India’s appeal can be attributed to a variety of factors. India’s GDP growth rate has remained steady in the three decades since economic liberalization in 1991. Since liberalization, the country’s government has never been more stable, with an incumbent party with a decade-long track record likely to win another five-year term in the 2024 election. And by now, investors have a track record in India: they are aware of the risks and savvy as ever about mitigating them.

Looking back at the risks

We have looked back at Control Risks’ projects in India since the beginning of 2022 and identified the most common risks our clients face, in which sectors those risks occur, and mitigation tactics.

We isolated 16 categories of risk identified during our assessments, including opaque shareholding structures, high-level bribery, facilitation payments, bid rigging, political exposure, ESG-related concerns, litigation history, fraud and money laundering, among others.

From January 2022 to September 2023, we conducted market entry assessments and due diligence across 21 sectors, ranging from agriculture and warehousing to automotive and IT. The sectors we look at most often are energy (including fossil fuels and renewables), real estate, professional services and manufacturing. The sectors we found to have the greatest variety of risks include: (1) fossil fuels, (2) renewable energy, (3) manufacturing, (4) real estate and (5) infrastructure.

Top five

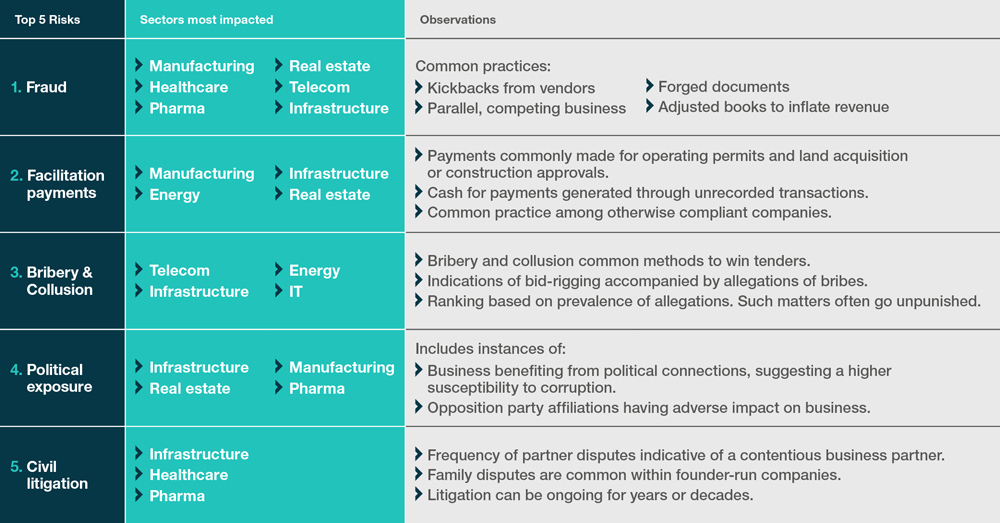

We highlight below the five risks we have encountered most often in India, the sectors in which those risks were most prevalent (instances occurring in more than 20% of projects), and observations of why and how these issues occur.

Based on projects from January 2022 to September 2023.

De-risking the deal

Rather than turn away from a deal or the opportunity that the Indian market presents altogether, investors are looking at ways to de-risk their deals to increase the likelihood of commercial success while decreasing the risk of reputational and legal damage. We see a few common tactics.

Cutting out the middleman

Third parties get a bad reputation for good reason. Although many serve as necessary intermediaries for business-to-government, or business-to-business transactions, they are often the vehicles for corruption. Investors considering a deal with an Indian counterparty should scrutinize its use of subcontractors, which may be used to grease palms to ensure smooth business operations, as well as politically connected agents who interface with government procurement agencies. An American company looking to sell products in India for the first time learned this the hard way after finding out that while its ultimate customer did not appear to be involved in any bribery, the distribution agent it was directed to engage with had a long history of illicit payments and bid-rigging. Scrutiny of any distributor is advised, and, if necessary, its removal from the deal altogether may be necessary to proceed.

Due diligence as a benchmarking tool

Integrity due diligence is frustrating to deal teams when it pours cold water over their hard work, identifying insurmountable compliance or reputational risks at the eleventh hour. To save valuable time for the business, some investors discreetly investigate the backgrounds and modus operandi of several potential investment targets simultaneously, using the due diligence process as a tool to narrow their search in the market before spending their own time on discussions and negotiations. This strategy seems to be deployed most by those with experience: a foreign investor with many years of experience in India decided to consider several partners and sectors before narrowing its search to deploy fresh capital; a multinational just entering the market but having to cut ties with its would-be business partner following the due diligence.

Informed negotiation and structuring

Buying out a founding partner with a toxic reputation, structuring JVs to avoid exposure to certain parts of a conglomerate with corruption issues, insisting that a counterparty institute certain ESG compliance measures, removing certain management personnel with conflicts of interest, removing a problematic subsidiary from an acquisition, or simply confronting a counterparty with its litigation history, are all tools at investors’ disposal in the negotiation phase following a thorough due diligence. Rather than allowing certain risks to be deal killers, investors are using their knowledge of such risks to enable deal success.

Moving forward

In 2024, Investors will be more inclined than ever to make India work for them. India is no longer a frontier market: investors have been involved in the country’s growth for long enough to be aware of the challenges. Many of the perceived risks around India persist (e.g., corruption, bureaucracy and market fragmentation), but recent years have seen a ramp up in vigilance, governance and market integration that makes India the market in which to invest and grow.