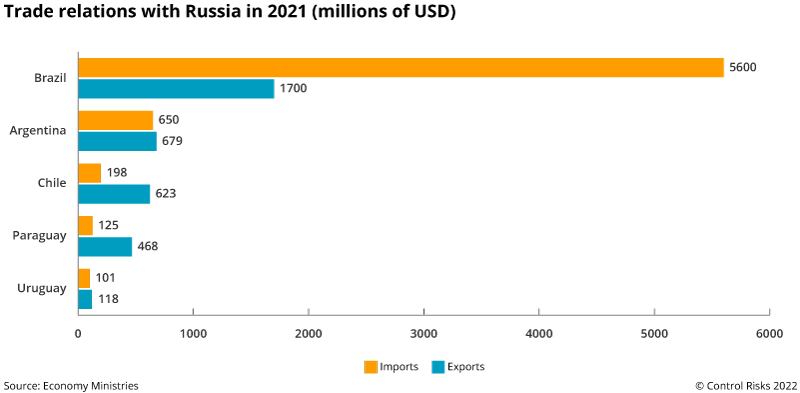

Trade relations between the Southern Cone, Russia and Ukraine are relatively modest. In the region, Brazil is the main trading partner but Russia and Ukraine represented less than 3% of its total trade in 2021. The military action in Ukraine unleashed a global commodity crunch – Russia and Ukraine are major wheat and corn exporters – and supply chain disarray that will have significant economic impacts in the region. Sanctions are also posing operational challenges: logistics companies have interrupted operations in Russia, international payment systems have been suspended, and trade flows will remain reduced at least throughout 2022.

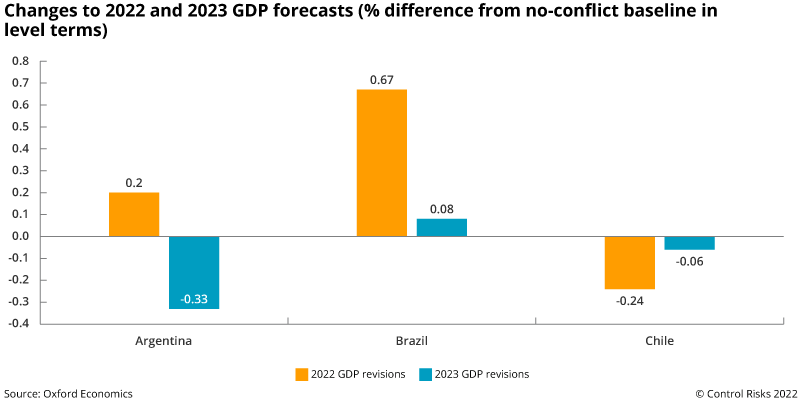

The uptick in commodity prices will benefit net commodity exporters in South America. However, it will increase prices for imports of industrial inputs, manufactured goods, food and fuel – generating mixed economic impacts across the region.

Regional diversity

For Chile, effects from the conflict are mostly indirect. As the world’s top copper producer, Chile will benefit from increases in mineral commodity prices. Copper prices have fallen from all-time peaks in early March but remain up nearly 5% since the start of the conflict. Higher copper export prices will partially offset rising liquified natural gas (LNG) and oil price import prices.

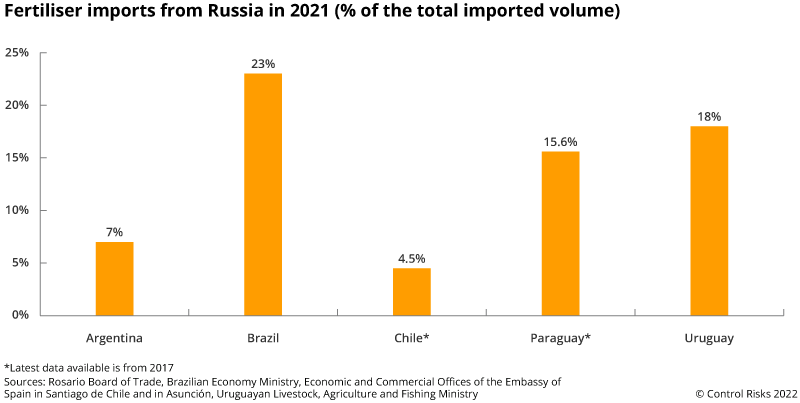

Argentina’s exports to Russia represent less than 1% of the country’s overall international trade volume and are mostly limited to fresh fruit, butter and peanuts. Russia’s COVID-19 vaccine (Sputnik V) and fertilisers were the top imports from that country in 2021. The reduced availability of fertiliser supplies will have limited impacts on Argentina’s agricultural outputs, considering that only 7% of fertilisers are imported from Russia. However, Argentina’s exports of wheat, sunflower oil and barley will benefit from rising agricultural commodity prices.

Brazil has a modest trade deficit with Russia. According to the Brazilian Economy Ministry, Russia in 2021 was Brazil’s sixth partner in terms of overall imports, while it ranked 36th in terms of exports – with only 0.6% of Brazil’s total, which consist mostly of soybean, chicken and peanuts. Although Russia accounts for 20% of all fertilisers used in Brazil, current reserves will last until October, which will likely give the government enough time to find alternative suppliers. High oil prices will also have mixed effects, as Brazil is one of the region’s biggest crude oil exporters but imports large amounts of refined oil. This will likely boost profits of state-owned oil company Petrobras, while pushing up fuel prices and the cost of goods that rely on road transportation.

Uruguay’s most affected industry will be dairy products, as Russia imports 10% of all Uruguayan production (and 60% of Uruguay’s butter production). In this case, Russia's economic crisis will likely reduce demand for these products. Finally, the conflict will directly affect meat exports from Paraguay to Russia – which account for 20% of Paraguay’s total meat exports. Paraguay’s Meat Chamber on 27 February informed that Russian buyers temporarily suspended imports of Paraguayan meat due to uncertainties around domestic consumption amid Russia’s economic crisis.

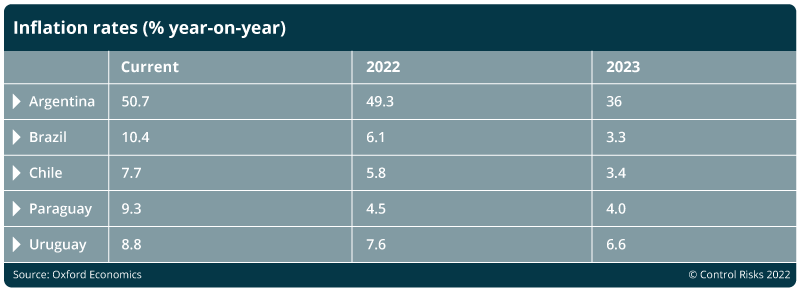

The five countries will seek to diversify their trading relations to compensate for disruptions in commercial transactions with Russia. Cristina’s visit to Canada on 12 March is but one example. Furthermore, the conflict’s effects on inflation will remain elevated (at least in 2022). The magnitude will depend on what governments do to smooth domestic prices (in Brazil, for instance, authorities are changing legislation to limit fuel price increases until the presidential election in October). Accelerated inflation rates will likely lead to a tightening in monetary policy across the region, such as higher interest rates – attracting financial investments but slowing economic activity in 2022.

Diplomatic developments

Trade is not the only front on which the conflict in Ukraine will impact the region – the situation has triggered diplomatic whirlwinds as well. Brazil’s President Jair Bolsonaro is the only leader in the Southern Cone that has not explicitly rebuked the military operation. On 27 January, he said Brazil will remain neutral due to its economic partnership with Russia. This approach masks an underlying ideological divide in his base. By maintaining a neutral stance, Bolsonaro avoids displeasing his supporters ahead of the October general election.

However, this stance ultimately exposed frictions within the administration. Two examples illustrate Brazil’s ambiguous approach. On the one hand, Bolsonaro on 24 February publicly reprimanded Vice-President Hamilton Mourão for saying that Brazil opposed Russia’s military actions. On the other, Brazil’s diplomatic corps voted in favour of the resolution condemning Russia at the United Nation’s General Assembly.

For his part, Argentinian President Alberto Fernández on 3 February went to Russia to discuss economic co-operation. During the visit, he said that Argentina should be the “gateway” for Russian investments in Latin America, likely in an effort to reduce dependence on the US and the International Monetary Fund (IMF) amid a new debt restructuring agreement. Even though the Argentinian president criticised the crisis in Ukraine, the government decided not to apply sanctions on Russia, showcasing a pragmatic approach.

The two largest economies in South America will maintain a low profile around the crisis (very likely avoiding the full imposition of sanctions) as they have little incentives to engage in controversial negotiations. Brazil and Argentina’s decision not to sign the Organisation of American States (OAS) statement on 25 February condemning the conflict illustrates the stance they will likely maintain throughout the affair.

All in all, the crisis in Ukraine exposed the lack of political co-ordination in the Southern Cone. Each country’s inward-looking approach became evident. One potential fallout from the conflict bears on the European Union trade agreement with the Southern Common Market (Mercosur). On top of the environmental concerns and trade disputes that have affected these negotiations, that Bolsonaro has hesitated to condemn the military action and that the bloc is unlikely to apply sanctions on Russia will give European countries arguments not to pass the agreement.