From a stronger focus on regulatory enforcement to more capable AI, these are five ESG trends that will likely impact businesses and investors in 2024.

1 Get ready for stricter enforcement

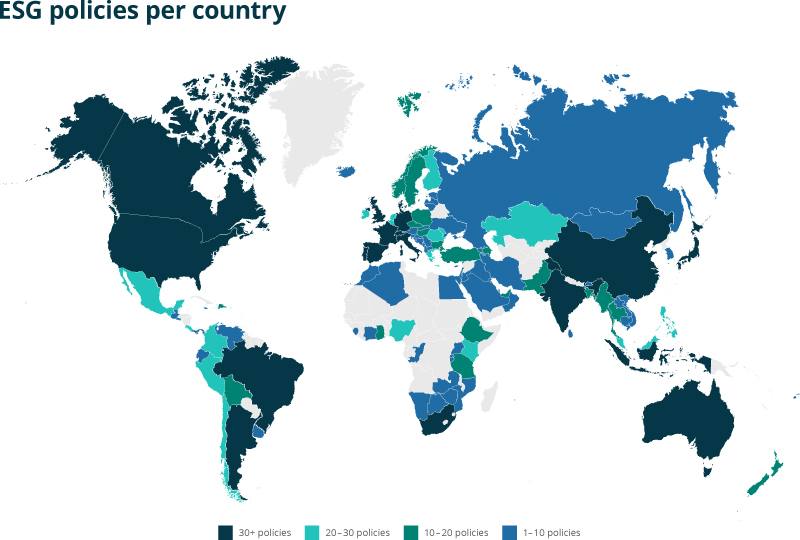

The past few years saw a significant increase in ESG regulation globally. In most cases, implementation included a transition period for businesses to adapt to new obligations. In 2024, enforcement will take centre stage. While the EU’s Corporate Sustainability Reporting Directive (CSRD) entered into force in January 2023, the compliance phase will start on or after 1 January 2024 for organisations listed in EU-regulated markets with more than 500 employees.

Other regulatory developments with global implications include the EU Corporate Sustainability Due Diligence Directive (CSDDD), likely being finalised in Q1 2024 and becoming EU law by 2026, and the German Supply Chain Due Diligence Act (SCDDA), which entered into force in January 2023. The scope of SCDDA was broadened as of 1 January 2024 to encompass enterprises based in Germany that have more than 1,000 employees.

Increasing enforcement and maturity do not mean that there will be no appetite for new regulation, though many efforts will face resistance from political and business leaders. In April, the United States Securities and Exchange Commission (SEC) will likely publish its final, long-awaited rule on climate-related disclosure requirements for businesses. Partially informed by recommendations made by the Task Force for Climate-related Financial Disclosures, the rule will also reflect pushback by anti-ESG political and business leaders in the US. Politicisation of ESG is a trend that will only intensify in the US market ahead of the November 2024 presidential elections. This politicisation may, to some extent, spill over to other regions, including Europe.

2 When AI met ESG

The integration of Artificial Intelligence (AI) into ESG risk management will increase in 2024. We anticipate that the primary use of AI will be optimising time-consuming, data-processing tasks around environmental reporting, particularly reporting of greenhouse gas emissions.

A key risk for businesses will be an over-reliance on AI-based tools to process and report ESG data. Companies will be held accountable for any ESG information they report. To ensure accuracy and strategic value, the use of AI should be integrated into a robust, human-run management system.

Activists will also be equipping themselves with AI tools, posing significant reputational risk. Activists will use AI to map human rights violations and environmental degradation, scanning sustainability reports and corporate footprint information against watchdogs’ datasets and social media data. To mitigate potential risks arising from such enhanced scrutiny, companies must reduce their exposure to greenwashing while reliably communicating their ESG impacts.

3 It’s all about the evidence

Businesses and investors have been testing and adapting ESG practices for over a decade.

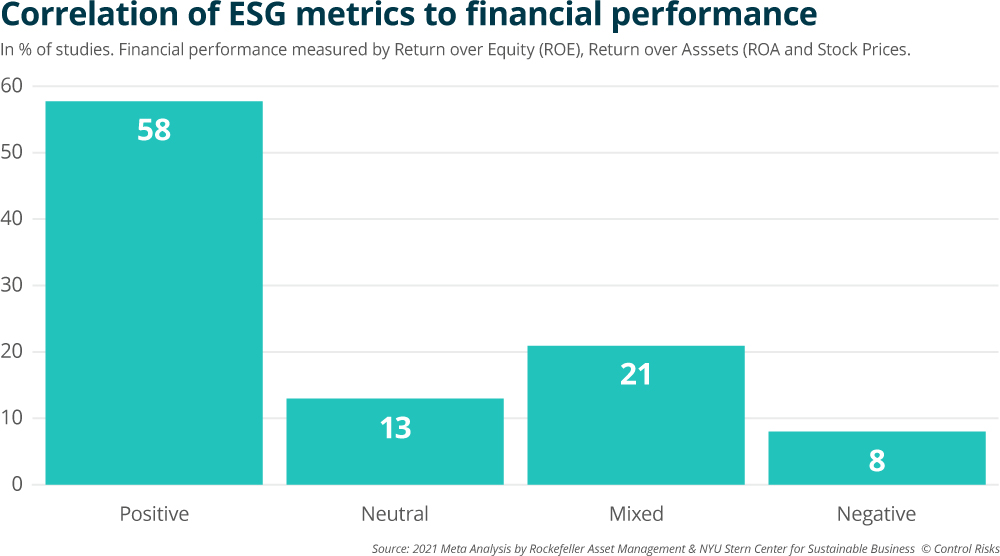

These efforts have generated a mountain of evidence about the positive impact of ESG-based decision-making. The growing pool of data around ESG will enable decision-makers to take increasingly informed decisions. This robust base of evidence will solidify ESG-based decision making as a competitive advantage for businesses despite political resistance in some jurisdictions.

Although implementation comes with increased costs in the short term, and although variation across sectors and jurisdictions is significant, high-quality evidence suggests that the adoption of ESG is correlated with higher performance for larger organisations. (The same does not apply to smaller companies.) A growing number of studies have also corroborated the original theory proposed by ESG advocates that companies with strong ESG credentials are more resilient to shocks, including shocks posed by climate change and those related to evolving market trends.

There is no single recipe for ESG success. Best practices to maximise ESG benefits include robust materiality assessments, strong stakeholder engagement, and alignment with science-based targets and policies.

4 The ultimate test for carbon offsets

Carbon offsets came under harsh scrutiny in 2023. Watchdogs identified overestimations of impacts and accounting controversies, calling into question the true merit of many high-profile carbon offset projects. The increased risk around such projects has led to reduced carbon prices and undermined their commercial attractiveness.

2024 will present the opportunity for carbon offsets to redeem themselves. Despite the negative impacts of a backlash on carbon offset project developments, increased scrutiny might be the best chance for these projects to contribute significantly to the net-zero transition.

The Integrity Council for the Voluntary Carbon Market (IC-VCM) – an independent governance body that aims to set “the highest standards for ethics sustainability and transparency for the global voluntary carbon market” – launched its Core Carbon Principles Assessment Framework in March 2023. This initiative aims at improving the quality of carbon projects and should help companies navigate the complexities of carbon offsets.

As per the IC-VCM guidelines, low-risk carbon projects will be those that remove or reduce emissions. These projects must meet a specific set of criteria:

- Projects must be compatible with the transition to net zero. Those that lock-in emissions should be ruled out.

- Projects must be permanent, compensating for emissions reversals within the next 40 years.

- Projects must be additional. They should promote reductions or removals that would not have happened otherwise, ruling out conservation projects.

- Projects must be robustly quantified. Impact should be measured conservatively to avoid overestimation.

Despite carbon offsets being central on the COP28 agenda, the conference failed to deliver new agreements, pushing discussions to COP29. However, industry-led initiatives and bilateral agreements like the IC-VCM guidelines will likely gain momentum in 2024 in lieu of international, centralised frameworks.

5 How’s that climate disruption vulnerability assessment?

According to the UN, 2023 was the hottest year on record. 2024 is likely to be no different. Severe and frequent disruptive weather events will increasingly test operational resilience – including supply chain resilience. This will force businesses to prioritise climate adaptation in their ESG strategies.

Inadequate vulnerability assessments – for both direct assets and supply chains – weaken a company’s ability to anticipate losses driven by climate-driven events. Companies often struggle to conduct vulnerability assessments because of insufficient in-house expertise and rapidly evolving regulation. Successful vulnerability assessments will be those that include:

- Well-informed materiality assessments to inform prioritisation strategies according to financial impact potential

- Close engagement of suppliers, partners and other relevant stakeholders to identify and mitigate indirect exposure

- Increased use of academic and scientific research to inform local- and sector-specific exposure

- Development of scenario-based analysis to inform vulnerability according to different triggers

- Integration of localisation strategies with climate risk assessments to optimise the resilience of supply chains

- Increased used of emerging technology, including AI, to make assessments more accurate and cost-effective

- Monitoring over time to ensure risk management continuity and consistency

Companies that heed the above recommendations will be in a better position to mitigate climate risk in 2024 and beyond.