As middle powers are seizing the moment to increase their global influence, regional and even country-specific evolutions in cyber threats and risks are likely to follow, with more sophisticated threat actors following the money, power and intellectual property, while middle powers themselves enhance their cyber ambitions. The opportunities presented by aspiring middle powers, particularly those in Asia-Pacific, Latin America and the Middle East, will be closely linked to equally significant cyber security, regulatory and digital sovereignty challenges.

Against a backdrop of persistent global technology competition between the US and China, navigating the pressures to pick a side – while not missing out on opportunities to leapfrog – will be a balancing act, and the decision made will impact not just the information and cyber security landscape, but wider foreign policy, regulatory and operational aspects as well. For strategic decision-makers, thinking ahead of global, regional and country-level digital and cyber security developments will be essential to identify opportunities and manage risks.

Digital ambitions take centre stage, but building resilience takes time

The speed and success of their digital transition will impact how successfully aspiring middle powers can increase their influence and entrench themselves as regional and global powers to be reckoned with. The digital ambition is already evident in technology and digital economy investments. Examples include India and Brazil being among the top ten countries globally in information and communications technology (ICT) investments, new initiatives in areas such as space and smart city developments, and a laser focus on emerging technologies across key jurisdictions in the Middle East and Asia.

However, building national resilience and maturity in cyber security takes time. The comparatively lower cyber security maturity in these jurisdictions will provide fertile ground for cyber threat actors to exploit. According to a recent ranking of cyber defence capabilities of the G20 economies, aspiring middle powers were ranked below countries with longer experience dealing with cyber security issues across almost all pillars. This reflects the extent of the challenge facing these countries – and organisations operating in them – in effectively defending against rapidly rising cyber threats.

Table 1: Cyber Defense Index 2022/23, selected country rankings (rank/20)

| Cyber Defense Index | Critical infrastructure | Cyber security resources | Organisational capacity | Policy commitment | |

|---|---|---|---|---|---|

| Saudi Arabia | 15 | 13 | 19 | 16 | 6 |

| Mexico | 16 | 16 | 18 | 10 | 15 |

| India | 17 | 20 | 12 | 13 | 17 |

| Brazil | 18 | 17 | 16 | 18 | 19 |

| Turkey | 19 | 18 | 17 | 19 | 20 |

| Indonesia | 20 | 19 | 20 | 20 | 18 |

Ambitious middle powers will also need to balance relations and engagements with the US and China with both nations forming critical aspects of the technology supply chain and technology innovation, particularly in the AI and Quantum technology spaces likely to determine global power hierarchies in the long-term. How middle states align with the US and China will determine the technology components they can access, the direction their technology and digital regulation takes, the specific software solutions available in country. US and China geopolitics is already shaping the hardware and software domains in aligned middle countries, such as in Europe where US allies have banned several Chinese hardware and software solutions from government and critical networks.

More sophisticated cyber threats bring growing challenges

Emerging and aspiring middle powers have seen a steady rise in the activities and capabilities of local cybercriminal ecosystems over the past several years. Countries such as Brazil, India, South Africa and Indonesia increasingly serve as cybercriminal hubs in their respective regions, driving cybercriminal threats locally and in neighbouring countries. Such capabilities have been expanded and enhanced by the global growth in cybercriminal as-a-service offerings, with local cybercriminal groups increasingly leveraging more sophisticated capabilities developed in countries such as Russia.

Such groups remain moderately capable compared with more sophisticated, transnational groups. However, growing economic and political clout – coupled with the challenges facing cybercriminal groups in more established cybercriminal target jurisdictions – will inevitably trigger an uptick in more advanced and disruptive cybercriminal attacks targeting middle powers. We have already seen an increase in foreign ransomware groups targeting regions such as Latin America, South-East Asia, the Middle East and Eastern Europe, with prolific and highly capable threat actors targeting large organisations and critical infrastructure in disruptive attacks.

The threat to private sector organisations extends beyond their own network, as criminal groups increasingly target supply chains and key third parties. Such threats will be particularly impactful when directed against local partners, vendors and key suppliers in countries with lower cyber security maturity. At the same time, critical public services required for business operations are increasingly at risk of being taken out by disruptive cybercriminal attacks, with follow-on impacts for companies and operations that rely on such services.

Digital middle powers in the crosshairs

As their regional and global influence rise, middle powers are likely to also come in the targeting focus of rival states and global powers seeking to understand their agenda, ambitions and trajectory. In geopolitical hotspots and for countries playing a critical military and political role in a regional context – such as Saudi Arabia, Turkey and India – foreign state-linked cyber operations for espionage and disruption are already a reality and well entrenched, demonstrating the likely trajectory for other emerging middle powers as their economic, political and military power expands.

As has been the case in the examples above, this is likely to be met with increased focus on developing domestic cyber capabilities to defend against attacks, and to enhance their own ambitions and requirements. Although such capabilities have typically been focused inwards, towards key opposition figures, groups and entities perceived as a threat to the governments’ power, we are likely to see increased intent to leverage cyber means to further foreign policy goals and regional ambitions. Developing and acquiring more advanced native capabilities beyond the commercial toolsets that are already available to these states is likely to be a growing priority for aspiring middle powers.

Countries are likely to adopt different strategies to achieve this, depending on their circumstances and the perceived urgency of the threat. Some will rely on key allies to supply the knowhow and tooling, others will form alliances with non-state actors, such as private sector entities and criminal groups, while others will opt to organically develop domestic resources. Their success will be greatly enhanced by technology and countries’ ability to leverage emerging and frontier technologies not just to advance their economic, political and military prowess, but also their offensive cyber capabilities.

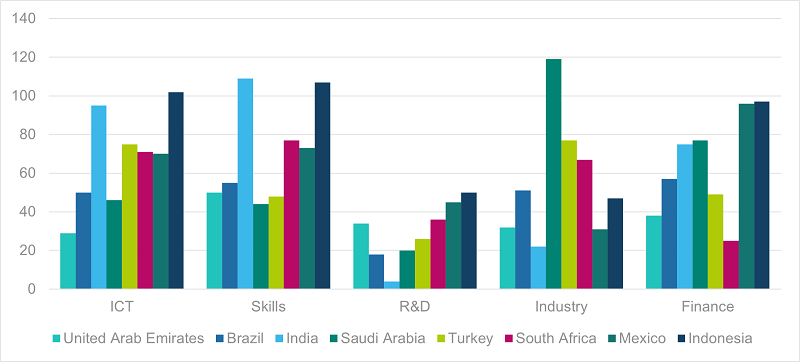

Figure 1: Preparedness to use frontier technologies, selected country rankings (rank/166)

Ranking of 166 countries’ readiness to use 17 frontier technologies, including artificial intelligence (AI), internet of things( IoT), blockchain, 5G and robotics

Stay ahead to seize the opportunity

To seize the opportunities that middle powers present, companies will need to stay on the front foot of all these digital challenges and risks. Understanding and monitoring the trajectory and impact of economic, geopolitical and technological changes is key to appropriately assess the risks – whether directly or through third parties and supply chains – and identify and implement controls to meet forthcoming challenges.

Control Risks regularly works with clients to understand the cyber threats and risks to them and their key partners when entering or expanding into new or unknown markets. In our experience, the pace of change across the cyber and digital sphere for most if not all middle powers has greatly increased the level of granularity required to fully grasp the nuance of threats and risks on a jurisdictional basis. This is particularly evident when strategising on market expansion, data providers and other key partners, as well as locations for digital infrastructure such as cloud solutions.

Strategic decision-makers with a good understanding of the digital roadmap and conditions for success of middle powers will be better placed to identify opportunities and risks early on. Identifying favourable pre-conditions and understanding triggers for disruption will enable decision-makers to react and adapt their strategies to changing circumstances as middle powers vie for position.