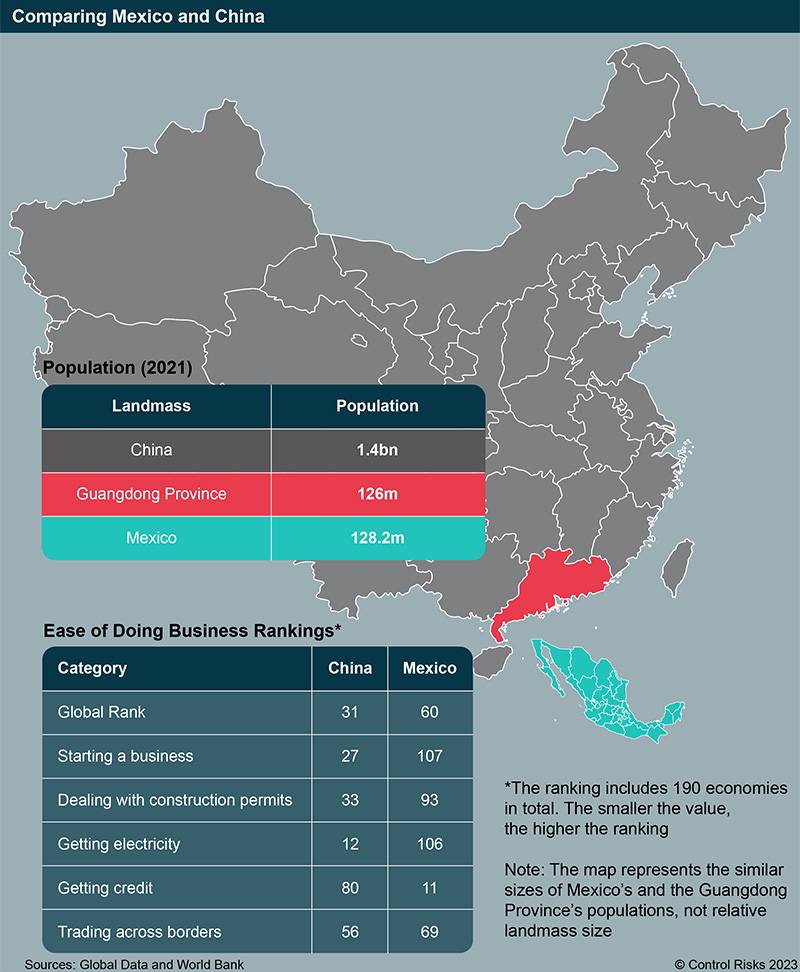

Perceptions of Mexico as a substitute of China in global supply chains clash with the nuanced reality where attractive and unappealing conditions in different areas coexist. With less than a tenth of China’s total population, suggestions that Mexico could replace the former’s role in global supply and production chains miss the mark.

China performs better than Mexico in many business environment indicators, such as access to electricity and dealing with construction permits, according to the World Bank’s Ease of Doing Business Rankings. Furthermore, security, operational, infrastructure, labor and regulatory risks weigh on Mexico’s nearshoring potential.

More specifically, Mexico faces challenges such as:

- Institutional weakness, including strained regulatory agencies.

- Supply chain disruption due to shortcomings in road and water infrastructure.

- Crime, violence and social unrest preventing supply chain continuity in some regions.

- Limited access to affordable, clean, reliable energy.

- Skilled labor limited to specific sectors like the automotive and aerospace industries.

- Legal uncertainty in key areas amid electricity regulation favoring state-owned companies.

However, there are positive prospects for most of these challenges:

- Autonomous institutions have helped stop the most radical parts of President Andrés Manuel López Obrador (AMLO)’s agenda affecting the private sector.

- The announcement of major investments has motivated authorities to expedite infrastructure improvements.

- Security risks in Mexico can be mitigated with appropriate measures and risk management programs.

- The federal government is increasingly interested on renewable energy projects.

- Companies investing in Mexico have taken charge of training skilled labor, circumventing structural shortcomings.

- Mexican courts have halted controversial regulations, and Mexico aims to comply with USMCA rules, easing concerns of legal uncertainty.

Perception vs reality

The cacophony of headlines about supply chain shifts involving China understate the complexity of the challenge. No single market will replace China. That remains as true for Mexico as for Vietnam, India, or any other country. However, these markets can in some cases replace certain segments of supply or production chains for still heavily China-dependent industries.

In this context, Mexico is set to remain a particularly attractive investment destination for the manufacturing sector, especially the aerospace and automotive industries as the US increases pressure for North American companies to produce all parts in the region. Furthermore, Mexico will be increasingly appealing for the tech and renewable energy sectors amid a growing skilled workforce and shifting energy policies.

Nearshoring inertias and geopolitical factors will help improve conditions for investment in additional industries in Mexico. However, China will remain a critical supplier in the foreseeable future for many key elements even in those industries growing in Mexico, like batteries or other renewable energy components.

What this means for businesses is a complex web of markets and risks. Reducing reliance on China-based sourcing can boost resilience, but alone will not necessarily de-risk supply chains. Aside from the Mexico-specific risks outlined above, sourcing from this country may not avoid China-specific challenges. For example, many Mexico-based operations are likely to continue to rely on China-based sourcing, or the Mexico-based suppliers are themselves Chinese-owned companies that could become subject to future US sanctions or trade restrictions.

Building lasting resilience and competitiveness

To ensure real gains in resilience, companies need a balanced assessment of geopolitical scenarios, alongside a benchmarking of regulatory, operational and commercial factors across potential markets. As diversification from China is likely to continue in the coming years, businesses will benefit from finding the correct mix of markets that builds long-term competitiveness. In this context, understanding risks and opportunities at macro and local levels will be key for companies to navigate the current trends in supply chain shifts.