This is an example of the analytical insight available on Seerist, a Control Risks company.

Electric vehicles (EV) will potentially account for 35% of China’s total car exports in 2024. Where is the Chinese EV industry at right now, and what role will it play in China’s domestic and foreign policies in the coming years?

New engine

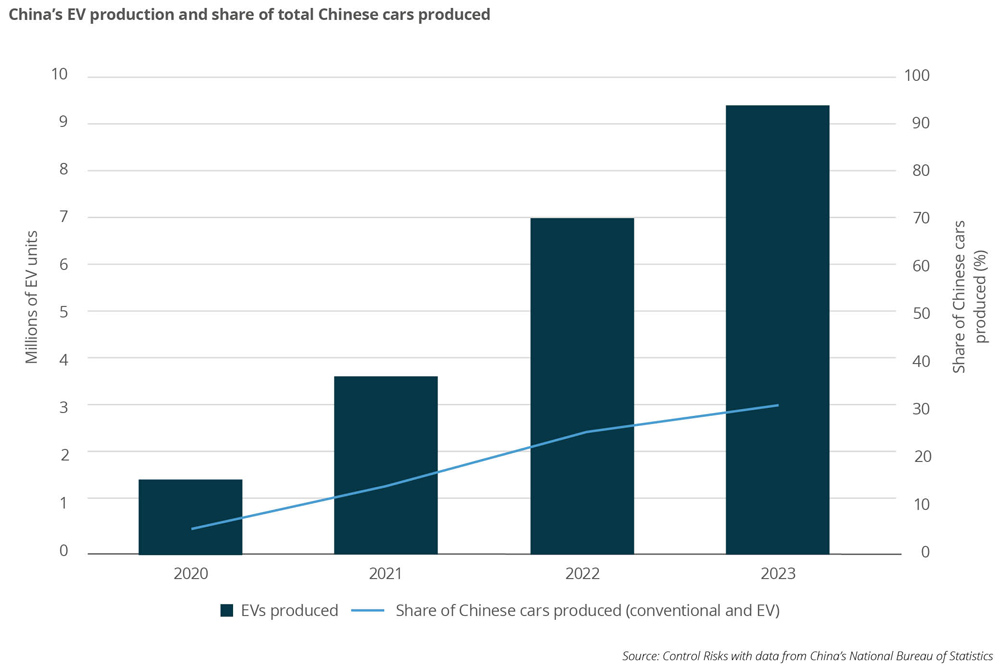

The EV industry is a central pillar of Beijing’s strategy for becoming a leading technological power. EVs are also critical to China’s industrial upgrading and decarbonisation goals. Government incentives, ranging from consumption tax cuts to preferential financing, have helped Chinese EV manufacturers achieve unprecedented growth, with EV production in 2023 seeing a 35% year-on-year increase. According to the International Energy Agency, EVs in 2023 accounted for 38% of new car sales in China, compared to 24% in Germany, 9.5% in the US and 18% globally. EV sales in China accounted for nearly 60% of global sales in 2023.

Domestic manufacturers continue to make significant progress in China’s EV sector. In 2023, domestic makers held 81% of the Chinese EV market, compared to 56% of the domestic market for conventional vehicles. The development of the domestic EV sector aligns with Beijing’s drive for more resilient and secure supply chains, with Chinese EV companies playing a greater role in global value chains, from the mining of lithium (a key component of EV batteries) to battery production.

Overseas drive

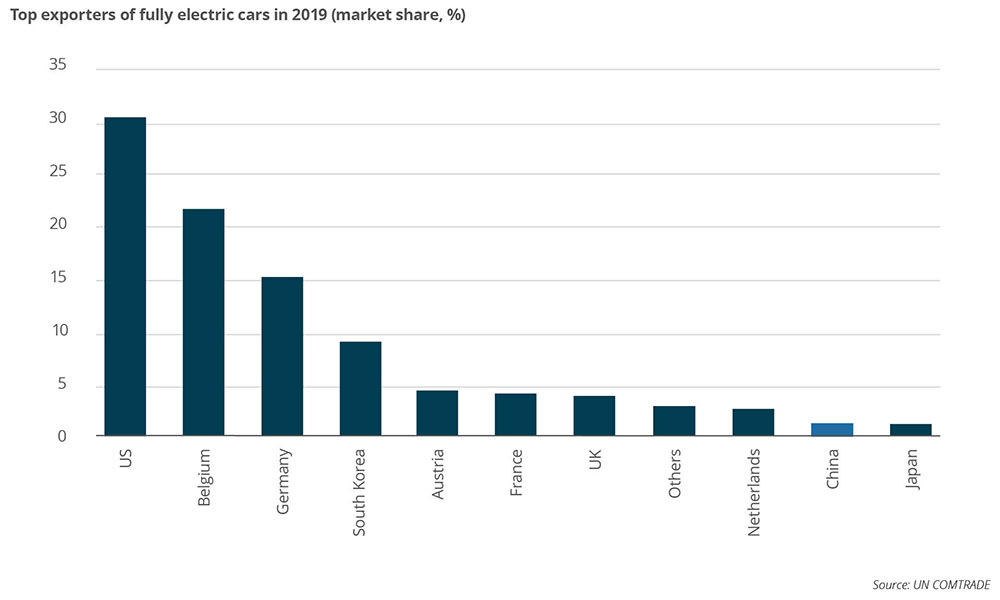

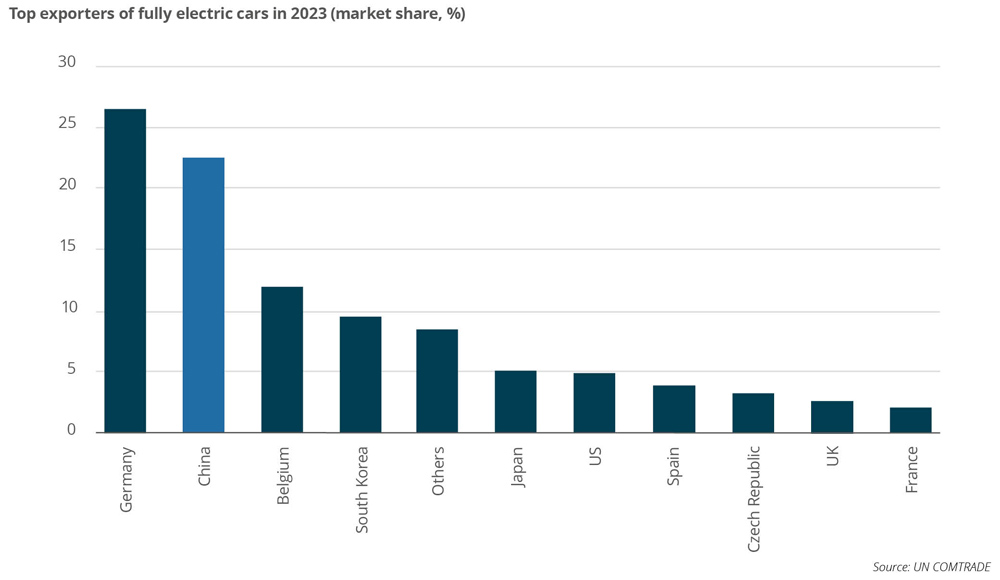

In recent years, fierce domestic competition, the phasing out of purchase tax breaks and weakening domestic consumption have led Chinese EV makers to look abroad. From 2019 to 2023, Chinese exports of fully electric vehicles surged from 2% of global market share to 23%, making China the second-largest exporter. Major Chinese EV makers have begun to set up overseas manufacturing and production units to better serve local markets, driven by supply chain considerations and trends of onshoring and nearshoring. Outbound investment by Chinese EV makers reached a record USD 29.7bn in 2022, followed closely by USD 28.2bn in 2023.

The Chinese government has sought to promote the expansion of EV makers abroad. On 7 February 2024, the Ministry of Commerce issued its “Guiding Opinion on the Healthy Development of Trade and Cooperation on New Electric Vehicles”. The guidance includes financing and logistics measures to support overseas investment and co-operation, especially in R&D, technology, standards setting and supply chains. Chinese EV companies are also encouraged to set up factories overseas to “introduce China’s advanced technologies and products abroad”.

The outward push comes at a time of increased imbalance in domestic supply and demand, as industry players crowd in to expand their market shares. Industrial overcapacity is particularly challenging for smaller EV manufacturers, which in 2023 produced at below 50% of their actual capacity. Many EV makers have been driven to reduce production costs and lower prices to remain competitive, triggering price wars.

Domestic pricing competition has not spilled over to exports, strengthening the attractiveness of outward expansion. In the coming years, increased industrial capacities combined with slower consumption growth will continue incentivising exports and investment abroad.

Brakes and accelerators

China’s growth and competitiveness in the global EV market has prompted mixed reactions. For many developing countries, Chinese EV imports are critical to their electromobility goals and clean technology transitions, while EV investments help to boost high-value production.

Several resource-rich countries welcome Chinese investment upstream in critical minerals and link it with manufacturing activity. Chile’s 2023 lithium mining agreement with China’s biggest EV maker included a deal for the building of a cathode factory. Similarly, Indonesia banned all raw nickel exports in 2020 and launched programmes to integrate mining and refining with EV battery manufacturing.

By contrast, in developed economies, the rapid influx of Chinese cars has driven increased national and economic security concerns, leading to various protectionist measures, including potential restrictions on trade and investment. For instance, the EU launched an anti-subsidy probe on Chinese EV imports last October. Then, in March, it mandated a customs registration process for Chinese EVs, which could allow regulators to impose retroactive tariffs if the investigation manages to prove unfair government support. However, European countries have continued to welcome Chinese investment in EV-related sectors to secure their supplies, particularly of batteries.

National security concerns will drive a harder line from the US. In February, the US government launched an investigation into the risks of data collected by EVs ending up on Chinese servers. The US is also disincentivising its EV makers from partnering with Chinese suppliers, especially battery producers. Last December, the US excluded cars with battery parts manufactured in several countries, including China, from tax breaks under the Inflation Reduction Act. In the coming months, the US will likely consider blocking the flow of Chinese cars and auto parts via third countries with trade deal amendments and tightened regulations around company ownership and provenance.

Chinese mettle, foreign metal

As China’s EV industry continues to grow and expand, Beijing will seek to maintain its edge in global supply chains. China dominates the production and processing of rare earths and other critical minerals crucial for EV manufacturing and battery technologies – though some resources, such as lithium, must be sourced abroad.

Since the 2020s, the vertical integration of upstream activities has become more prominent in China’s EV sector expansion. Major Chinese mineral processors, EV manufacturers and battery producers have been actively acquiring assets in South America, Australia, Africa and South-East Asia to secure a steady supply of minerals like lithium, nickel and iron ore.

Its dominance of EV supply chains has allowed Beijing to better withstand economic frictions with Western countries and impose countermeasures on trade and tech restrictions. In 2023, Chinese authorities imposed export controls on graphite and export restrictions on rare earths processing equipment. China has also been more willing to impose sanctions, as evidenced by the implementation of its Anti-Foreign Sanctions Law. However, the Chinese government is unlikely to impose sweeping trade restrictions, which could spark a major retaliation cycle. So far, Beijing's controls appear to target goods with more symbolic rather than strategic value. An anti-dumping probe of European brandy imports has been interpreted as Chinese retaliation for the EU probe into its EVs. Chinese authorities have denied such a link.