Built Environment & Infrastructure Risk Management

-

Search

The concepts of fraud and return on investment (ROI) are rarely discussed in the same conversation; nevertheless there is significant merit in exploring the idea of using fraud detection as a proactive opportunity for business growth and a competitive advantage. As businesses face razor thin margins in an increasingly competitive global environment and fraudsters evolve in sophistication, the best offense is a good defense. For executives seeking to increase the competitiveness of their business, preventing fraud and its impacts in a cost efficient and effective way presents a major opportunity to grow the bottom line.

Fraud hits a company in three ways: it causes losses in business revenues (e.g., through illicit payments and disguised sales); it increases operating expenses (e.g., fraud detection and recovery); and as a result it has a serious impact on profitability. The good news is that companies can fight back at fraud by combining smart technology with analytics.

By investing in an intelligence-led, technology-driven data analytics solution, corporate fraud investigators and compliance officials can minimize the occurrence of fraud and recover funds more efficiently than ever. According to the Association of Certified Fraud Examiners (ACFE), victim organizations that lacked anti-fraud controls suffered twice as much in median losses compared to organizations with anti-fraud programs such as proactive data monitoring/analysis systems, management reviews and fraud hotlines1.

As fraud detection technology matures, and the return on investment from proactive fraud detection solutions increases, preventing fraud and recovering losses are fast becoming the most cost effective strategies to increasing a corporation’s bottom line. When comparing traditional performance improvement strategies to fraud prevention initiatives, organizations can achieve a greater ROI by implementing fraud detection programs.

For example, a financial institution recently implemented a proactive data analytics solution to monitor and prevent external fraud. The solution combines data aggregation, data analytics and data visualisation to streamline the effectiveness and efficiency of their in-house fraud investigation team. This intelligent solution enabled the team to move from reacting to preventing fraud with material financial recovery. The return on investment was over 1200%.

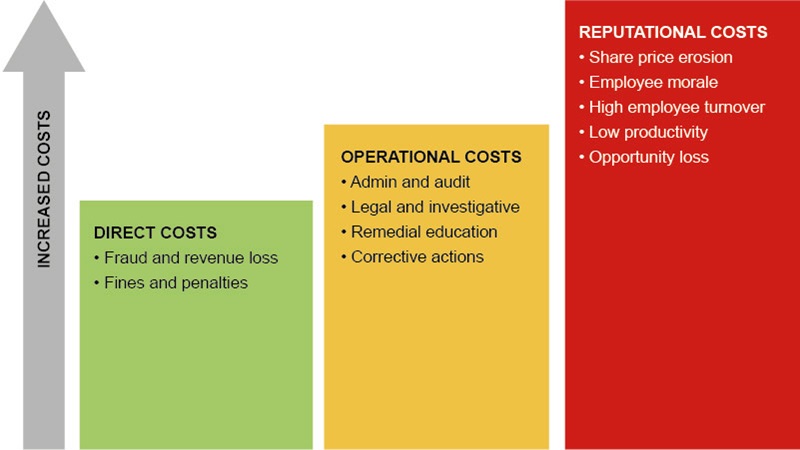

The losses attributed to fraud often include only the direct costs such as fraud loss itself. Little consideration is given to the slew of negative impacts such as loss to employee morale and reputational damage that follow a fraud event. In an age when customer loyalty can change in the time it takes to read 140 characters, reputational damage can be fatal and non-recoverable. So, when these additional costs are factored into the total cost of fraud, the ROI of an effective fraud prevention program can be even greater. In fact, studies by Nevada University (2014)2 and Friedrich-Alexander University (2015)3 identified that companies facing fraud within their senior management team could see 30% erosion to their share price above and beyond the initial loss.

As long as there are rules and laws in business, opportunistic fraudsters will find a way to break them. The ACFE estimates that the typical organization loses 5% of annual revenues to fraud.

Besides revenue loss, companies incur operational costs (i.e., labor costs) by dedicating resources and assets to detect, remediate and recover from fraud. In large companies where fraud can be prevalent, fraud investigation units have evolved significantly, but not always at the same pace as the fraudsters themselves. For some global financial institutions, the current state fraud detection program is still the initial pilot program that they implemented years ago and has not been updated or enhanced to keep up with the growing sophistication of fraud.

In addition, human investigators are costly, inefficient and subjective. In large global corporations, critical information needed to detect and assess potential fraud is buried in a myriad of disparate systems that are inaccessible to these costly human investigators. They are forced to manually review and aggregate information needed to assess incidents of potential fraud, with each hour of their time snow balling into huge operational costs.

The evolution of technology-driven fraud solutions, such as predictive analytics, may enable companies to rethink their position on the unavoidability of fraud losses. Advancements in technology continue to drive fraud detection costs down, while simultaneously increasing efficiency. Businesses can now generate strong ROI on fraud detection.

The latest evolution of anti-fraud solutions empowers the fraud investigator to drive operational efficiency and lower labor costs in the continuous fight to tackle fraud. These solutions enable the fraud investigator to do the following:

Fraud is an inherent risk for organizations, but if compliance officers arm themselves with cost effective solutions such as data analytics to monitor, investigate and recover from fraud, their organizations can achieve a return on investment, better compete in the hyper competitive global market, and insulate their companies from market risks such as fraud. With many companies navigating the fine line between profit and loss, any effort to anticipate and remediate against such risks can prevent the scale of success from irreversibly tipping in the wrong direction.